Prices

August 29, 2019

CRU Forecasts Downtrend in Demand, Pricing Until 2H 2020

Written by Tim Triplett

Steel demand will continue to weaken into 2020, but will bottom next year and set the stage for an inventory rebuild and rising consumption beginning in the second half, predicted CRU Principal Analyst Josh Spoores in his remarks Monday during Steel Market Update’s Steel Summit in Atlanta.

U.S. industrial production is currently growing at just a 1 percent rate, and the steel-intensive portion of IP is slightly negative. So, CRU forecasts a 0.9 percent decline in steel sheet demand in 2019, and an even worse contraction of 2.2 percent in 2020 before demand rebounds.

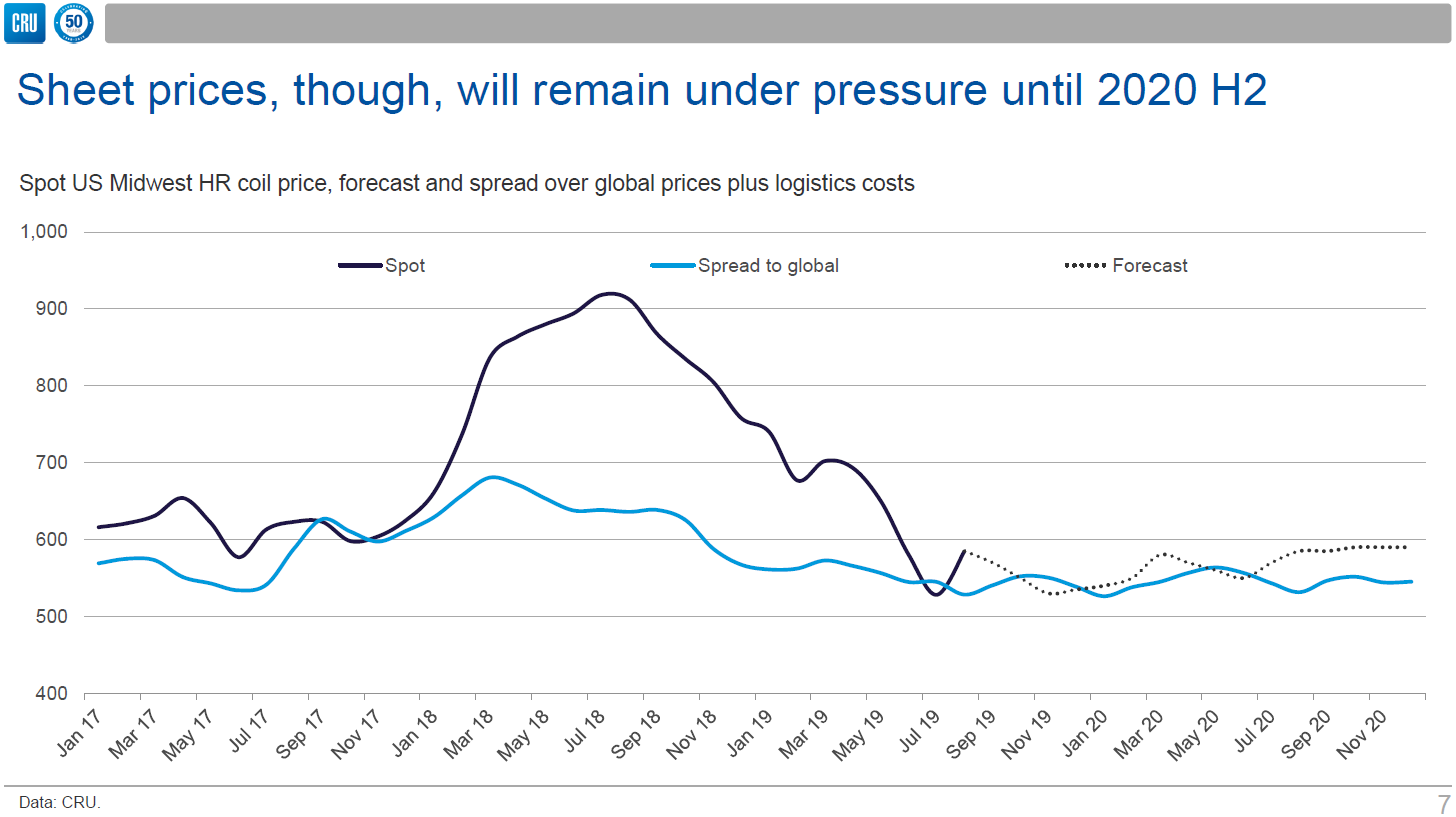

Steel sheet prices will remain under pressure until the second half of next year. In the near term, sheet inventories are plentiful on the service center level and on-order activity is bearish for prices. “We expect sheet inventories to be a little too high for the next few months,” Spoores said.

Price momentum is slowing despite the recent mill price increases. CRU expects hot rolled prices to dip toward the end of the year with $530 per ton likely in December. CRU currently forecasts an average hot rolled price of $572 per ton for 2020, down from a 2019 average of $612.

“We are in a slowing economic environment, but our view is that 2020 is the bottom and we will start to pick up from there,” Spoores said.