Market Data

March 16, 2020

Service Center Shipments and Inventories Report for February

Written by Estelle Tran

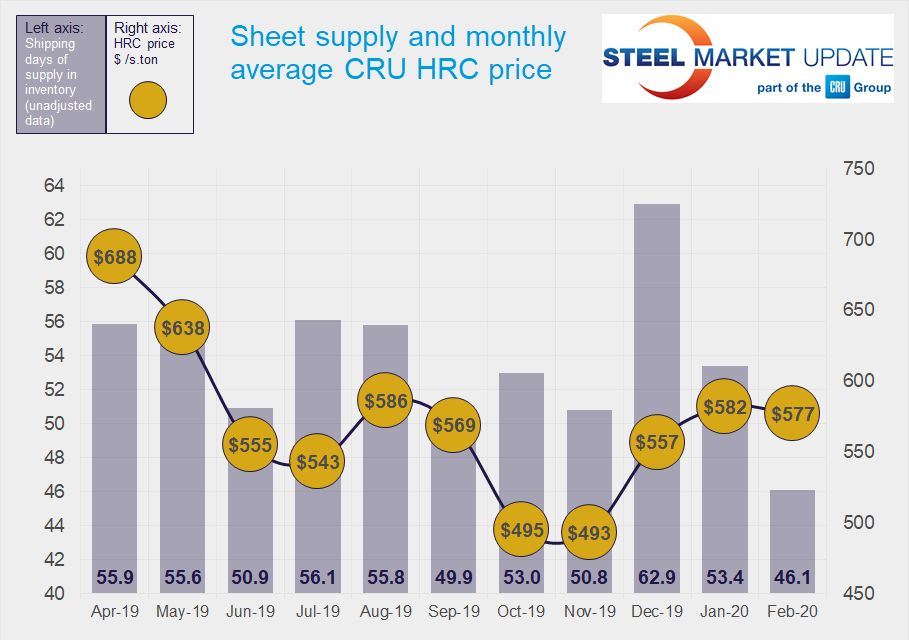

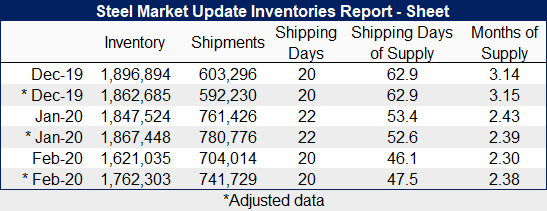

Flat Rolled = 46.1 Shipping Days of Supply

Plate = 49 Shipping Days of Supply

Flat Rolled

As prices eroded in February, service centers further reduced their flat rolled inventories 4.6 percent month on month by month’s end, according to adjusted February data compared with January’s final. With 20 shipping days in February compared to January’s 22, shipments decreased by only 2.6 percent. The result was a significant reduction in the shipping days of supply, which dropped to 47.5 days in February from 53.4 in January. Flat rolled inventories at service centers represented 2.38 months of supply at the end of February, compared to 2.43 in January.

Looking ahead, we expect inventories to remain low, given the uncertainty surrounding steel prices, oil prices and Covid-19. The Covid-19 outbreak will cause further supply chain disruptions in the weeks ahead, in addition to a negative impact on consumer spending. We expect on-order volumes to remain around the current elevated levels, given the low inventory levels and mill outages planned for Q2. The material that is due to arrive, however, will be at higher costs relative to recent service center sales.

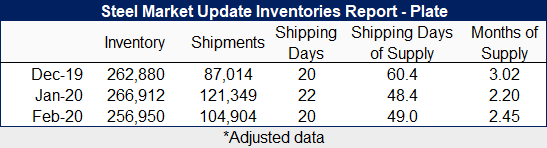

Plate

Service centers continue to maintain low plate inventories, as prices have been flat-to-down and shortening mill lead times provide no incentive to build inventory. Service centers carried 49 shipping days of supply at the end of February, up slightly from 48.4 in January. In terms of months of supply, this represented 2.45 months of plate supply compared to 2.2 in January.

Shipments fell back in February not only in total shipments, but the daily shipping rate also decreased 4.9 percent.

Though service center inventories of plate drew down in February, the small boost in on-order material shows a relative comfort level with plate pricing. With mill lead times shortening to 4.71 weeks, according to the latest SMU data, there appears to be no incentive for service center buyers to change their behavior. The negativity in the steel and oil markets and overall economy will likely weigh on plate service centers as well.