Overseas

June 25, 2019

CRU: How China's Economic Stimulus Could Impact Global Steel Demand

Written by Tim Triplett

By CRU Analysts Kevin Bai and Ruilin Wang

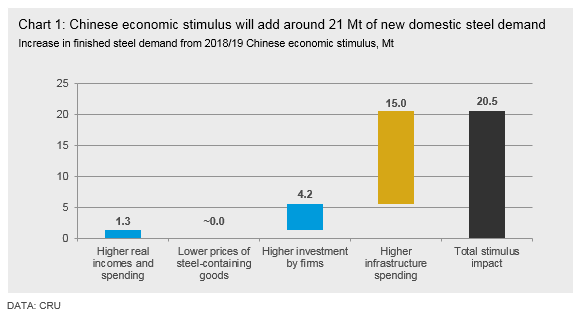

Chinese economic stimulus in 2018 and 2019 will add a total of 21 Mt to Chinese domestic steel demand, most of which is expected to manifest in 2019. Including this, total Chinese domestic steel demand is now expected to grow at around 3 percent this year.

Other Highlights

• Construction products will see the greatest increase in demand. This is because the stimulus that translates most effectively into steel demand is on infrastructure projects through direct government spending;

• Conversely, though the tax cut element of the stimulus is larger in monetary terms, transmission of this into additional steel demand is weak because only a small proportion will ultimately be spent on steel-containing goods, either by firms or individuals;

• Full consideration of the effects of the latest round of economic stimulus has lifted our base case forecast of Chinese steel demand compared to previous views. Further upgrades have been made due to a stronger than expected real estate market in Q1 and on into Q2, amidst loosening purchasing restrictions and reducing mortgage rates.

The overall uplift in domestic consumption due to 2018/19 economic stimulus, and a breakdown of its origins, are shown below in Chart 1.

Introduction

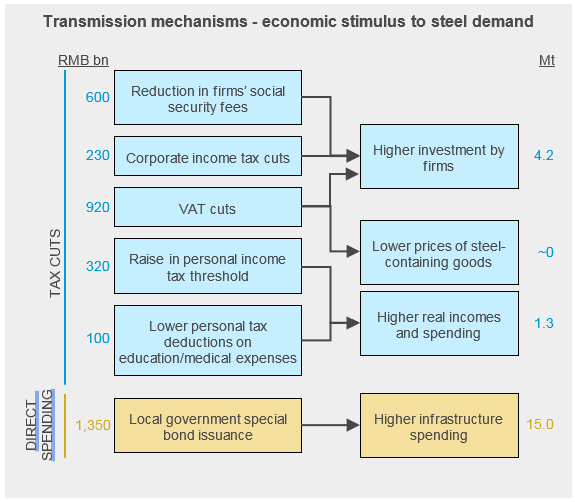

China’s 2018/19 economic stimulus is less positive for commodities demand than past episodes. This is because the majority, 65 percent, of the RMB3.7 trillion stimulus is in the form of tax cuts, with the remaining RMB1.4 trillion in direct spending in the form of local government special bonds.

This Special Feature quantifies the impact of economic stimulus on steel demand by reference to possible mechanisms by which the latest round of economic stimulus could boost steel demand. These are:

- Higher disposable incomes due to income tax and VAT cuts, leading to higher discretionary spending on steel-containing goods;

- Lower prices of manufactured goods after VAT cuts, leading to increased demand for them through price elasticity of demand effects;

- Corporate tax, VAT and social security burden cuts for companies, leading to better margins and therefore increased capital spending on steel-intensive machinery;

- Increased direct spend on infrastructure with monies from local government special bonds.

*Total tax cuts include a RMB200 bn reduction in import tariffs on consumer goods. This is assumed not to impact domestic steel demand and is therefore excluded from the analysis.

1: Higher Disposable Incomes Due to Tax Cuts

The combination of income tax and VAT cuts has certainly left Chinese consumers with higher disposable income, but what does this mean for steel consumption?

