Market Data

June 28, 2019

BEA: U.S. GDP Grew by a Strong 3.1 Percent in Q1

Written by Peter Wright

The third estimate of U.S. GDP growth in Q1 2019 was 3.1 percent, but the mix of components gives cause for concern. This SMU report is very similar to the one we published for the first estimate on April 27. The first estimate for Q2 2019 will be published on July 26.

After the worst economic downturn since the Great Depression, the current U.S. expansion will become the longest on record in July. The post-financial-crisis expansion began in June of 2009 and is now 120 months long.

On Thursday, the Bureau of Economic Analysis (BEA) released the third estimate of GDP growth in the first quarter of 2019 stating: “The acceleration in real GDP in the first quarter reflected an upturn in state and local government spending and accelerations in private inventory investment and in exports. These movements were partly offset by a deceleration in personal consumption expenditures. Imports decreased in the first quarter after increasing in the fourth.”

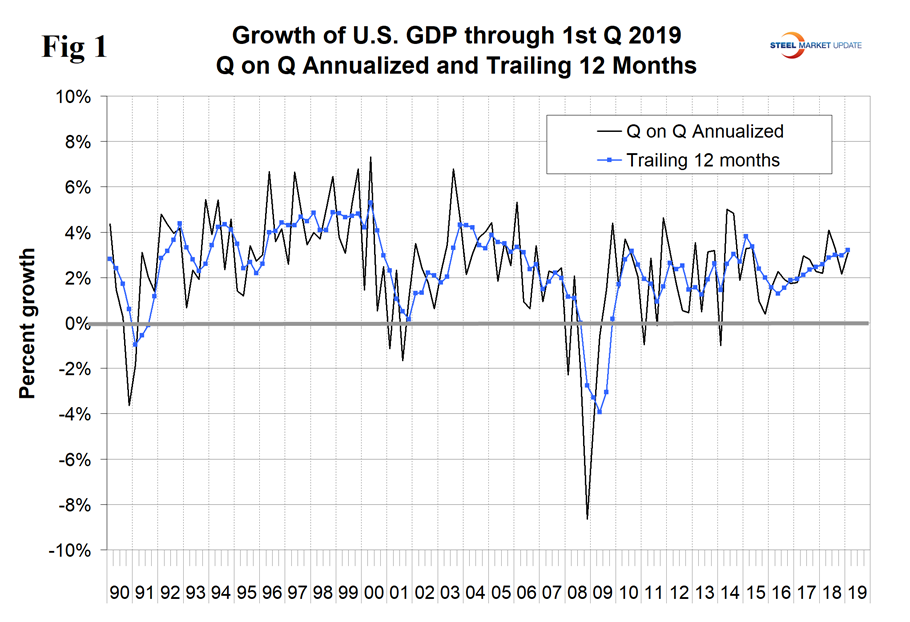

GDP is now measured and reported in chained 2012 dollars, and on an annualized basis in the fourth quarter totaled $18.91 trillion. The growth calculation is misleading because it takes the quarter-over-quarter change and multiplies by four to get an annualized rate. This makes the high quarters higher and the low quarters lower. Figure 1 clearly shows this effect. The blue line is the trailing 12-months growth and the black line is the headline quarterly result. This latest data is one of the few times these measures coincide. On a trailing 12-month basis, GDP was up by 3.20 percent in Q1, which was the best result since Q2 2015. To put that result into perspective, the average in 37 quarters since Q1 2010 has been 2.27 percent. The blue line in Figure 1 shows the slow but steady progress of the trailing 12-month result since Q2 2016.

