Prices

May 14, 2019

CRU: Turkey’s Economic Troubles Persist, at Least Through 2019

Written by Tim Triplett

By the CRU Economics Team

The Turkish economy is suffering its first recession in a decade. This has had knock-on effects on the global steel market, given Turkey’s prominence in this industry. A key question for the steel market is therefore, how long will the recession in Turkey last? We think that in the most optimistic scenario economic growth in Turkey will bottom out in 2019 and return to positive territory in 2020. But we see material risks to the downside, where the recession drags on into 2020. This insight explores the vulnerabilities that led Turkey into recession, and the risks that could prolong the pain.

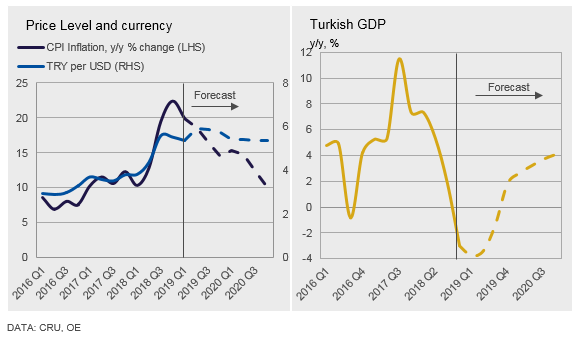

The Turkish economy fell into recession in the second half of 2018 following a currency crisis. This was triggered by geopolitical tensions with the U.S., which resulted in the latter imposing tariffs on Turkish exports. Foreign investors became concerned that Turkey would not be able to meet its external funding requirements, most of which is in foreign currency. This caused the Turkish lira to lose 40 percent of its value against the USD in 2018. The weak currency raised the price of imports, pushing up on inflation sharply, and forcing the Central Bank of the Republic of Turkey (CBRT) to dramatically raise interest rates. The higher rates depressed consumption and investment growth, culminating in the recession we see today.

Turkish Lira Under Pressure Despite Monetary Tightness

The CBRT kept its main policy rate, the 1 week repurchase rate, unchanged at 24 percent in its latest meeting held on April 25. The decision is unsurprising given Turkey’s high rate of inflation and its vulnerable currency. Prolonged monetary tightness, however, did not prevent the further deterioration of the lira, which lost as much as 15 percent in 2019, and 2 percent in the last week. The recent drop came on the back of the Supreme Electoral Court’s decision to annul the results of the Istanbul municipal elections, which were held on March 31. The decision heightened investors’ concerns over Turkey’s political instability. There are similarities between today’s situation and summer 2018, when Turkey faced a currency crisis, which marked the onset of its recession.

Underlying Vulnerabilities: Borrowing in Foreign Currency

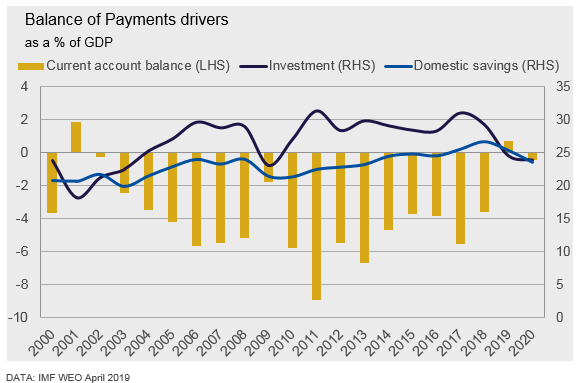

Why is Turkey so exposed to international investors’ financial appetite? We think this is linked to structural vulnerabilities of the Turkish economy, namely low domestic savings and persistent current account deficits. Indeed, the low level of domestic savings relative to the investment rate has required Turkey to try and borrow from abroad. Such demand for external borrowing has been matched by foreign investors agreeing to lend to Turkey both in the form of foreign direct investments as well as indirect investments via capital markets, in return for favorable rates of return. The desire and ability to borrow from abroad explains why Turkey has experienced a current account deficit for the past 20 years.

Persistent current account deficits inevitably expose a country’s economy to the appetite of foreign investors (and speculators). Specifically, an economy that heavily relies on foreign funds can only shield itself from currency attacks so long as it maintains its credibility in the eyes of foreign investors. When investor confidence in the domestic economy falls, foreign investors start selling large amounts of domestically owned assets and exchange the proceeds for their foreign currency, causing the domestic currency to lose value. In turn, this prompts other foreign investors to do the same, thereby causing massive depreciations to the domestic currency. This is exactly what happened to Turkey in August 2018; geopolitical tensions with the U.S., and doubts over the soundness of Turkey’s economic policies prompted investors to swiftly de-invest from lira denominated investments, causing the lira to plummet against the USD.

