Plate

December 13, 2019

Regional Imports Through October: Cut-to-Length Plate

Written by Peter Wright

Steel Market Update offers a comprehensive series of import reports ranging from the first look at licensed data to the very detailed look at volume by district of entry and source nation. The report you are reading now is designed to plug the gap between those two. National level import reports do a good job of measuring the overall market pressure caused by the imports of individual products. The downside is that there are huge regional differences. This report breaks total YTD import tonnage for each flat rolled product into regions and the growth/contraction for each region. Then it graphs the regional history of that product over a six-year period. We will report regional import data for each of six flat rolled products every other month.

![]()

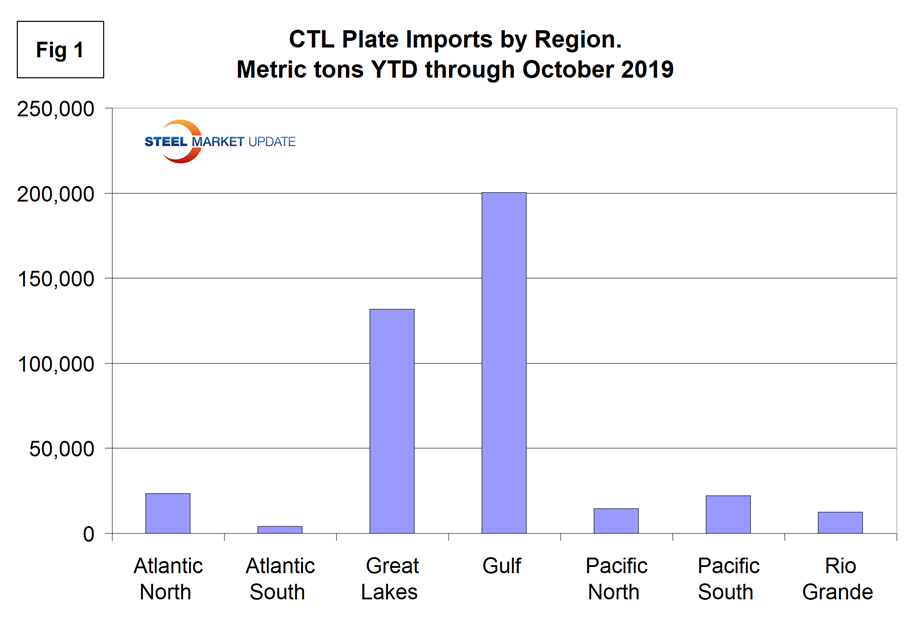

This month, we are reporting through October. These six reports are intended to be reference documents with very few specific comments. The charts tell the whole story. Our intent is to provide buyers and sellers with an understanding of what is going on in their region of operation. Figure 1 shows the year-to-date tonnage into each region and the huge variation between them. Figure 1a presents the same data as a pie chart. The highest volume region in 2019 YTD October was the Gulf at 49.0 percent of the total followed by the Great Lakes at 32.2 percent.