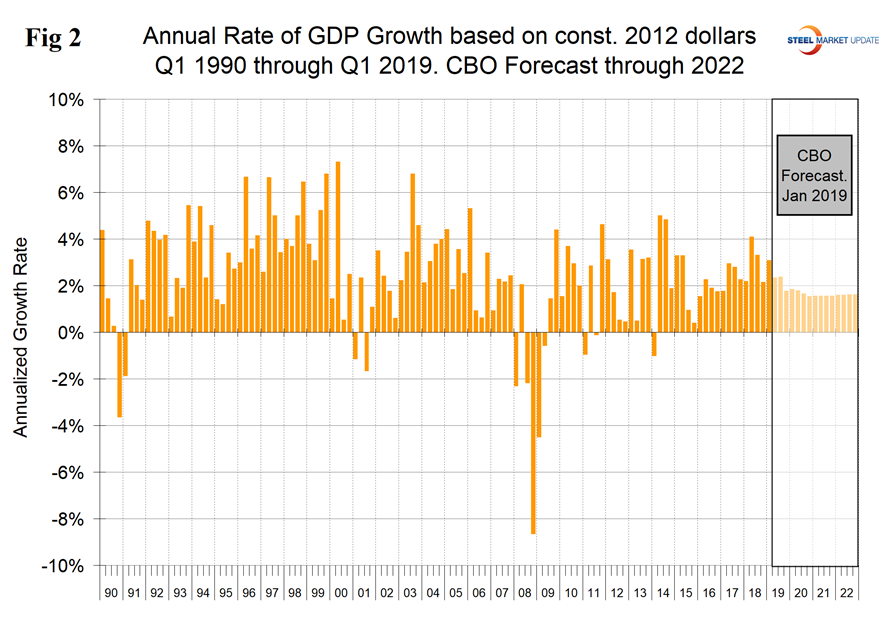

Figure 2 shows the headline quarterly results since 1990 and the January 2019 Congressional Budget Office forecast through 2022. The CBO underestimated the growth rate in Q1 2019 and expects the boost from the tax break to decline by Q3 2019.

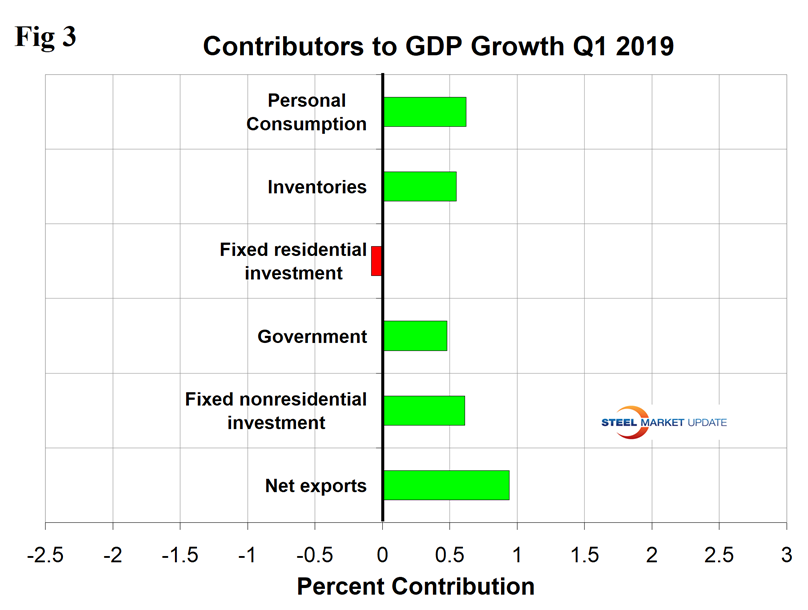

The mix of the six major contributory components in the final GDP growth calculation is shown in Figure 3. Normally, personal consumption is the dominant growth driver, but this was not the case in the first quarter when this contribution was 0.62 percent, down from 2.57 percent in Q2 last year. Personal consumption includes goods and services, the goods portion of which includes both durable and non-durables. The first-quarter result was made good by the positive contribution of net exports, which added 0.94 percent to the total. Inventories also made a positive contribution of 0.55 percent. Rising inventories are entered as a positive in the GDP calculation. Note that in the definitions at the end of this piece, inventories are not mentioned. Over the long run, inventory changes are a wash and simply move the reported growth from one period to another.

On June 27, Economy.com wrote: “The U.S. economy continued to grow at a steady pace through the first quarter. However, just as the expansion is set to become the longest in U.S. history, recession fears have increased. Driving the angst is slower economic growth, which appears to have recently fallen below the economy’s potential. Some slowing in growth this year was expected, as last year’s gain was temporarily juiced up by deficit-financed tax cuts, mostly to wealthy individuals and large corporations, which amounted to a substantial nearly 1 percent of GDP. This fiscal stimulus has since faded, and some ill effects of the tax cuts, including softer house price appreciation due to the scaling back of preferences in the tax code for homeownership, are playing out this year.”

