Overseas

November 14, 2019

CRU: Global Sheet Prices Fall More, But an Uptrend is at Hand

Written by Josh Spoores

By Principal Analyst Josh Spoores, from CRU’s Steel Sheet Products Monitor

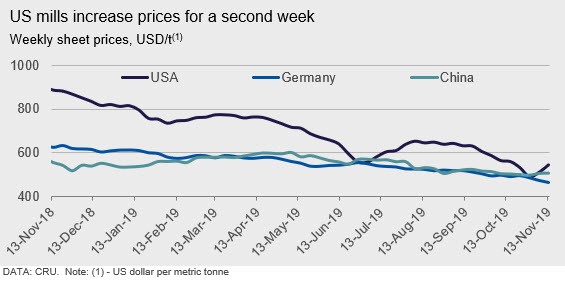

Global sheet prices remain in a downtrend for November, though are starting to recover in some markets. Overall, CRU’s Global Flat Products Price Indicator (CRUspi flats) fell 3.3 percent m/m in November to 137.7, the lowest level recorded since October 2016. This indicator of global sheet prices is down 22.5 percent y/y. Price fell across most regions, with declines in Asia, Europe and North America featuring as key components of the CRUspi flats.

Price declines in the U.S. market were the sharpest of all regions when measuring the Oct. 9 price assessment to weekly prices at the end of October. Indeed, HR coil prices fell in the U.S. by 13 percent or $67 /st during this period, though due to slightly higher scrap costs for November and multiple mill price increases U.S. weekly prices are now up $49 /st from their low just two weeks ago, yet still down m/m.

Like the U.S. market, weekly prices in the hyper-competitive South East Asian market reached a low at the end of October but have risen over the past two weeks. Prices here had been driven down by aggressively priced material from Russia and India, which forced domestic prices to near break-even levels. The recent price increases have been spurred by increased buying activity, which has allowed domestic steelmakers here to find some relief.

In Europe, sheet prices have continued to fall, though there is some evidence to suggest that this trend is on the verge of reversing. Even though Italian price movements have been mixed w/w, the extent of declines has been more limited while some data submissions to us show w/w price gains from the same market participant. Furthermore, multiple mills in the region have now taken serious steps to cut production.

This environment of low steel prices and consequent challenging profitability levels for producers in most regions has led to planned capacity outages in multiple regions. ArcelorMittal has initiated plans across regions to take down steel production at Saldanha Bay in South Africa, Krakow works in Poland, the #3 furnace at their Indiana Harbor works in the U.S. and they have announced intentions to also shut down the furnaces at their recently-acquired and possibly soon to be divested Ilva works in Italy. Other temporary outages have been announced in Europe and the U.S. in addition to this recent wave of announcements.

Outlook: Price Declines to Reverse Course Despite Limited Demand Gains

Price rises so far have been limited in extent and to just a couple of markets. The expectation of higher prices over the near-term was foreseen in our October report and we continue to expect price rises across most markets given a combination of stronger seasonal demand and production cuts. The latter has been spurred by very poor producer margins and this is little changed since that report—the vast majority of HR coil prices are still bumping up against, if not settling below, mill costs.

Though mill production cuts are one key to improving margins and shifting the direction of prices, until industrial demand starts to rise at a greater rate than was achieved in 2019, margins and sheet prices, though improved, will remain under pressure. In most markets, we do not expect strong underlying demand recovery in 2020 Q1. Rather, apparent demand will be slightly higher given some seasonal demand recovery, but is also reliant on restocking.