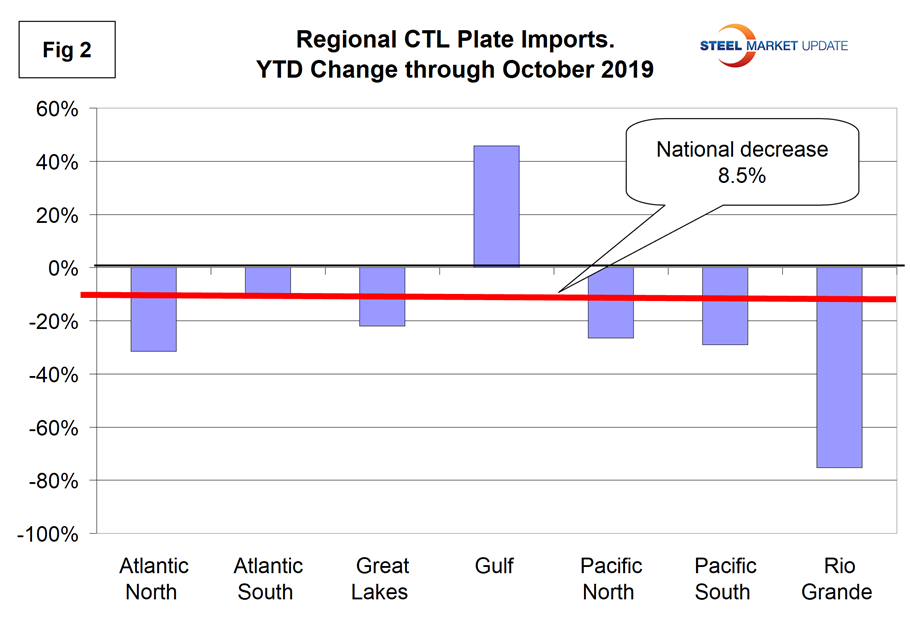

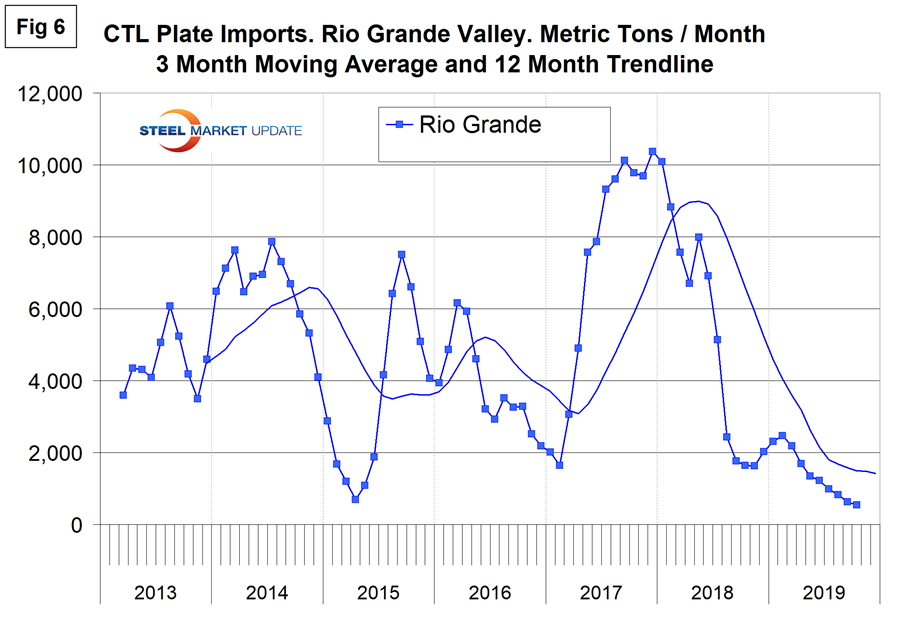

Year to date through October, total CTL plate imports were down by 8.5 percent, but the volume into the Gulf was up by 45.8 percent. The tonnage across the Rio Grande was down by 75.3 percent.

Figure 2 shows the year-to-date change for each of seven regions and the change at the national level