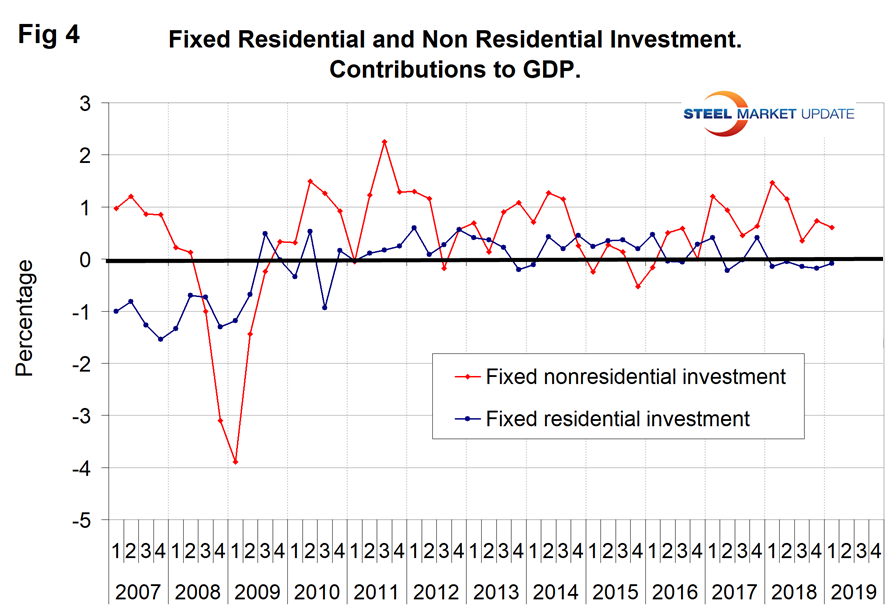

Figure 4 shows the contributions of residential and nonresidential investment. After the recession nonresidential investment bounced back, but residential did not and has had less than a 1 percent variation since Q3 2010. After a disappointing result in Q3 2018, nonresidential bounced back in Q4 when it made a 0.73 percent contribution before reverting to 0.61 percent in Q1 2019. The contribution of government expenditures was 0.48 percent in the first quarter.

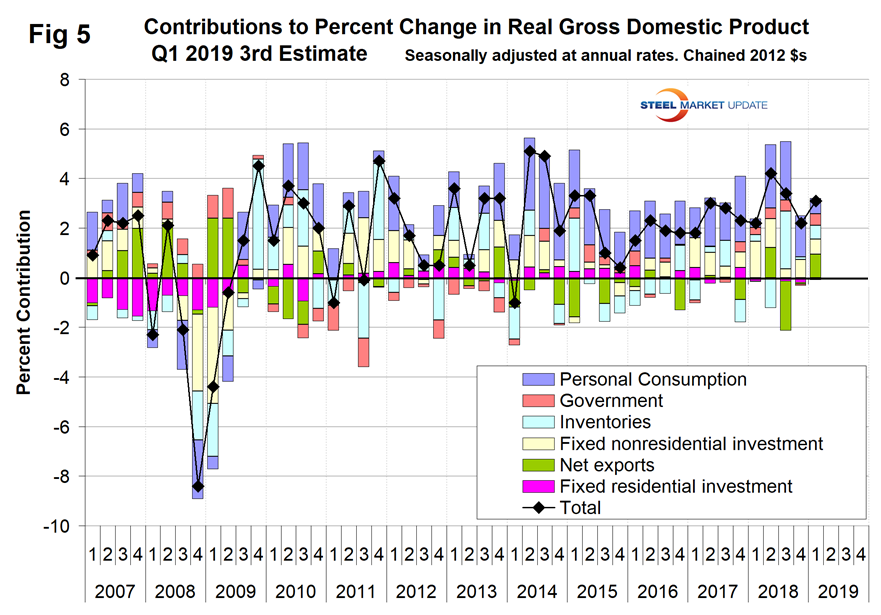

Figure 5 shows the quarterly contributors of the six major subcomponents of GDP since Q1 2007. This chart clearly shows the whipsaw effect of inventory changes, which are coded pale blue. It also shows the unusually low contribution of personal consumption expenditures in Q1 2019.

