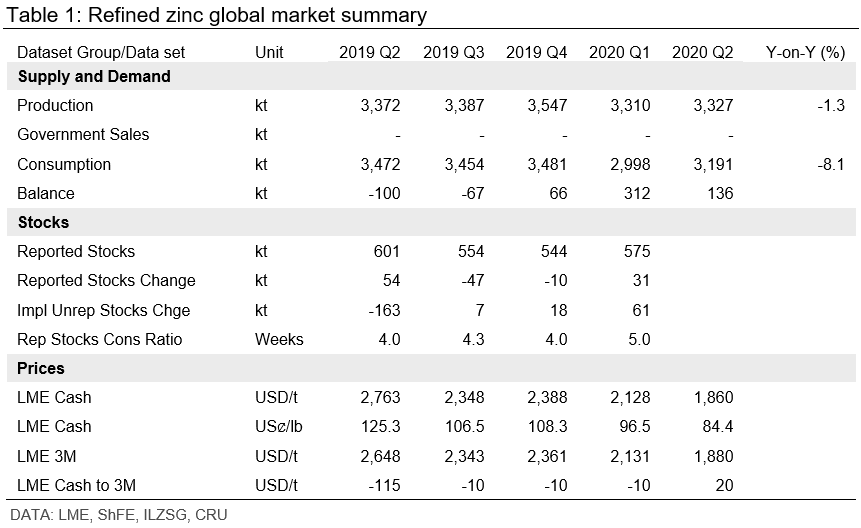

Prices

April 16, 2020

CRU: Zinc’s Price Off Lows as China Emerges from Lockdown

Written by Helen O’Cleary

By CRU Senior Analyst Helen O’Cleary, from CRU’s Zinc Monitor

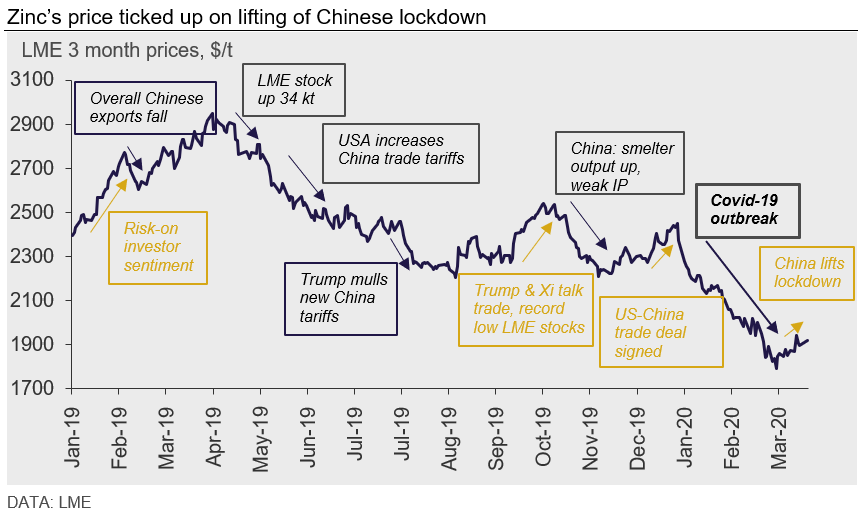

As the Chinese market gradually emerges from its Covid-19 lockdown and businesses and individuals start to return to normal, acute outbreaks of the virus across the world mean that many countries are still operating under severe restrictions. Even as China attempts to reinvigorate domestic demand, export market weakness threatens to hamper its economic recovery. At the time of this writing, the relaxation of restrictions in Spain and Italy is helping to keep zinc’s price just above $1,900/t, but the extension of lockdowns in countries such as India, Canada, Mexico and Peru and a reluctance by many others to give a date for even a tentative return to normal means recent gains could easily be eroded.

After falling below $1,800/t on March 25, zinc’s price reacted favorably to Trump’s suggestion that he may relax some restrictions (prematurely, as it turned out) and the rebound in China’s March manufacturing PMI, a sign that month-on-month activity had improved. At the time of this writing, the relaxation of restrictions in Spain and Italy is helping to keep zinc’s price just above $1,900/t but the extension of lockdowns in countries such as India, Canada, Mexico and Peru and a reluctance by many others to give a date for even a tentative return to normal mean recent gains could easily be eroded. Metals prices are likely to take their next cue from the release of Chinese Q1 GDP data on April 17. Indications from the Chinese economy since the lockdown was lifted suggest that business activity is ramping up in most regions, although provinces reliant on export trade, such as Guangdong, immediately felt the chill wind of weakening export markets. The expectation is that a coordinated effort to kick start China’s economy will quickly show positive results. But the staggered impact of the outbreak on economies in European countries and U.S. states means that a common strategy to exit lockdowns and restart these economies will be difficult to engineer. This is reflected in dire GDP forecasts from the IMF and others which suggest that the real impact of shutting down large sections of the global economy will be felt over the longer-term and risks to demand therefore remain skewed to the downside.