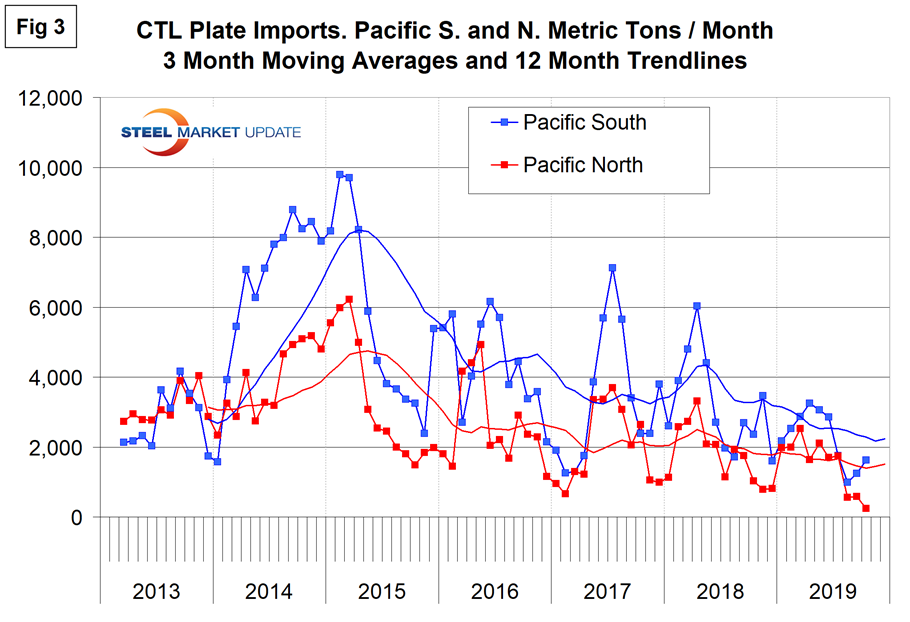

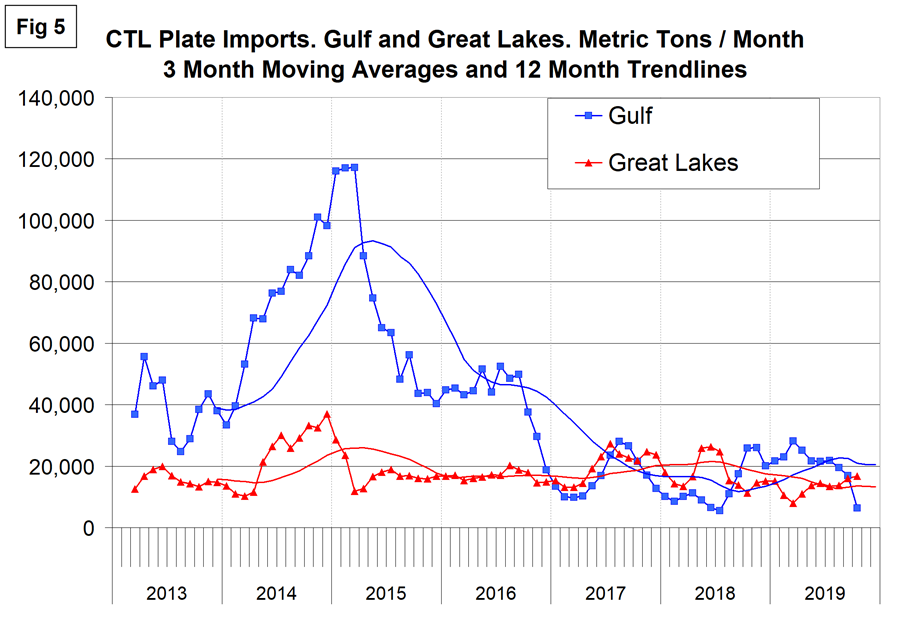

Figures 3, 4, 5 and 6 show the history of CTL plate imports by region since March 2013 on a three-month moving average basis. Note, the Y axis scales are not the same.

Regions are compiled from the following districts (we will report on tonnage by district and source nation next month):

Atlantic North—Baltimore, Boston, New York, Ogdensburg, Philadelphia, Portland ME, St. Albans and Washington, D.C.

Atlantic South—Charleston, Charlotte, Miami, Norfolk and Savannah.

Great Lakes—Buffalo, Chicago, Cleveland, Detroit, Duluth, Great Falls, Milwaukee, Minneapolis and Pembina.

Gulf—Houston, New Orleans, Mobile, San Juan, St. Louis and Tampa.

Pacific North—Anchorage, Columbia Snake, San Francisco and Seattle.

Pacific South—Los Angeles and San Diego.

Rio Grande Valley—Laredo and El Paso.