Prices

October 8, 2019

Ferrous Scrap Drops Another $30-40 Per Ton in October

Written by Tim Triplett

Lack of demand for ferrous scrap, especially in the Ohio Valley and Chicago market, forced prices down another $30-40/GT for October, on top of a similar decline in September, sources tell Steel Market Update. Scrap prices are their lowest in years, dropping eight out of the last 10 months. Shred prices today are around $215/GT, with prime grades only around $10 to $15 higher.

“Momentum did shift to the sellers’ side in late trading as the markets trended from down more than $40 a ton to down $35. Then sellers began pulling tons as they smelled a bottom. Multiple mills were still looking for additional tons [as of Oct. 7],” said a dealer in the Northeast.

The export market has strengthened and is now approximately $20/GT higher than domestic on an FOB East Coast basis, he added. “Most market participants feel October prices will represent the bottom, although price rebounds may not happen for 60-90 days.”

October’s $30-40/GT dip can be attributed to weak steel demand and falling finished steel prices, along with several mill outages planned for the fourth quarter, said another scrap executive. Declines in the export market in September added to the downward pressure on scrap prices, although foreign demand seems to have stabilized in October.

“While this October scrap trade was somewhat typical of the seasonal change we usually see at the start of Q4, the nearly yearlong downturn in manufacturing here and around the world exacerbated this seasonally lower move,” said the exec.

The price slide would have been worse in the U.S. except that one minimill system in the Southeast was short scrap and began buying earlier than most traders expected at down $30. The weaker areas in the Midwest and Ohio Valley then began to trade at lower levels of down $35 for obsolete grades and down $40 for prime grades, he said.

Looking forward, he said, weakness in manufacturing will continue to weigh on the market through the rest of Q4. While he doesn’t expect scrap to move much lower, there’s little reason for it to move much higher, either. “Shredder feed prices are at their lowest level since the fall of 2016, in no small part due to record low Zorba (shredded non-ferrous) values. But with all the global and domestic weakness in manufacturing, it’s hard to see the scrap market moving a lot higher for the next 30-60 days. After that, upward moves will depend on the export draw and when we work off the domestic finished steel production/ inventory overhang.”

CRU North America Analyst Ryan McKinley said the primary driver of the October decline was the litany of maintenance outages alongside relatively high inventory levels. “The reduction in mill buy programs meant many mills in the Ohio Valley were not aggressively chasing remote tons, so the typical premium this area tends to hold over the Great Lakes region evaporated almost entirely. Even with low scrap prices, inbound flows into dealers’ yards appear to be steady,” he added.

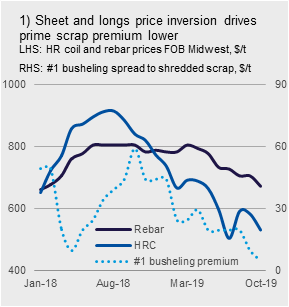

McKinley also reported spread compression between obsolete and prime grades. On average, shredded scrap and #1 busheling are only about $5 apart now domestically. This compression has been going on all year and is driven in large part by the inversion of sheet prices relative to longs prices, he said (see chart #1 below).

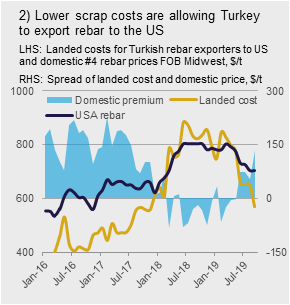

The export market is down by $20 or so month over month, but has seen some stability in the last couple of weeks as enough deals have been booked to keep scrap flowing to the export yards, McKinley said. “Interestingly, this low-priced scrap environment has put Turkish exporters back in the U.S. finished steel market,” he noted. “We could see scrap headed back this way in the form of rebar, which could help keep downward pressure on finished steel prices (and perhaps scrap prices by extension). A couple of months ago, we saw U.S. domestic steel prices rise above the landed cost for Turkish exporters and I think we will see this continue so long as scrap stays low (see chart #2 below).

Looking ahead, McKinley expects little change in scrap prices for November. “There is a possibility for another small drop. It all depends on if dealers manage to find homes for all of their material this month. It will also depend on if mill order books strengthen at all following these maintenance outages,” he said.

The pig iron markets are holding on for dear life, reported another SMU source. As he explained, “Last month, the U.S.-based mills tried to buy at $300 MT CFR, but were not able to convince the CIS producers to accept this price. So, they could not book much Low-Phos pig iron. Then, they thought they could buy S. Brazilian higher P at their price, thinking they had no other home. To their chagrin, the Chinese came in and bought 170,000 MT at a price of about $280/MT FOB Brazil. This equates to about $310/MT CFR NOLA. Needless to say, these producers don’t need the U.S. market now. So, now the scrap market has dropped an additional $40 in October and the U.S. mills still have not bought pig iron to any large extent. Now they want to buy even cheaper from the CIS. But the producers there have not relented. The parties are $50-60/MT apart. Mills want to buy at $280/MT NOLA and the Russians want $325. If they settle at $295, there would still be a $90-100/GT premium for pig iron over #1 busheling on a delivered works basis. With iron ore prices where they are, it should be interesting to see how this gets resolved.”