Prices

December 8, 2019

SMU Market Trends: Mills Collecting Higher Prices, But for How Long?

Written by Tim Triplett

The mills have succeeded in collecting a portion of their recent price increases, but how much and for how long? Steel Market Update canvassed buyers this week and opinions varied widely.

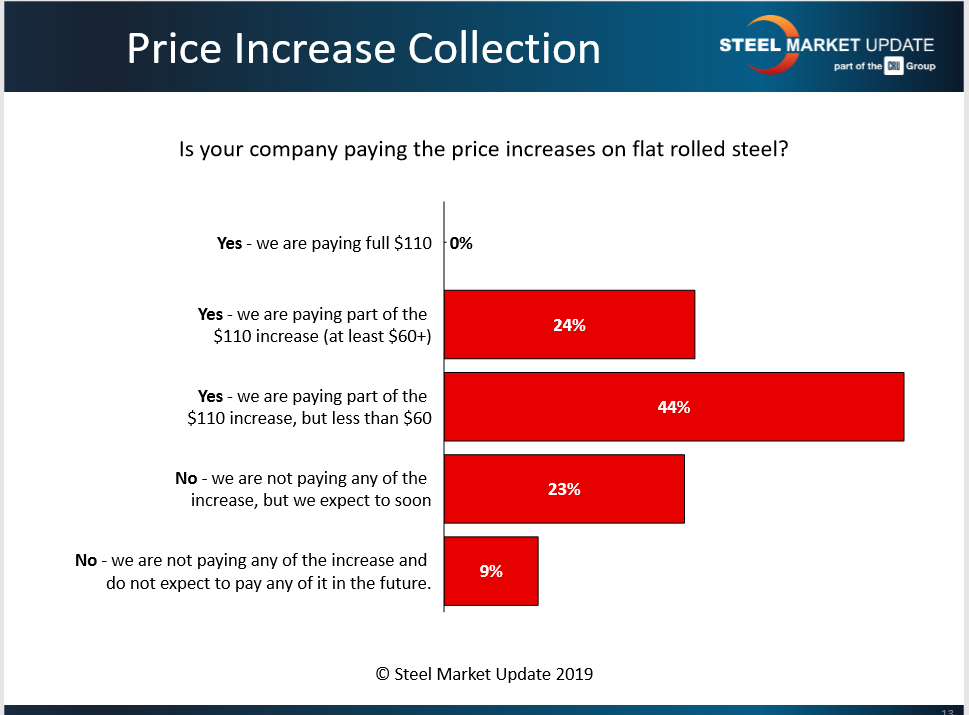

Flat rolled producers raised prices by a total of $110 per ton in three rounds of announcements during October and November. Steel Market Update data estimates that the average price for hot rolled has increased by about $75 ($3.75/cwt), to the current $555 per ton.

That figure appears a bit high based on the responses SMU received from service centers and manufacturers. Less than one-quarter (24 percent) of the buyers responding to SMU’s questionnaire this week said they are paying an additional $60 or more for steel. The biggest group of respondents (44 percent) said they are now paying more, but less than $60 of the $110 increase. The remaining one-third (32 percent) said they are not yet paying higher prices, and many don’t expect to in the future. No buyers reported paying the entire price increase.

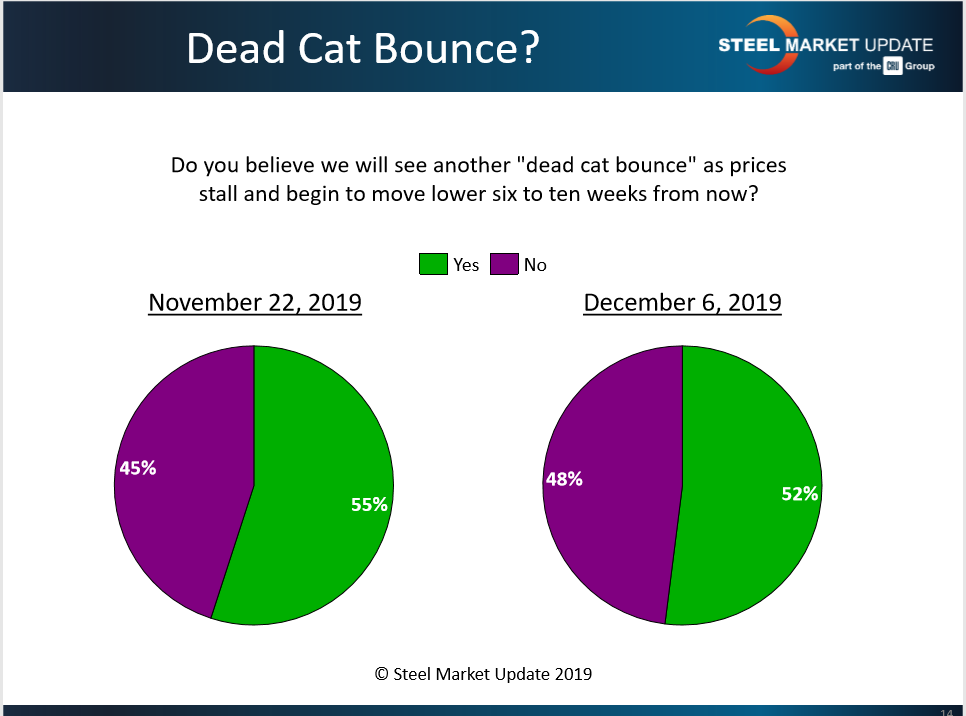

Dead Cat Bounce?

