Market Data

March 8, 2020

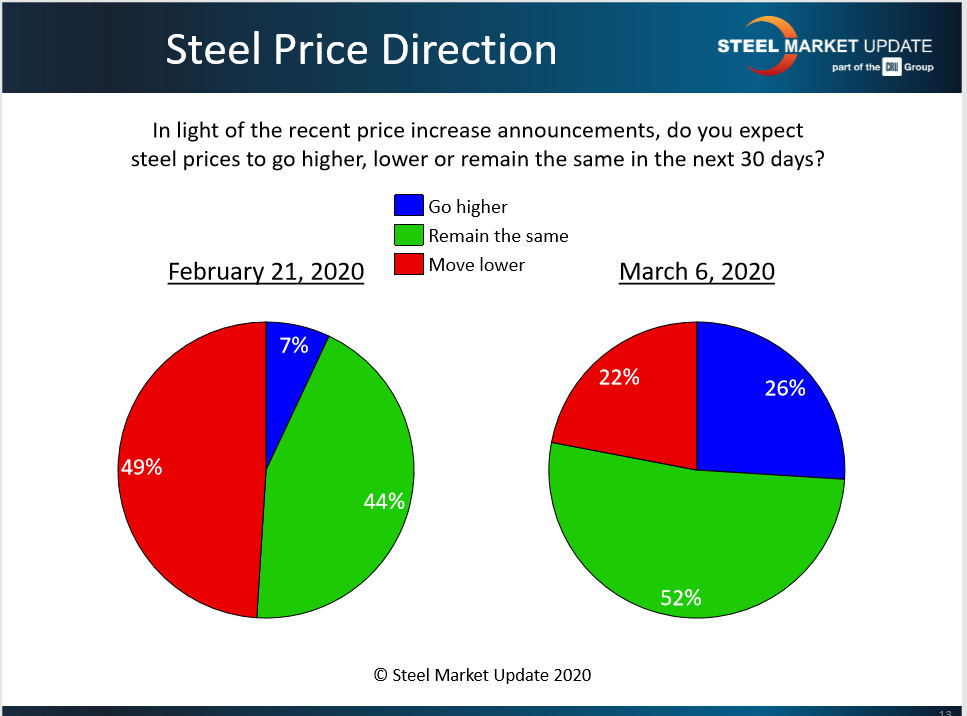

SMU Market Trends: Few Expect Higher Prices

Written by Tim Triplett

Last week’s price hike by the mills did little to change the outlook of most steel buyers. The majority (52 percent) of those responding to Steel Market Update’s canvass of the market this past week still believe prices will remain the same, despite the latest $40 increase announced by the mills on Feb. 27. Another 22 percent expect prices to move even lower in the next 30 days, while just 26 percent anticipate higher prices.

The benchmark price for hot rolled moved up by $20 to $580 per ton, based on SMU’s latest poll of steel buyers a few days after the mills’ announcement. Whether that was a short-term reaction or a signal that prices are changing direction remains to be seen. Most respondents’ comments are skeptical. Coronavirus fears are the wildcard:

“The increase was an attempt to keep pricing stable, but I don’t think it’s going to work this time.”

“HRC will move higher in the short term based on relines, maintenance, etc., but I don’t think it’s sustainable.”

“I see maybe a slight upward bias, but nothing significant.”

“The most recent announcement was to stop the fall. As long as scrap remains constant, and demand seems OK, there should be no significant movement.”

“With roughly 500,000 tons of hot roll being taken out of the market in April/May due to the plethora of planned outages, and scrap trending up, we feel pricing for hot roll will move slightly higher. Even more so for coated products.”

“If demand is affected by coronavirus fears, prices will come down.”

“I could see prices going up a bit based on scrap prices, but I don’t see them climbing too much higher or dropping too much lower with all the uncertainty over the coronavirus and demand.”

“Prices could go flat and not drop more. There are too many uncertainties to know for sure. If demand softens in the short term, the price will start flat but then keep going down.”