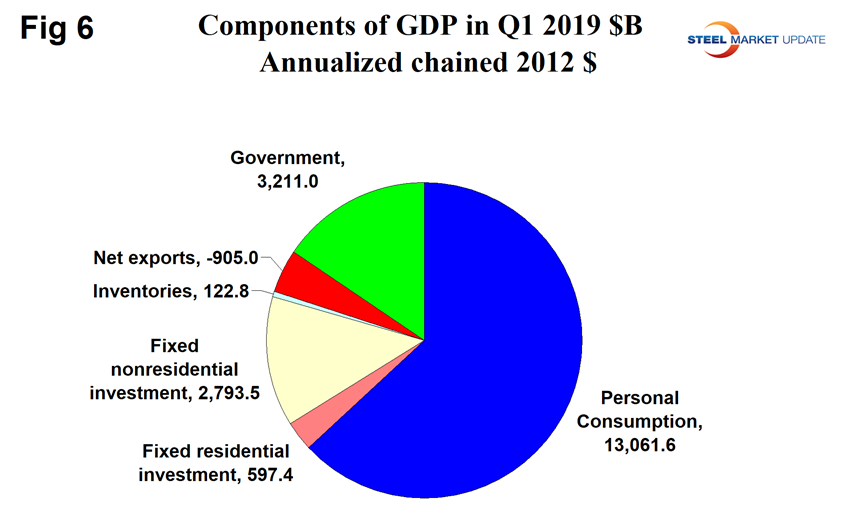

Figure 6 shows the breakdown of the $18.8 trillion economy.

Moody’s Analytics has looked back at the 2017 Tax Cuts and Jobs Act (TCJA) to see what effect it had on economic growth. “About a year and a half has passed since Congress enacted the TCJA of 2017, and the U.S. economic data since then have largely stuck to the script. On cue, the pace of growth of the economy accelerated. Moody’s Analytics estimates that the TCJA added 0.36 percentage point to real GDP growth in 2018. The maximum impact occurred in the second quarter, when the TCJA is estimated to have contributed more than a percentage point to growth on an annualized basis. However, this bout of deficit-financed stimulus has come at the cost of federal tax receipts, which have surrendered most of the hard-earned gains made since the Great Recession. The TCJA reduced the share of individual income withheld for taxes; Moody’s Analytics estimates that it slashed tax withholdings by a near $130 billion in 2018. The new tax law also lowered the corporate tax rate to 21 percent from the prior top statutory rate of 35 percent and expanded the immediate expensing of capital investments by businesses. Corporate tax revenue subsequently plunged below 1 percent of GDP by early 2019, which is less than half the 2 percent of GDP it averaged during the past half century. As a result, the TCJA has directly exacerbated the federal budget deficit.”

SMU Comment: The trailing 12-month growth rate has improved steadily since Q2 2016. On this basis, which we think is the best way to look at the data, Q1 2019 was the highest result since Q2 2015. The bad news is that personal consumption expenditures made their second lowest contribution since Q2 2013. The latest result was inflated by the contributions of net exports and an increase in inventories.

The CBO estimates that the partial shutdown delayed $18 billion in federal spending and suspended some federal services, thus lowering the projected level of real GDP in the first quarter of 2019 by $8 billion (in 2019 dollars), or 0.2 percent.

Definition of GDP: Gross domestic product (GDP) is the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production.

GDP is defined as Consumption (C) plus Investment (I) plus Government Spending (G) plus [Exports (E) minus Imports (I)] or: GDP = C + I + G + (E-I)

This equation is known as an identity. An identity is an equality that remains true regardless of the values of any variables that appear within it. That means it is not a guess or an approximation. It is simple reality.

National savings is GDP minus (consumption plus government spending). That means that investment equals savings plus net exports. If there are no net exports, then money must come back into the U.S. from outside the country to finance investments, along with savings.

Thus, if there is a government deficit, there must be savings by both consumers and businesses, plus capital flows from outside the country, to offset that deficit in order for there to be any money left over for investments.

Another definition of GDP states that it equals the growth in working population multiplied by their productivity.