Steel buyers are almost evenly split on the staying power of the recent price hikes. A slight majority (52 percent) of those responding to SMU’s questionnaire this week said they expect to see another “dead cat bounce” as prices stall and begin to move lower in the next six to 10 weeks.

Following are varying comments:

“I believe some of the increases will stick through the first quarter.” Service Center/Wholesaler

“Yes [dead cat bounce], unless there are some capacity reduction announcements.” Service Center/Wholesaler

“Seasonal factors and inventory levels should give this upturn some staying power.” Service Center/Wholesaler

“Now with AK sold to Cleveland-Cliffs, blast furnaces out at USS, the effect of the Brazil tariffs on NLMK and AM Calvert, it will be Chicken Little the sky is falling. Mills will scare everyone into buying steel over the next month. They will raise prices and watch it all disappear before their eyes in February. There is no true demand.” Manufacturer/OEM

“We could see some pullback after a while, but not a complete retracement to the lows.” Service Center/Wholesaler

“No [dead cat bounce], I expect a shortage of coated and CRC in the short term. Inventories are being driven too lean, and any hiccup in domestic lead times or import delays will cause some shortness in the first part of Q1. But it will not be long-lived and will recover in the latter part of Q1.” Trading Company

“With imports continuing to decline and domestic production beginning to slip, we think pricing will remain stable well into Q1, depending on demand.” Service Center/Wholesaler

“Margins and net profits, or lack thereof, in the mill and service center sectors should support some sustained level of price increase. If the mills get too aggressive with significant and continual price increases, end-users will view it as a ‘will they never learn’ event and wait it out. Frankly, I agree with the end-users. This binge and purge pricing approach hasn’t worked in the past and won’t work in the future.” Service Center/Wholesaler

“The time frame for the dead cat bounce will be a bit longer than 6-10 weeks. Probably by May bookings.” Manufacturer/OEM

“The mills are greedy and poor judges of the market.” Service Center/Wholesaler

“Depends on how high the prices get in the meantime.” Service Center/Wholesaler

“I’m not convinced the economy is that strong. Inflation is too low, real wages aren’t going up, low interest rates are not stimulating the economy as much as they should, and manufacturing is slowing. Demand and supply will take over; prices will go down.” Manufacturer/OEM

“Who the heck knows? Nothing makes sense anymore. We can only control what we can control.” Manufacturer/OEM

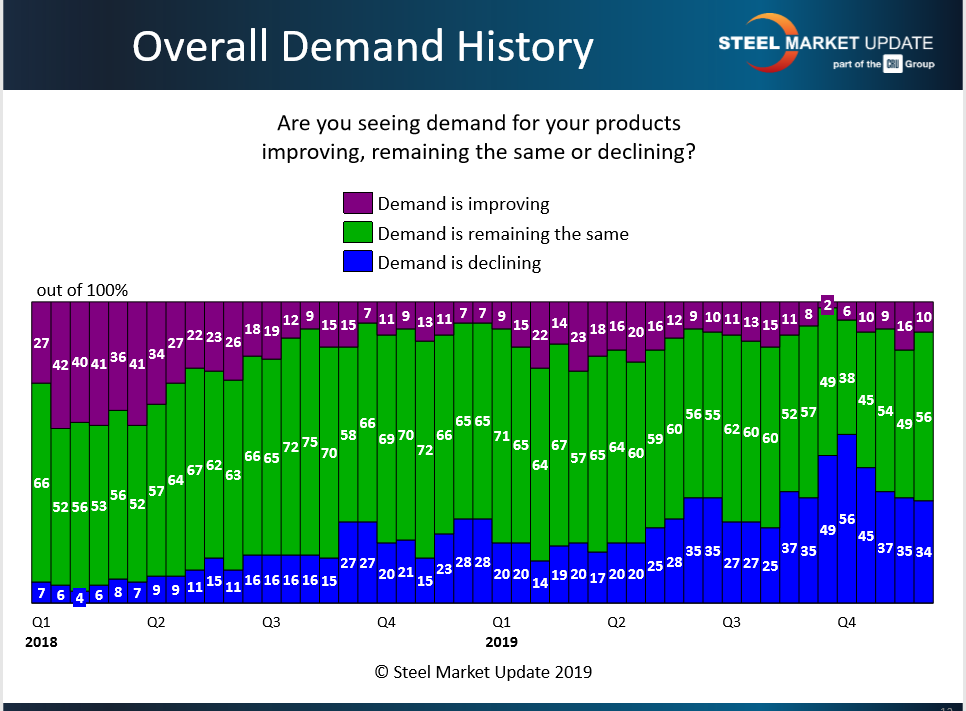

Ultimately, mills can only collect higher prices over the long term if there is sufficient demand. Most buyers (56 percent) report flat demand in the current market. Another 34 percent see demand declining. Only 10 percent see demand improving, which may not bode well for steel prices.