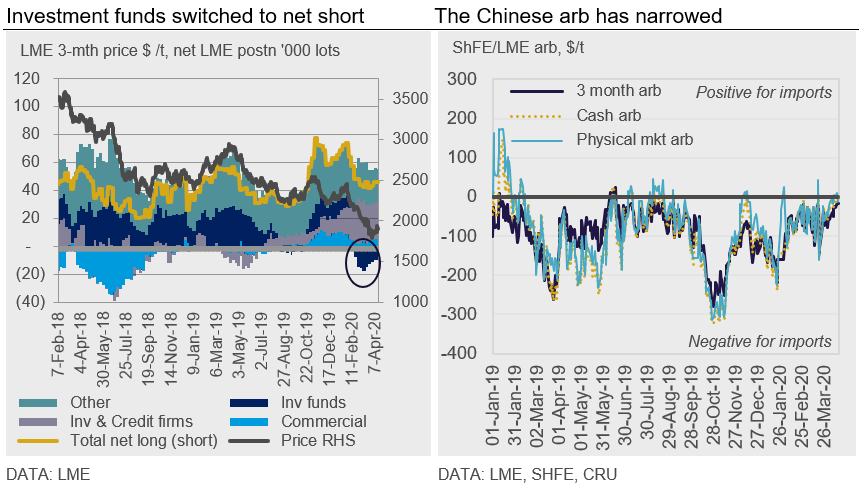

LME commitments of traders’ data show that investment funds switched their non-risk-reducing positions (which we take to mean speculative) to net short in early February. All other investor categories remained net long, but total net longs fell to 46,000 lots (1.15 Mt) in early April, down from 74,000 lots (1.85 Mt) in early January.

Zinc’s price on the LME and ShFE moved broadly in tandem through the first three weeks of March, although the ShFE started to make gains over the LME towards the end of the month and this continued into April. The restart of business activity in China and the subsequent decline in refined stocks has given some support to the ShFE price and the arb has narrowed significantly. It is now on the brink of becoming positive for imports, but we do not expect the arb window to open decisively while the Chinese domestic market remains well supplied.

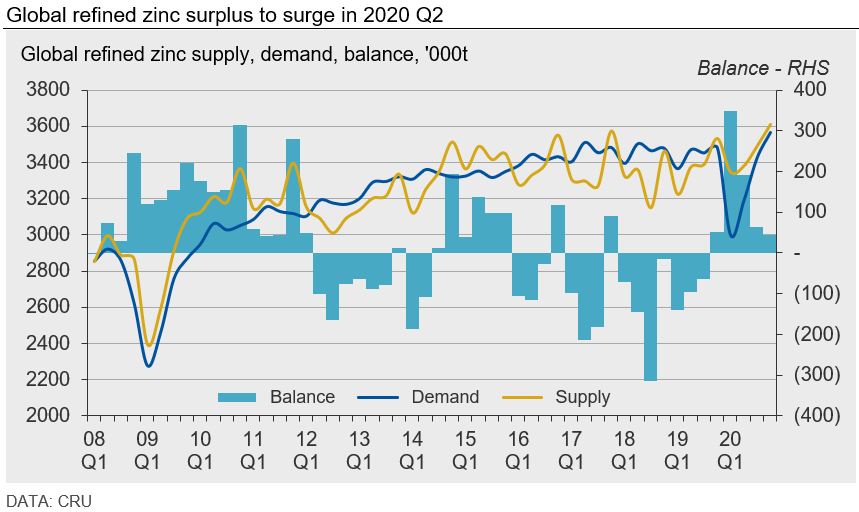

Global Refined Surplus Expected to Surge in Q2

Given the impact on refined demand has been much greater than on supply so far, we expect surpluses to build much more quickly this year than we were anticipating previously. To date, there have been relatively few smelter disruptions due to Covid-19 lockdowns, as many are deemed to be essential operations and have been allowed to continue operating. Some operations are running at lower than normal rates in line with government-mandated restrictions, while most others are said to be operating normally. Demand destruction is most apparent in the auto sector but, even so, we understand there are still pockets of activity. Construction sector activity has all but ceased in countries with the most severe restrictions (parts of Europe, the USA and India).

While it appears that Q1 will be the weakest for Chinese demand this year, Q2 is likely to be the worst in most of ex-China. While cuts in refined supply may filter through later in the year if mine lockdowns are extended and concentrate availability tightens, we currently expect demand to remain considerably weaker than supply this quarter, resulting in a refined surplus of 450,000t in 2020 H1 and a full-year surplus of around 470,000t (compared to our January forecast of a 190,000t surplus in 2020). We expect the Chinese market to register a 250,000t deficit in 2020 and China’s full-year net imports to be around 450,000t, resulting in a modest stock build in China (around 200,000t) and an ex-China surplus of 270,000t.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com