Prices

July 30, 2019

CRU: Iron Ore Holds Steady Among Strong Chinese Demand

Written by Tim Triplett

By CRU Senior Analyst Erik Hedborg

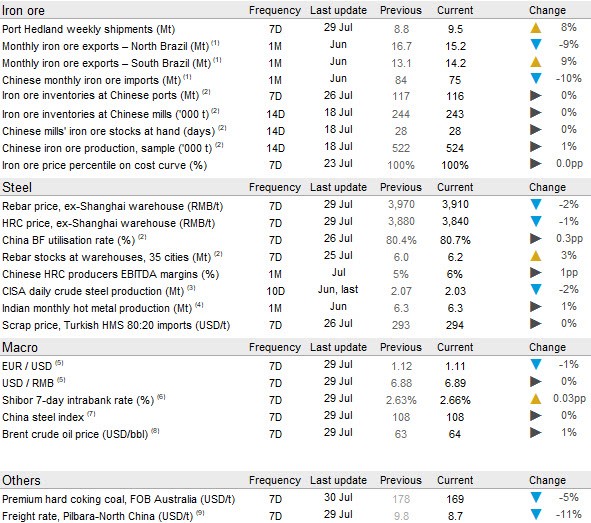

Iron ore prices were steady in the past week as mills in China continue to demand spot cargoes while inventories at ports and mills remain low. Seaborne supply has, although somewhat improved, remained relatively weak as we conclude the month of July, a month that typically has lower Australian exports due to maintenance. On Tuesday, July 30, we have assessed the 62% Fe fines price at $119.00 /t, up $0.70 /t w/w.

In the seaborne market, arrivals of Brazilian iron ore have risen in the past month and shipments from Australia have improved somewhat compared with the start of the month. In July, BHP’s shipments have exceeded expectations and we have heard from several sources that the company has offered plenty of spot cargoes with August arrivals. Our analysis shows that the company has been operating at an annualized run rate of 275 Mt/y in July, thereby exceeding the run rate in both Q4 and Q1. However, car dumper maintenance is expected within the next month and it is possible that the company’s shipments could drop in the second half of August. In the past two weeks, Roy Hill has carried out its quarterly shiploader maintenance, which resulted in 10 days without a single shipment. This is longer than in previous quarters when the maintenance period has averaged seven days.

We expect Port Hedland shipments for July to reach just above 41 Mt, well below the 48.9 Mt shipped in June, but a slight improvement over the July 2018 shipments of 40.7 Mt.

On the demand side, steelmakers were heard to maximize production at the moment due to expected weakness in the coming months. China’s 70th anniversary celebration at the start of October is expected to result in widespread production cuts, which will soften the market in September. Steel prices have remained flat in the past week, but inventory levels at ports and mills remain low, which is seen by market participants as a key factor supporting current price levels.

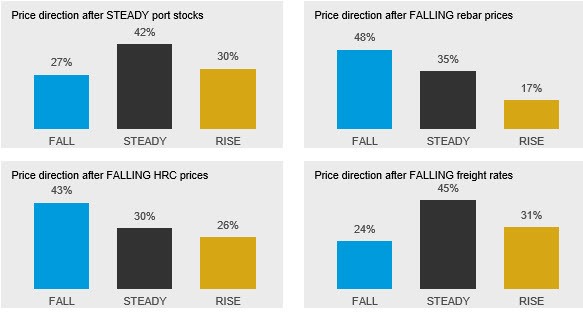

In the coming week, we still see a downside, although limited, to iron ore prices. Considering the weak margins, steel prices in decline, steady port inventories and expected strengthening to seaborne supply, we maintain the view that there is room for iron ore prices to decline somewhat in the coming week.