Income tax reductions amount to a total of RMB420 bn through a combination of an increase in the personal income tax threshold and reduced personal tax deductions on education and medical expenses. In addition, cuts in VAT rates on manufactured goods and transport may also pass through to consumers, though may equally be used to inflate corporate profits instead (see below). We have assumed a 50 percent pass-through of VAT cuts to end consumers for the purposes of this analysis, meaning a further RMB460 bn cut in tax burden for consumers. The question is how much of this will be spent on steel-intensive goods?

Although declining, Chinese savings rates are amongst the highest in the world, and the propensity to save is greater at times of economic slowdown when equity markets perform poorly or there is otherwise economic uncertainty. We cannot precisely evaluate how much of the increase in disposable incomes will be saved and not spent, but if that is 50 percent, it would amount to around RMB440 bn.

The tax cuts not saved could be spent in many ways. Housing remains an attractive investment for Chinese families given the belief that this is a sound investment given the sometimes-rapid rise in house prices over the last decade. Chinese families will often make savings in other areas in order to divert monies towards additional housing costs, and so this is a possible destination for some of the tax savings. This may be particularly the case when credit conditions are eased, as has been the case since March. However, this may simply result in inflation in housing costs if supply of housing cannot immediately respond and not lead to significantly greater construction activity.

Cars or domestic goods may also attract some of this additional spending power, though we judge this will only be the case if prices are reduced or other sales incentives are offered. This has been the case in some markets this year, bringing some demand forward, but has not been widespread or sustained.

Moreover, household consumption has grown strongly since 2015 while steel demand has not. Therefore, while we can see mechanisms to lift steel demand, the weakness of the past relationship implies that only a small fraction of the increase in disposable income will be spent on steel-containing goods.

By estimating the proportion of household spending on steel-containing goods, and then the steel content of those goods, ultimately less than 5 percent of the uplift in household spending due to personal income tax reductions and VAT cuts is judged to directly apply to steel. This translates to an uplift in steel demand of just 1.3 Mt.

2: Lower Consumer Prices from VAT Cuts

Our previous analysis shows that, if VAT cut savings were fully passed on through the value chain to the steel end-user, steel would be priced at most RMB100 /t ($14 /t) lower than otherwise would have been the case. Once steel intensity of use is considered, the theoretical reduction in manufacturing costs is small, and even if all is passed on in the form of price, that saving as a proportion of the cost of the washing machine is even smaller. Using a price elasticity of demand factor of 0.5:1, this means a very small uplift in steel demand indeed.

For example, the maximum change in the price of a washing machine is RMB2, i.e. 100 (the reduction in steel price per tonne) x 0.02 (steel content of a washing machine). This is a fractional saving on the price of a washing machine, therefore the maximum increase in demand is trivial. This is even more the case for a car and, we assume, for the majority of manufactured goods, too.

The above reflects the case of full pass through of VAT saving through the value chain, which is unlikely. Therefore, we do not count any additional demand from a reduction in VAT from price elasticity of demand effects, as these are judged small enough as to be essentially zero.

3: Corporate Tax Cuts

Our previous analysis showed that an uplift in margins of a firm can result from the reduction in VAT in manufacturing, construction and transport sectors. The assumption above that 50 percent of the VAT saving is passed on to consumers means the other 50 percent is retained by firms.

In addition, corporate income tax and firms’ social security burden has been reduced, in total by RMB830 bn. There is some evidence that this has boosted corporate profits. Based on financial data from the NBS, margins increased by 0.3-7 percent for most industrial enterprises. The extent of this varies by industry or position in the supply chain as a function of bargaining power. The margin of steel-related industries such as metals, mining, machinery, and home appliances rose by 2-3 percent.

