Prices

July 2, 2019

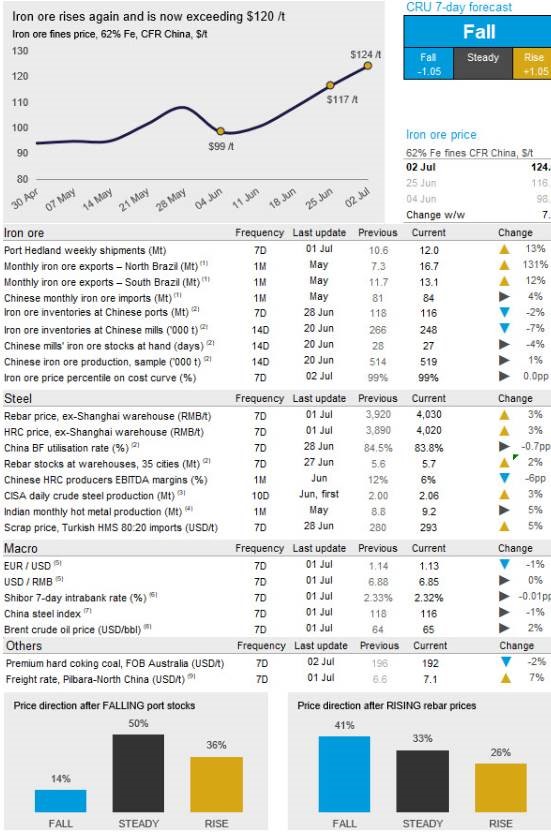

CRU: Iron Ore Trading at $124 Per Ton on Low Port Inventories

Written by Tim Triplett

By CRU Senior Analyst Erik Hedborg

Iron ore prices continued to climb in the past week as port stocks fell further and the market enters a period of weaker seaborne supply. On Tuesday, July 2, CRU assessed the 62% Fe fines price at $124 /t, up $7.50 /t w/w.

Demand in China remains strong as steel prices have improved w/w. Easing trade talks between China and the U.S. together with production cuts in Tangshan have improved sentiment, while higher raw materials prices are feeding into steelmakers’ costs. The cuts in Tangshan are affecting sintering, pelletising and BF operations and will last until the end of July, with a possible extension if pollution levels do not improve.

Seaborne supply was strong in June with elevated shipments from Brazil and Australia. However, July is typically a weaker month in terms of iron ore supply as producers such as FMG, BHP and Roy Hill all carry out extensive maintenance. There is uncertainty in the market regarding the extent of these measures this year as most miners have been running their systems very hard in June. CRU expects monthly Port Hedland shipments to hit a new record in June with close to 49 Mt shipped. The previous record was 47.3 Mt, set in June 2018.

We hold the view that prices will correct from today’s high level as a weaker steel market will eventually put pressure on iron ore prices. Steel margins are still at low levels and we expect steelmakers in China to eventually reduce output as demand weakens.