Market Data

October 1, 2019

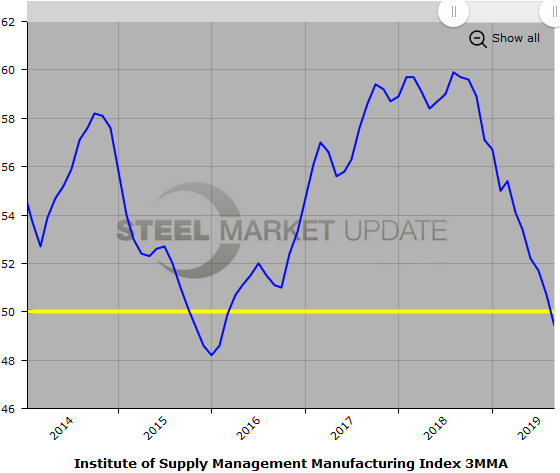

ISM's Manufacturing PMI Lowest Since June 2009

Written by Sandy Williams

The September Manufacturing ISM Report on Business showed further decline of the manufacturing sector. ISM’s PMI edged down 1.3 points to 47.8 from the August reading of 49.1.

“This is the lowest reading since June 2009, the last month of the Great Recession, when the index registered 46.3 percent,” said Timothy R. Fiore, chairman of the Institute for Supply Management Manufacturing Business Survey Committee. “The PMI contracted for the second straight month. The contraction continues six straight months of softening in manufacturing.”

All components of the index were in contraction below the 50 no-change mark except the Supplier Deliveries Index at 51.1 percent, which dipped 0.3 points from August.

New orders hit their lowest reading since June 2012 registering an index reading of 47.3 in September, up only 0.1 point from August. Production decreased 2.2 percentage points to 47.3 in September. Backlogs continued to contract as demand remained weak with the index falling 1.2 points to 45.1.

Raw material inventories contracted for the fourth straight month registering an index reading of 46.9 in September. “Inventories were again depleted relative to production, due primarily to the close attention being paid to input material receipts relative to new orders received,” said Fiore. Customer inventories were considered too low in September at a reading of 45.5 percent.

The prices index rose 3.7 points to 49.7 as raw material prices decreased for the fourth consecutive month. Prices were reported as lower for steel and aluminum products.

Employment contracted for a second month in September, falling 1.1 points to 46.3 and the lowest index reading since January 2016. “Comments were generally neutral concerning hiring for attrition. Force reduction comments were minimal, but 29 percent of employment comments were cautious regarding employment expansion,” said Fiore.

Exports and imports registered at 41 percent and 48.1 percent, respectively, in September. New export orders had its lowest index reading since March 2009 as survey respondents noted sluggish activity due to softness in global trade. Imports contracted for the third consecutive month.

Survey comments included:

- “General market is slowing even more than a normal fourth-quarter slowdown.” (Fabricated Metal Products)

- “Demand softening on some product lines, backlogs have reduced, and dealer inventories are growing.” (Machinery)

- “Business has been flat for us. Year-over-year growth has slowed dramatically.” (Miscellaneous Manufacturing)

- “Business outlook remains cautious. Orders seem to be decreasing, but luckily not as sharp of a decrease as we were expecting.” (Transportation Equipment)

- “Economy seems to be softening. The tariffs have caused much confusion in the industry.” (Electrical Equipment, Appliances & Components)

- “Second month in a row in which shipments have outpaced new orders.” (Computer & Electronic Products)

- “Continued softening in the global automotive market. Trade-war impacts also have localized effects, particularly in select export markets. Seeing warehouses filling again after what appeared to be a short reduction of demand.” (Chemical Products)

Below is a graph showing the history of the ISM Manufacturing Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.