Prices

May 14, 2019

CRU: Macro and Geopolitical Uncertainty Keeps Iron Ore Prices Stable

Written by Tim Triplett

By CRU Senior Analyst Manjot Singh

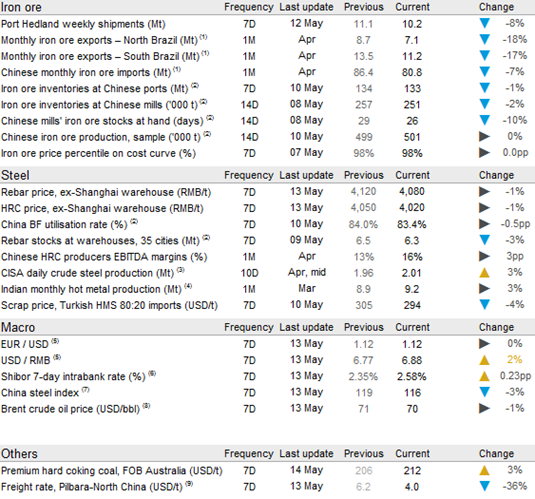

As has been the case in the last few weeks, Chinese BF utilization rates have remained above 80 percent and rebar inventories have continued to dwindle, suggesting buying appetite for raw materials has been robust in China. In terms of iron ore specifically, inventories at Chinese ports and mills declined w/w, albeit slightly, which indicates Chinese steelmakers are not ready to give up on their pursuits of maintaining high levels of hot metal production, yet.

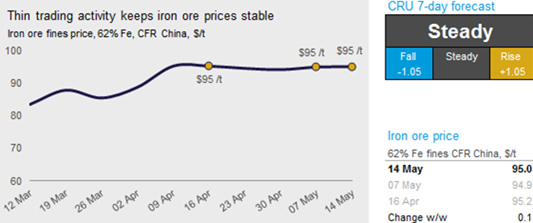

However, the uncertain geopolitical and macro environment is restraining market sentiment in terms of iron ore and steel prices. Just like Chinese steel prices, iron ore prices have also remained largely flat w/w. The Chinese yuan has weakened by another 2 percent w/w against the U.S. dollar, which is likely to be giving mills a reason to pause from seaborne spot purchases at current prices. On Tuesday, May 14, CRU assessed the 62% Fe fines price at $95 /t, virtually flat w/w.

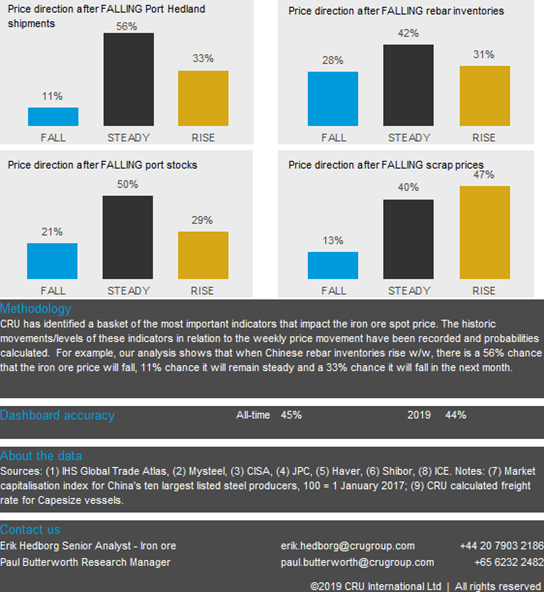

On the supply side, shipments from Port Hedland declined by 0.9 Mt w/w to 10.2 Mt. The Australian financial year ends in June and history demonstrates that iron ore shipments from Australia tend to be strong during that month. We expect this year to be no different and we project Australian shipments to recover to ~11 Mt per week in the coming weeks, barring any unforeseen logistical disruptions. According to our sources, Indian exports of low-grade iron ore and even pellets is holding strong in the wake of high international prices. In separate news, we heard that Roy Hill is revising its mine plan to support consistent product grade, which will result in significantly higher stripping ratios. This will materially increase mining costs for the miner.

Although the iron ore fundamentals are still looking healthy, there are a few downside risks that are emerging in the market. Some of these risks include waning steel demand due to the upcoming monsoon season in China, a weakening Chinese yuan and an uncertain geopolitical environment due to the ongoing U.S.-China trade negotiations. Due to these reasons, we believe both buyers and sellers will exhibit more of a “wait-and-see” attitude, which will keep iron ore prices STEADY in the next seven days.