Prices

November 9, 2019

SMU Market Trends: Will Price Increases Stick?

Written by Tim Triplett

Will the market accept the recent price increases—a total of $80 on flat rolled and $40 on plate? Obviously much depends on steel demand. Judging by the responses from steel buyers polled this past week by Steel Market Update, demand remains a question mark.

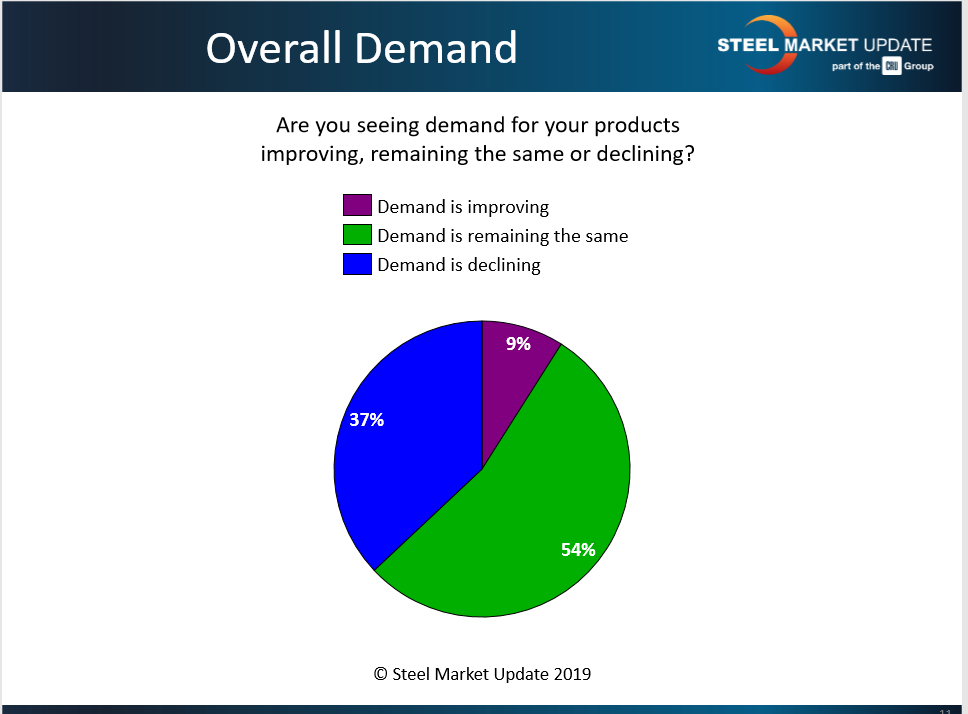

More than half of those responding to SMU’s market trends questionnaire on Monday and Tuesday said demand from their customers is flat or unchanged. Another 37 percent reported declining demand for their products. Less than 10 percent said they have seen improvement in demand.

Much of the current decline is seasonal in nature, which makes it difficult to gauge the true demand for steel moving forward into next year. “Demand is lower now as customers worry about a future slowdown and still have high inventories bought last year at higher prices in anticipation of a more robust and tighter steel market,” commented one respondent. Others reported a bump in sales activity this week, “but only because buyers are trying to beat the price increase.”

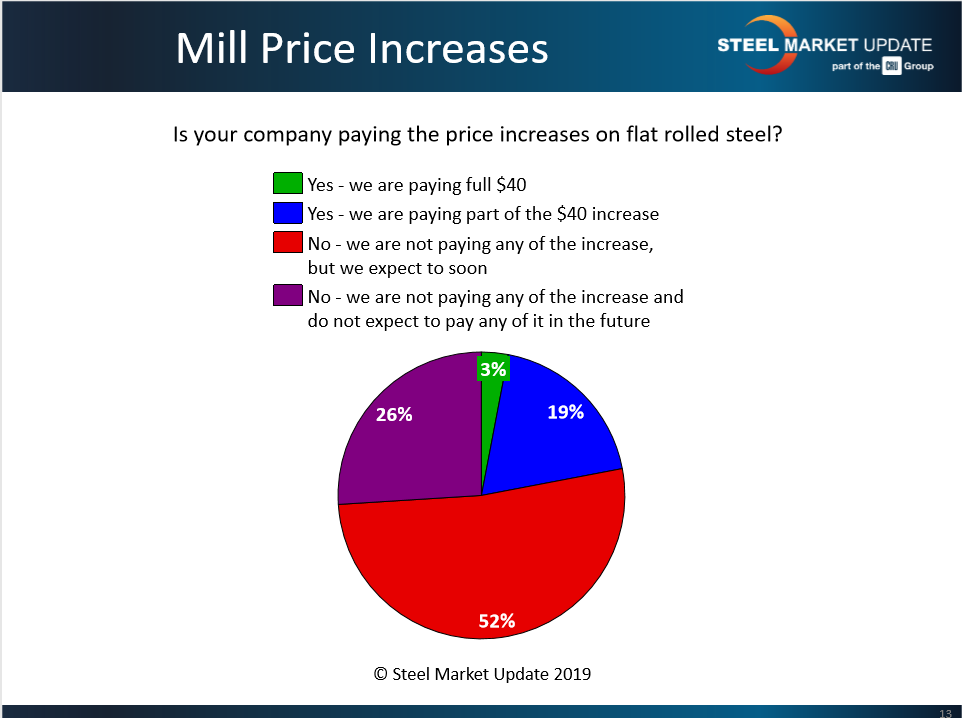

Are buyers paying the price increase on flat rolled steel yet? Polled about 10 days after the first increase was announced, only a tiny percentage of the respondents said they were paying the full $40 per ton and only about 19 percent said they were paying even part of the increase on new orders. More than half (52 percent) said they have not paid any of the increase yet, but they expect to soon. That leaves a pretty substantial group, 26 percent, who don’t believe the increase will gain any traction in the market and don’t expect to pay any of it in the weeks to come.

Note that buyers responded to SMU’s questionnaire prior to the mills’ second $40 price increase announced on Thursday. The second round of increases was no surprise as 80 percent of those polled said they were expecting another price hike within the next few weeks.

As one manufacturer commented, “a failed increase can only be met with another announcement as a way to attempt to achieve some traction.”

“They may try again, but it will get kicked back to them. People already have orders placed now for first-quarter 2020,’ said one skeptical service center exec.

“They will try to stop the bleeding. However, demand is the key,” said one OEM.

Observed another manufacturer: “The mills have no discipline. They appear content to make money in one quarter and then tank the numbers in the next for the sake of not losing market share. For them, the name of the game is always TONS.”

Other findings from SMU’s poll of the market this week show mixed signals. Mill lead times have lengthened a bit, which suggests the mills’ order activity is picking up. Yet, the majority of buyers still report mills open to price negotiations on new spot orders, even as they attempt to collect higher prices.

Will the latest increases prove to have some staying power or is the market poised for its third dead cat bounce of 2019? Stay tuned.