Market Data

May 4, 2020

CRU: Covid-19 Scenarios--Strategies for Managing the Cycle and Beyond

Written by Ben Jones

By CRU Managing Consultant Ben Jones, from CRU’s Steel Sheet Products Market Outlook

Understanding the shape and nature of the Covid-19 cycle will be critical to commercial success, and in some cases, survival of many industry players. Traditional thinking about pathways back to normality (e.g. V, U, W, L shaped recoveries) ignores the potential for fundamental changes in the market. The most successful businesses remain agile and anticipate structural change amid “noisy” market signals. This has the potential to unlock massive rewards through early or counter cyclical decision making, such as those that bought assets when the industry was depressed in the mid-2000s, prior to the China boom. In this Insight, CRU Consulting provides guidance on evaluating the implications of three scenarios—labeled “Bump in the Road,” “Disorderly Adjustment” and “Managed Adaptation”—for management teams seeking to navigate such unprecedented circumstances. (See our previous Insight, “Re-thinking the Covid-19 cycle: a scenario-based approach,” for further background on these scenarios).

Covid-19 is Upon Us. It’s Big, Bad and Different…

Understanding the shape and nature of this cycle will be critical to commercial success, and, for many industry players, survival. It is tempting to think of this cycle in terms of different paths back to market conditions that existed just prior to the emergence of Covid-19. However, such significant disruptions can fundamentally change markets, including longer-term demand, supply technology adoption, competitiveness and market structure as well as the role of government. Identifying, evaluating and tracking these impacts is key.

Moreover, as previously outlined, each cycle is fundamentally different in character. The rapid emergence of mass unemployment across many countries following recent social distancing policies is a case in point; in the U.S., for example, over 20 million workers have claimed unemployment benefits in just a month. Such figures literally swamp the labor market impacts observed during the global financial crisis (effectively rolling back over a decade of subsequent employment growth in a few weeks). This has potentially serious implications, for example, on the affordability of household real estate and consumer durables, which are critical to sustaining demand for many mined commodities.

Using Scenarios to Guide More Effective Decision Making

The most successful businesses remain agile and anticipate structural change amid “noisy” market signals. They maintain a strategic focus on the end-state of a crisis rather than a return to the past, unlocking rewards through the ability to act early and, oftentimes, counter cyclically.

CRU Consulting has previously developed three scenarios—“Bump in the Road,” “Disorderly Adjustment” and “Managed Adaptation”—which describe the potential shape of the Covid-19 cycle and the future market conditions which may ensue in its aftermath. These scenarios are intended to provide key building blocks towards the adoption of more coherent, resilient and adaptive strategies.

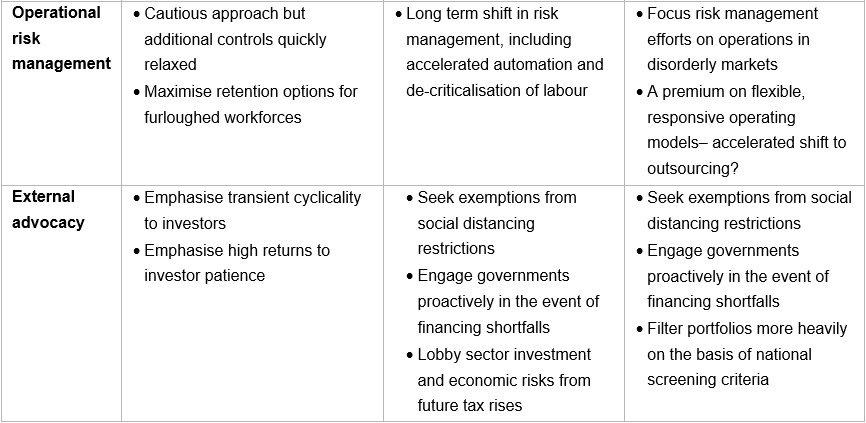

Understanding the potential implications of these scenarios for business decision making is critical. This requires a proper and robust evaluation of the market and firm impacts under different scenarios and actionable strategies. Such exercises are inherently specific to individual resources, industries, market segments, assets and operators. However, a high-level illustration of the potential implications of these scenarios for decisions relating to cash management, capital planning, M&A, operational strategies as well as external relations are shown in Table 1 below.