This raises the possibility that firms will invest more in machinery and equipment, and industrial real estate. However, the debt-to-asset ratio is high for some firms, who may consequently prioritize deleveraging above investment. Alternatively, they may simply choose to take higher margins. Therefore, we assume only a minority of savings are spent, at least this year, on higher steel-intensive capital goods. In addition, we assume some machinery purchased will not be from domestic sources, therefore would not increase domestic steel demand.

Considering these limitations and our data for capital intensity of investment in machinery, around 4.2 Mt of additional steel demand is implied from this mechanism.

4: Infrastructure Spend

Additional infrastructure projects are and will be funded by higher local government special bond quotas totaling RMB1.350 trillion in 2018/19. This is the largest source of additional steel demand and, for the most part, buoying demand for construction steels.

Local government special bonds are similar to municipal bonds/securities in other countries, such as the U.S. They are issued by local governments, political subdivisions of a local government such as cities, counties and towns, in order to finance public-purpose projects including roads, airports, hospitals, schools, and water and sewer systems.

By inspection of past infrastructure project spend and steel consumption in them, we estimate that around 5 percent of the total value of infrastructure projects spend is directly allocated to steel purchases.

Using the expected price of construction steels over the investment period, we therefore estimate total additional steel consumption from this infrastructure investment as 15.0 Mt. Some of this may roll over into 2020 and beyond, but the majority, including 2018 bond issue spend, is assumed not to.

Overall Impact

Most of the overall 20.5 Mt uplift now factors in our forecast for 2019 and represents over half of the upgrade in steel demand in our base case projections for the year. We now expect total steel demand of around 816Mt in 2019, up 3.2 percent on 2018. What else has changed? A stronger real estate market and reported steel output in Q1.

Stronger Real Estate Sector in H1

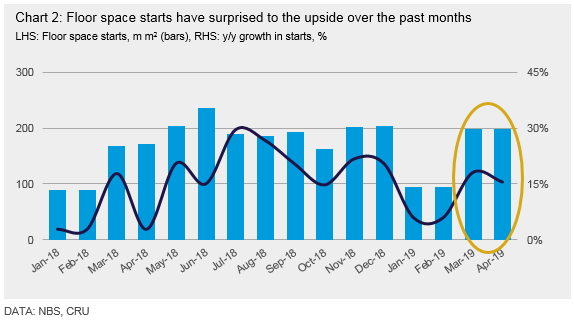

Floor space starts surprised to the upside in Q1 and increased 15.5 percent y/y in April (see Chart 2), supported by better housing sales as well as the new construction standard, which requires higher steel density in new buildings. Although the central government continues to reiterate the principle that “houses are for living in, not for speculation,” local governments have developed different ways to boost housing sales by taking advantage of the “one city, one strategy” policy, including loosening purchasing restrictions and reducing mortgage rates. These have led to rising residential mortgage volumes since March and supported higher longs demand so far in the year.

Stronger Production Data in H1

To a large extent, reflecting this stronger real demand, long products production was stronger than expected in the Jan-Apr 2019 period, and we estimate will remain high in May and June, too. An improvement in steel mills’ EBITDA margins and looser hot metal capacity restrictions in the winter heating season contributed to a 5 percent y/y increase in BF capacity utilization in 2019 Q1. Higher margins have continued to encourage steel mills to ramp up production so far in Q2 and we expect H1 longs production to increase by around 12 percent y/y.

Conclusion

Chinese economic stimulus in 2018 and 2019 will add a total of 21 Mt to Chinese domestic steel demand, most of which is expected to manifest in 2019. Together with stronger demand in H1 due to higher construction activity than expected, this will mean domestic steel demand will grow over 3 percent in 2019.

Moreover, construction products will see the strongest demand growth given H1 real estate market strength and that the stimulus that translates most effectively into steel demand is on infrastructure projects through direct government spending.

The sheet products demand uplift from stimulus will be weaker. This is because the impact on steel demand from tax cuts is weak and only a small proportion of higher disposable incomes or profits will ultimately be spent by individuals or firms respectively.