Market Segment

February 6, 2020

ArcelorMittal Reports Big Loss in 2019

Written by Sandy Williams

ArcelorMittal posted a net loss of $1.9 billion for the fourth quarter of 2019. In comparison, the global steelmaker posted a loss of $539 million in Q3 and a net profit of $1.19 billion in Q4 2018. For the entire year 2019, ArcelorMittal posted a net loss of $2.5 billion compared to net income of $5.1 billion in 2018.

“2019 was a challenging year for the global steel industry,” said ArcelorMittal Chairman and CEO Lakshmi Mittal. “Macro headwinds were exacerbated by supply chain destocking, resulting in demand weakness in our core markets and significant spread compression to levels that were both exceptional and unsustainable. Despite the continued macro uncertainty, the destocking cycle appears mature and the recent trends for steel spreads in our core markets have been more encouraging.”

Total steel shipments for the quarter fell 2.3 percent from Q3 to 19.7 million metric tons. Sales for the quarter fell 6.7 percent to $15.5 billion due to lower average steel prices, decreased shipments and lower prices for iron ore and pellets. Crude steel production decreased 11.1 percent to 19.8 million MT in Q4 compared to Q3.

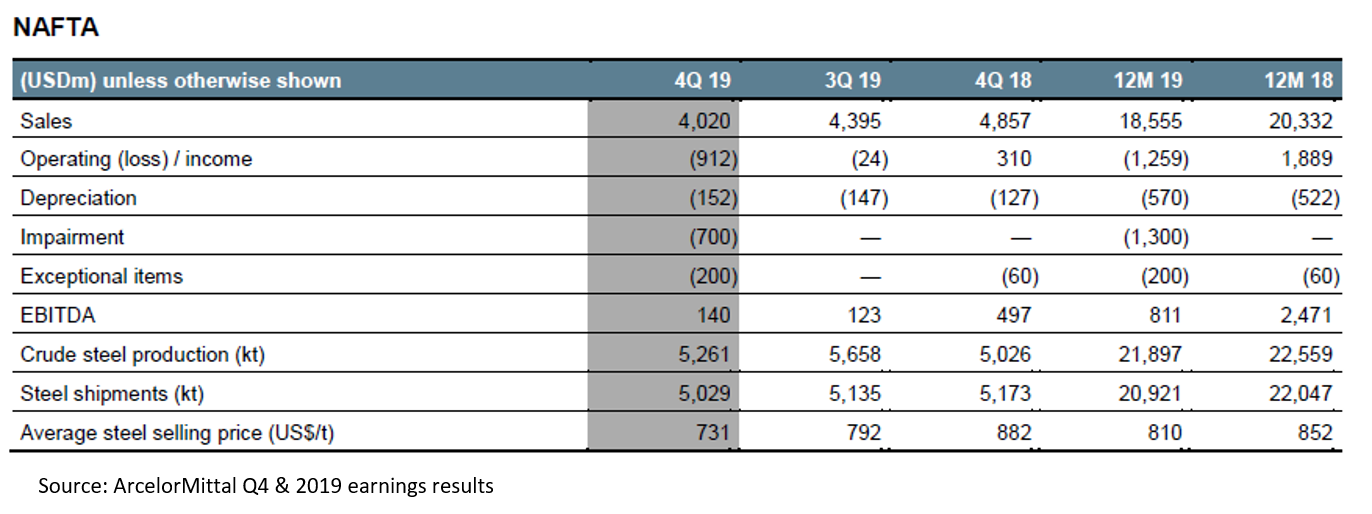

In the NAFTA segment, crude steel production fell 7 percent quarter-over-quarter due to planned outages in flat and long product operations in response to weaker demand. Sales fell 8.5 percent to $4.0 billion due to lower steel prices and destocking. NAFTA shipments fell 2. 1 percent with flat steel shipments dipping 2.9 percent during the quarter. Average steel selling price was $731 per ton, down 7.4 percent for flat products and 6.8 percent for long products.

Also negatively impacting NAFTA results were $200 million in inventory-related charges and $60 million related to the new U.S. collective bargaining agreement.

Weak market conditions in Europe prompted a decision to reduce European flat rolled production by 4.2 million MT in the second half of 2019. As a result, European crude steel production fell 22 percent to 9.09 million MT in the fourth quarter as compared to 11.6 million tons in Q4 2018.

The acquisition of Essar India in 2019 was the culmination of a 15-year journey, said Mittal. ArcelorMittal has a 60 percent share of Essar India in a joint venture with Nippon Steel. The new entity is called ArcelorMittal Nippon Steel India Limited (AM/ES). “The asset is performing well and offers considerable brownfield potential aligned with the country’s ambition to triple crude steel production over the next 10 years,” he said.

The company is continuing negotiations with the Italian government regarding the Ilva steel mill, including substantial investment by the Italian government. A court hearing on interim measures is scheduled for Feb. 7.

Next year will be a busy one for ArcelorMittal with a number of North American investments reaching completion in 2021.

In Canada, investments are underway to modernize the hot strip mill at ArcelorMittal Dofasco. Slated is installation of new coilers, coil inspection, coil evacuation and strip cooling equipment, among others. The improvements will allow the company to producer higher-value products and provide cost savings of around $25 million in EBITDA.

In the U.S., the installation of two latest-generation walking beam furnaces at Burns Harbor is expected to be completed in 2021. The project focuses on improving hot rolling quality and productivity and sustaining market position while reducing energy consumption. EBITDA benefit is projected at approximately $45 million.

In Mexico, construction of a new $1 billion hot-strip mill is on track to be completed in 2021. The 2.5 million metric ton hot-strip mill is expected to capture market share from imports as a highly competitive, low cost processor of slab. The mill has the potential to add $250 million of EBITDA for ArcelorMittal.

ArcelorMittal plans to reduce its CO2 emissions in Europe by 30 percent by 2030 and be carbon neutral by 2050. Three pathways to achieving its target have been identified:

- Clean power steelmaking, using clean power as the energy source for hydrogen-based steelmaking, and longer term for direct electrolysis steelmaking;

- Circular carbon steelmaking, which uses circular carbon energy sources, such as waste biomass, to displace fossil fuels in steelmaking, thereby enabling low-emissions steelmaking;

- Fossil fuel carbon capture and storage, where the current method of steel production is maintained but the carbon is then captured and stored or re-used rather than emitted into the atmosphere.

The impact of the coronavirus on the market will be more evident once the Chinese holiday period concludes, said ArcelorMittal. “Absent a degradation of the situation and/or a further extension of the holiday period, we believe the effect of the coronavirus will likely have a short‐term negative demand impact in China and to a lesser degree elsewhere,” said the company in its earnings remarks.

Putting a challenging year behind them, ArcelorMittal is optimistic regarding the demand outlook for 2020. “Although market conditions remain challenging, there are encouraging early signs of improvement particularly in our core markets of U.S., Europe and Brazil. With inventory levels having reached a very low level following a period of de-stocking, we are seeing customers return to the market, supporting an improved pricing environment,” the company said..