This analysis begins to reveal rich insights into different strategic options and their likely desirability under different futures. Cash management is shown to be a critical issue across all scenarios, particularly among the most levered firms. However, current equity prices may offer value from share repurchase schemes for some under “Bump in the Road.” Adapting to “Managed Adaptation” and “Disorderly Adjustment,” which feature more persistent health risks and deeper behavioral changes, requires a much deeper understanding of future shifts in end uses and competitive advantage as a guide to successful investment planning. The depth and extended nature of these cycles also limit the scope for strategic shut-downs and idling to bolster prices. Box 1 outlines two illustrative case studies for firms with different exposures and underlying financials.

Case Study Illustrations – “Stress Testing”

Case study 1: Cash rich, large diversified miner: “Bump in the Road” implies a heavy emphasis on opportunistic M&A, largely among previously identified targets. The transition scenarios, by contrast, warrant a much more in-depth focus on the firm’s commodity and asset mix. The potential for structural demand shift may warrant a reorientation, for example, of end use market exposures, while the expectation of deep and potentially heterogenous changes in competitiveness are suggestive of the need for deeper stress testing on core NPV-based supply cost modeling and portfolio management.

Case study 2: Moderately levered, mid cap base metals producer: Understanding the price cycle is key to ensure robust views on future cash generation. Capital planning, particularly in the face of “Managed Adaptation” and “Disorderly Adjustment,” warrants the preparation of defensive options on divestments and a deep enquiry in the macro market and financial channels shaping access to and price of both debt and equity. This implies deeper stress testing on core NPV-based supply cost modeling, with a particular focus on the cost of capital.

Case study 3: Commodity investment fund: Deep analysis of downside risk is warranted across all scenarios. “Managed Adaptation” and, particularly, “Disorderly Adjustment” require more selective portfolio decisions, focusing on intra commodity differences, the strength of individual balance sheets, and the potential for systemic commodity market risk. Identifying new sources of long-term competitive positioning is desirable under both these scenarios, including, for example, shifting market access and profitability associated with rising consumer concerns regarding environment, social and governance issues.

Towards More Resilient Decision Making

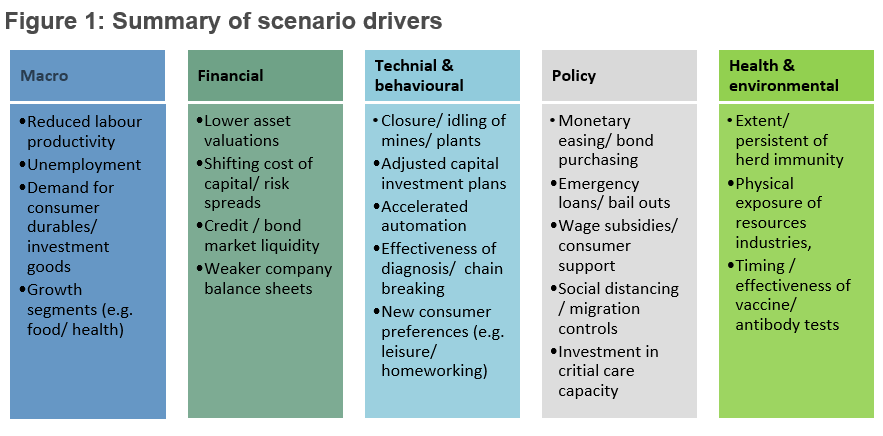

Having agreed to appropriate scenario narratives with the principle internal stakeholders, the next challenge is to identify the relevant drivers. This is an essential step towards a proper and robust evaluation of the market and firm impacts under different scenarios. Here we re-emphasize the importance of challenging traditional—backward looking—thinking on the nature and out turn of these drivers. Previous experience suggests that severe and multi-faceted shocks such as Covid-19 drive fundamental changes in markets which are not uncovered through standard trend-based analysis. This raises a premium on ensuring input to these processes from a range of stakeholders and individuals who are less likely to be encumbered by entrenched positions or traditional thinking.