Further Painful Rebalancing Lies Ahead

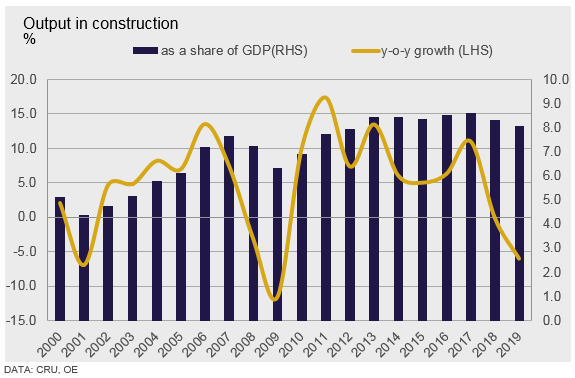

Ever since the currency crisis, Turkey has been on a path of painful economic adjustment. The weak lira has helped exports, which recorded an all-time high in 2019 Q1; it has also hurt imports, leading to an improved trade balance. Similarly, ultra-tight monetary policy has restored some confidence in the lira, albeit provoking a severe credit crunch, with negative consequences for credit-dependent sectors like the construction industry.

Construction sector output accounted for 8.3 percent of GDP in 2018 and is an important driver of the economy. It is notable that the size of this sector has quadrupled since 2000, when it accounted for only 2 percent of GDP.

The recession has taken a heavy toll on this sector, where output growth has turned from being positive to negative over the past 12 months. And, as the chart above shows, we expect the construction sector to contract by 6 percent year-on-year in 2019. A plummeting lira exposes the construction industry as the cost of raw materials, which Turkey imports in large amounts, increases. To revamp the sector, the government has recently announced it will help by freeing up banks’ balance sheets from real estate loans that have turned sour. Nevertheless, a full recovery for the industry is unlikely to happen without an easing in monetary policy.

As part of a broader plan to help sustain the economy, the government recently promised it will also address the very high rates of food prices seen recently. The “agriculture masterplan,” to be unveiled later in May, is meant to fight food inflation, which averaged above 30 percent in the first four months of 2019.

Best Case Scenario: Growth Bottoms Out in 2019

Turkey should return to positive growth in 2020, but there is very little room for mistakes. It is vital that policymakers do not take actions that provide temporary relief to the economy at the cost of longer-term sustainability.

We see three particular risks that could prolong the recession beyond 2019.

First, and most importantly, is continued pressure by the government on the CBRT to prematurely lower interest rates. This risks undermining the stability of the Turkish lira as well as jeopardizing efforts to reduce inflation. With regards to the former, the situation is already rather gloomy. Pressures on the lira have gradually built up over the previous two months, as low foreign reserves and weakened CBRT credibility led the lira to a seven-month low against the USD.

Second, the recent decision by the U.S. not to renew waivers on Iranian oil, which Turkey has benefitted from thus far. Indeed, as Turkey is an oil-importing country, increases in the price of oil raise the current account deficit and put downward pressure on the lira. Avoiding further currency crises is of utmost importance for Turkey, given what it has already been through. Indeed, in the next 12 months, $137 billion U.S. needs to be repaid by Turkey’s private sector to foreigners, and a further lira depreciation would make such repayments harder to meet.

Lastly, another scare for Turkey comes from growing geopolitical tensions with the U.S. Should Ankara’s purchase of missiles from Russia or its potential unwillingness to stop buying Iranian oil lead to U.S. sanctions, stormy weather is to be expected.

It is hard to quantify the impact of these risks individually, as they are heavily interlinked. What is certain is that, should they materialize, the current recession will continue into 2020. On the other hand, should the vulnerabilities not materialize, we expect inflation will decrease in coming quarters, allowing the CBRT to start lowering interest rates in the second half of 2019. This is an essential ingredient for the economy to recover in 2020. Nevertheless, we stand ready to downgrade our forecasts should future events go south.

Editor’s note: This article was written prior to Thursday’s announcement by the Trump administration that the U.S. would reduce tariffs on Turkish steel from 50 percent to 25 percent, returning the tariffs to their August 2018 levels.