Prices

May 5, 2020

CRU: Iron Ore Prices Steady During Chinese Holiday

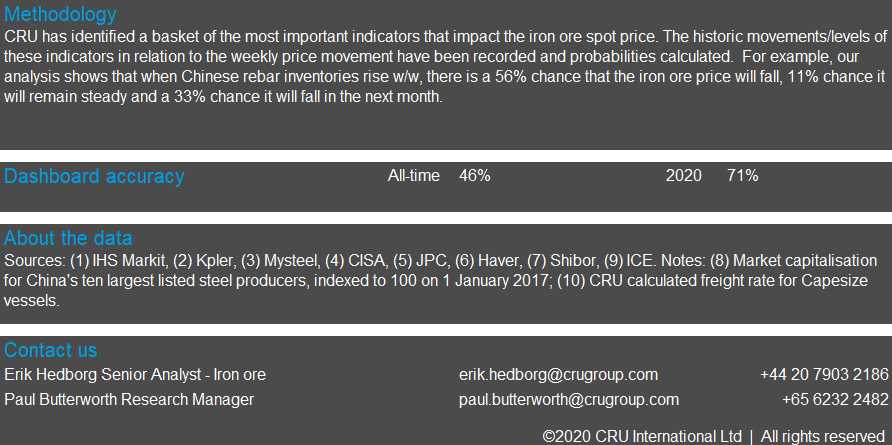

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

In a quiet week, iron ore prices have remained steady as Chinese buying activities were muted during the country’s Labor holiday. On Tuesday, May 5, iron ore prices were trading at $83.5 /t, $1.0 /t higher than the prior week.

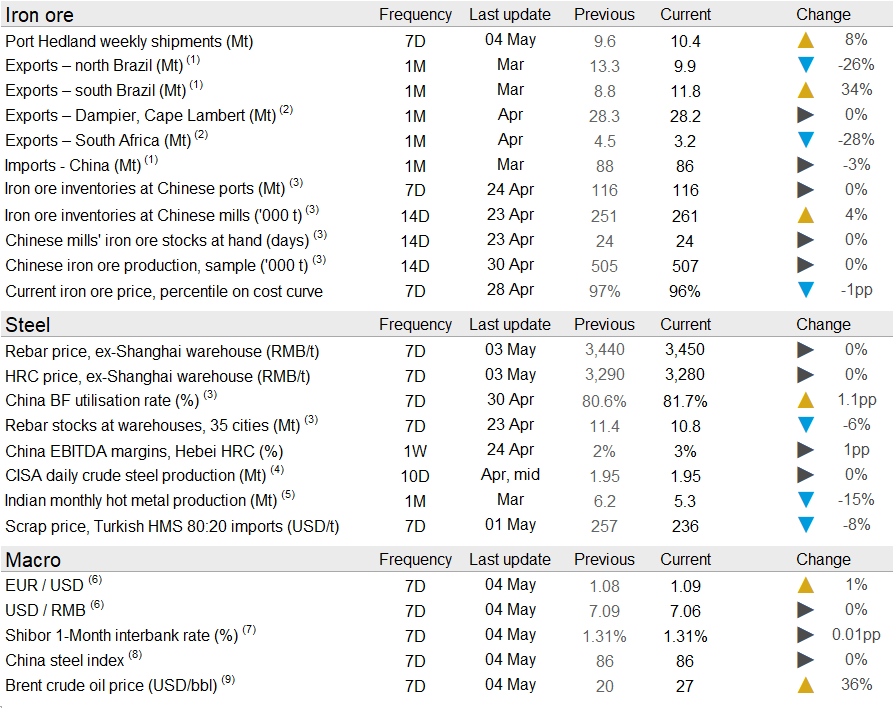

China’s recovery has continued in recent weeks and steelmakers are ramping up steel production, as indicated by our BF utilization rates below. The rising steel production and high inventory levels are adding pressure on steel prices, which means steelmakers’ margins remain low. At end-April, Chinese domestic iron ore production was rising, which resulted in some pressure on domestic concentrate prices.

It has been another decent week for seaborne iron ore supply as Port Hedland shipments rose following the completion of Roy Hill’s quarterly shiploader maintenance. Rio Tinto, which had an outstanding April, has continued to ship at high levels while Brazilian supply has been steady. Weather conditions in northern Brazil continued to improve, which will result in more Carajás material on the market in coming months. However, there are growing concerns about the escalation of Covid-19 cases in northern Brazil. The region’s healthcare system is already under stress and the number of new infections is growing at a rapid pace.

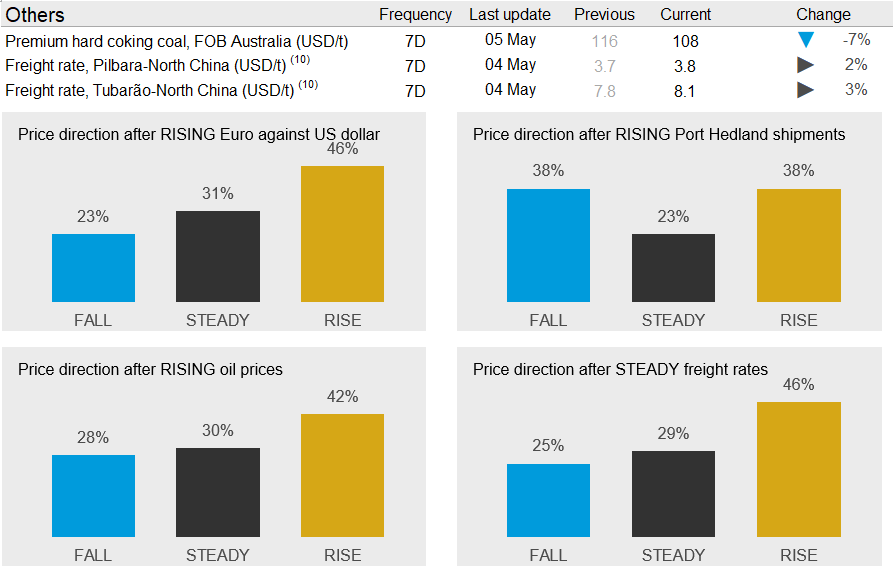

In the coming week, we expect iron ore prices to rise slightly. Our macro indicators below point towards higher prices and the low inventories in the supply chain are likely to keep prices from falling further. Although seaborne supply has improved, steelmakers will still be willing to pay a premium to secure supply in this uncertain environment.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com