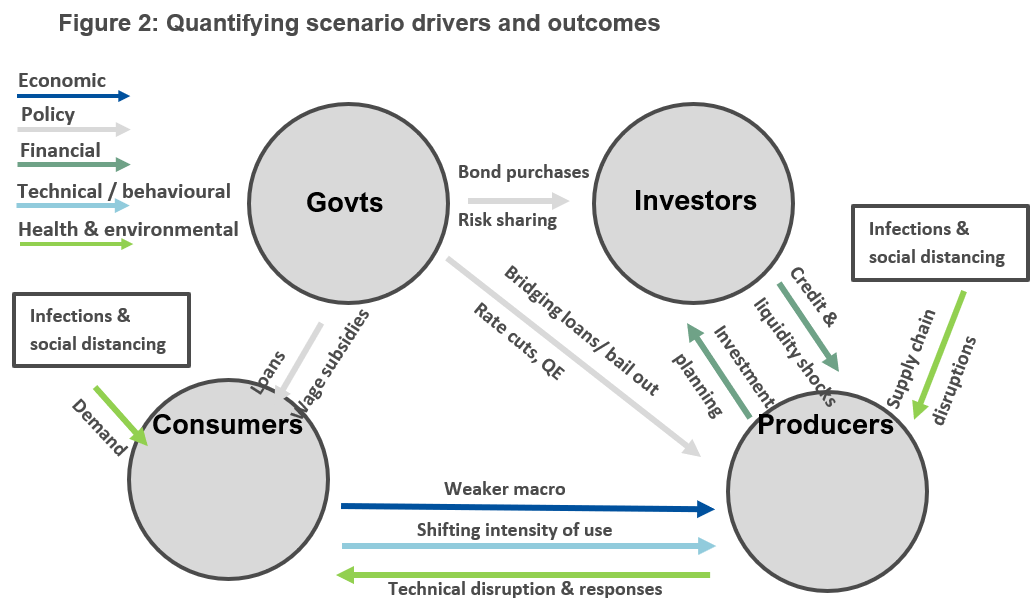

CRU Consulting has deep expertise in supporting clients in scenario development, evaluation and interpretation. This experience has been developed and applied across the mining, metals and fertilizer industries during numerous periods of strategic and operational uncertainty. Figure 1, for example, illustrates some relevant drivers in helping to understand the potential economic and industrial impacts of Covid-19. Figure 2 illustrates the complex nature of the interrelationships which form part of CRU Consulting’s quantitative evaluation framework.

