Prices

May 5, 2020

SMU Price Ranges & Indices: Market’s in Transition

Written by Brett Linton

The prices we reference this evening reflect orders being placed this week, as well as the prices being quoted by the mills to their customers. It is important that our readers understand there was a flurry of activity last week at numbers at, or below, the low end of our range. We discussed with one steel mill on Friday orders having been taken at, or slightly below, the CRU number published last week. We are also aware of coated orders in the $30.00/cwt-$32.00/cwt range, which are below the numbers we reference this evening.

The market changed late last week. The domestic steel mills raised prices $40 to $60 per ton (more if you were able to buy at the bottom of the market). For now, mills appear to be firm, but with short lead times this could change in the coming weeks.

SMU is going to keep our flat rolled Price Momentum Indicator pointing at Neutral as the market continues to be in transition. There is upward pressure right now, and we have come off the cycle lows.

Here is how we are seeing prices this week:

Hot Rolled Coil: SMU price range is $440-$500 per ton ($22.00-$25.00/cwt) with an average of $470 per ton ($23.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end remained the same. Our overall average is up $10 per ton over last week. Our price momentum on hot rolled steel is now Neutral until the market establishes a clear direction.

Hot Rolled Lead Times: 2-4 weeks

Cold Rolled Coil: SMU price range is $660-$680 per ton ($33.00-$34.00/cwt) with an average of $670 per ton ($33.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton over last week, while the upper end remained the same. Our overall average is up $20 per ton compared to one week ago. Our price momentum on hot rolled steel is now Neutral until the market establishes a clear direction.

Cold Rolled Lead Times: 4-7 weeks

Galvanized Coil: SMU price range is $640-$700 per ton ($32.00-$35.00/cwt) with an average of $670 per ton ($33.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $20 per ton compared to one week ago. Our overall average is up $20 per ton over last week. Our price momentum on hot rolled steel is now Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $709-$769 per net ton with an average of $739 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-6 weeks

Galvalume Coil: SMU price range is $640-$700 per ton ($32.00-$35.00/cwt) with an average of $670 per ton ($33.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $10 per ton over last week. Our overall average is up $10 per ton compared to one week ago. Our price momentum on hot rolled steel is now Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $931-$991 per net ton with an average of $961 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-6 weeks

Plate: SMU price range is $580-$620 per ton ($29.00-$31.00/cwt) with an average of $600 per ton ($30.00/cwt) FOB delivered to the customer’s facility. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged over last week. Our price momentum on plate steel is Lower, meaning we expect prices to decline over the next 30 days.

Plate Lead Times: 3-5 weeks

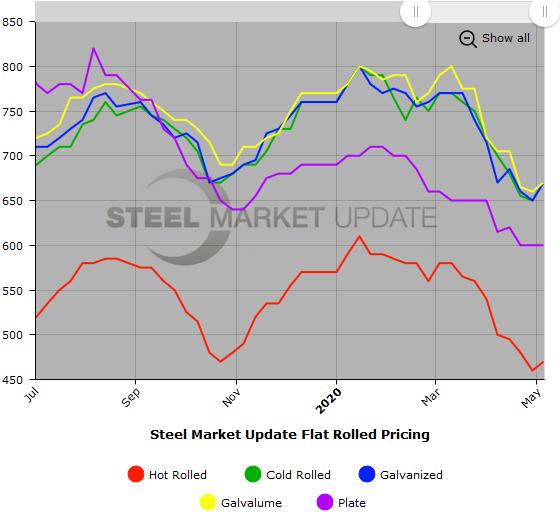

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. Note that plate prices are not yet available on our website, but we are in the process of adding that dataset. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.