Prices

August 6, 2019

CRU: Iron Ore Prices Tumble Amid Escalating Trade Tensions

Written by Tim Triplett

By CRU Analyst Michelle Liu

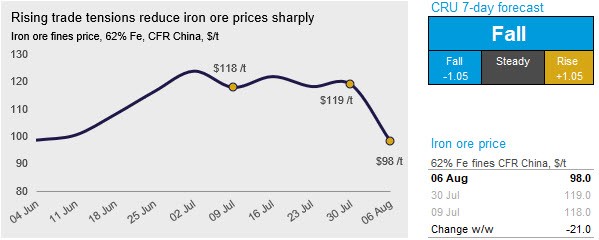

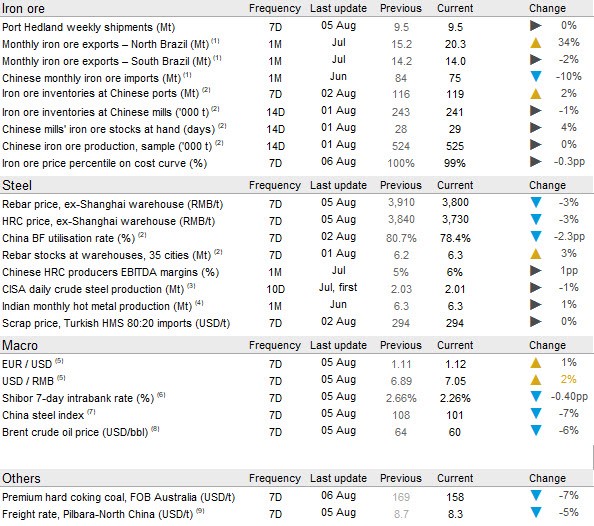

Rising trade tensions between the U.S. and China have driven one of the largest w/w falls in iron ore prices, a drop of $21 /t w/w to $98 /t. The U.S. president’s threat of imposing 10 percent tariffs on the remaining $300 billion worth of Chinese imports last Friday has escalated trade tensions between the two nations to a new high as people do not expect a trade deal will be finalized soon. Consequently, the renminbi weakened to above RMB 7 per U.S. dollar for the first time in 11 years. Financial and commodity markets fell across the board.

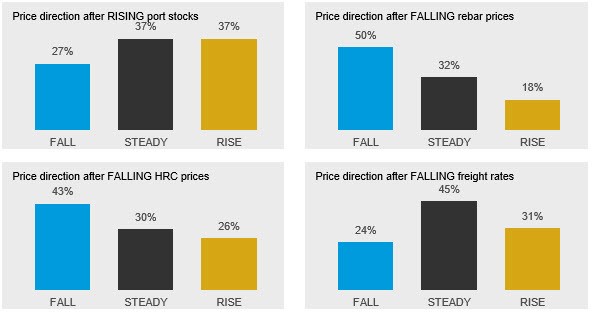

For iron ore markets, the macroeconomic blow is the last catalyst needed for the price fall as market conditions have been worsening for weeks prior to this. Although high steel output in China continues to provide support for raw material demand, falling steel prices have squeezed mills’ margins to negative territory since the beginning of August. Coupled with the depreciation of the renminbi, it had tempered buyers’ interest in paying $120 per metric ton of iron ore in late July.

Moreover, seaborne supply is gradually recovering. In July, iron ore exports from Brazil increased 17 percent m/m to ~34 Mt with shipments from Vale’s northern system reaching an all-time high. In Australia, shipments from Port Hedland were unchanged at 9.5 Mt this week. A slight decline from BHP and FMG were compensated by higher volume from Roy Hill as they are returning to normal levels after its ship loader maintenance. Weaker demand and strong supply caused port inventories in China to increase this week. In addition, buying demand from India remains weak during the monsoon season amid weaker economic growth. We expect prices to fall again next week due to excess supply and bearish sentiment in the market.