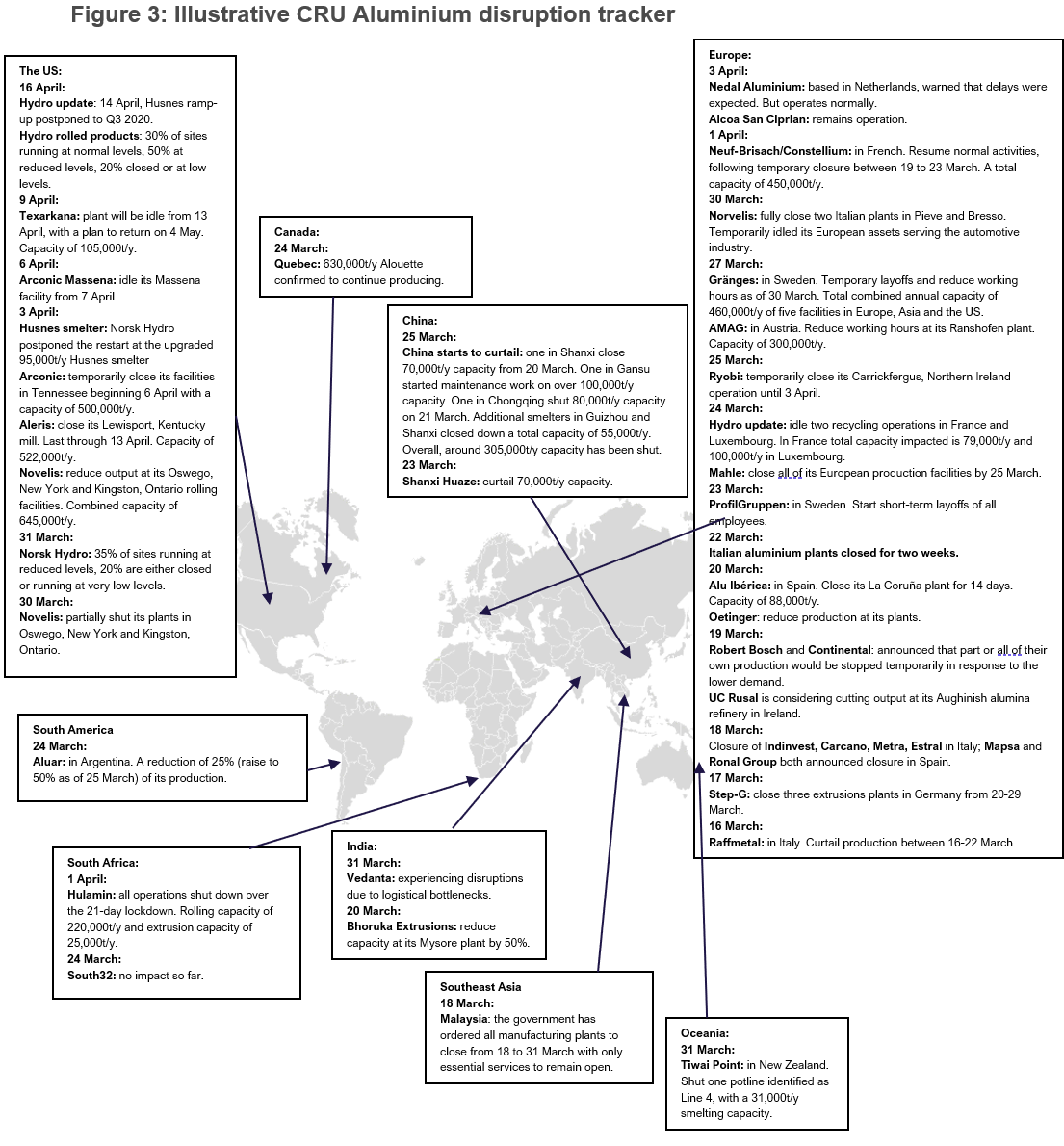

Having evaluated and interpreted the strategic implications of a given set of scenarios, maximizing corporate agility requires close tracking of available forward-looking indicators in order to obtain early signals on market out turn. Indicator selection and securing available data feeds are critical to success. In some cases, traditional market intelligence indicators, such as competitor investment announcements and outage rates, will serve. But the data feeds will need adapting to the new context in which health risks are directly impacting supply.

For example, CRU Consulting has developed a series of high frequency disruption indices which can be used to help track supply side disruption (illustrated in Figure 3).

In other aspects, successful tracking of the Covid-19 cycle will require monitoring of substantively new indicators: fundamental epidemiological drivers (such as the extent and persistence of individual and herd immunity rates, and the lead times for the development and roll out of a mass vaccination program) will require monitoring and interpretation of a dynamic medical research literature, as well capacity development in key steps of the production and distribution chain.

Scenario development is a key tool in assessing the potential implications of the Covid-19 crisis for both markets and assets. As such, it can provide essential support for effective decision making by assisting businesses in remaining agile and anticipating structural change amid “noisy” market signals. CRU Consulting’s scenario evaluation, interpretation and tracking advisory services are at the cutting edge of management support to the mining, metals and fertilizer industries. They are built on our rich market knowledge, client-centric approach, as well as technical experience and data capabilities.

If you would like to discuss any of these issues or better understand the key opportunities and risks affecting your business, please contact ben.jones@crugroup.com or andrew.keen@crugroup.com.