Market Segment

May 21, 2020

CRU: Chinese Steel Destocking Continues

Written by CRU Americas

By CRU Analyst Nikki Ni, from CRU’s Steel Monitor

Over the past month, Chinese steel demand has accelerated, resulting in lower inventories while output remained at a high level. The ongoing demand recovery has improved the Steel PMI to 45.9 in April, up by 3.7pp m/m. Despite being below the 50-mark, the consecutive m/m improvement means that industrial activities have continued to operate at stronger rates. This improvement has been underpinned by underlying demand recovery. For instance, according to the China Association of Automobile Manufacturing (CAAM), auto sales went up by 43.5 percent m/m, and 4.4 percent y/y in April. Similarly, the contraction of fixed asset investment in the real estate sector also decelerated in April at -3.3 percent y/y, according to China NBS.

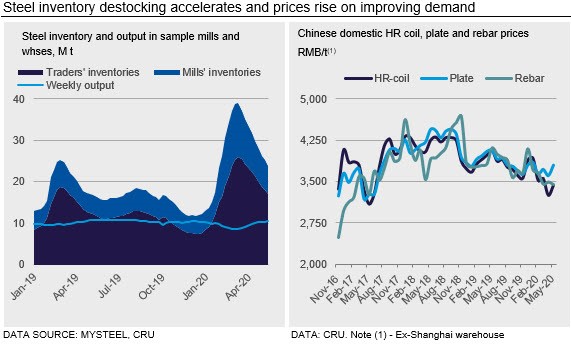

As a result, steel inventories have fallen significantly with rebar and HR coil dropping by 24 percent and 14 percent m/m, respectively. The speed of destocking was 12pp faster than that in the same period last year. This has been supported by a combination of the start-up of new projects and the acceleration of existing projects in order to compensate for the two months of lost activity.

The demand improvement has enabled steel prices to rise over the past month, but there have been variations. In the second half of April, due to volatile crude oil prices and the Chinese government’s probe to restrict loans for SMEs flowing into the property market, steel prices initially fell. However, they picked up again after the May holidays ended due to bullish sentiment ahead of the government’s two-session meeting. Domestic rebar prices returned to RMB3,500 /t after the May holidays and jumped up by another RMB90 /t early this week, while HR coil prices lifted by RMB220 /t m/m to RMB3,580 /t on May 19.

Despite demand being strong, adequate supply has limited further steel price increases. Steel inventories at sample mills and trader warehouses remained 45 percent higher than that in the same period in 2019. Meanwhile, steel output has also picked up, driven by higher steel margins. According to CRU’s Steel Cost Model, EBITDA margins on rebar and HR coil domestic sales have improved to ~11 percent by mid-May, up by 6-10pp m/m. These stronger fundamentals have enticed steelmakers to maximize output wherever possible. By mid-May, surveyed BF capacity utilization has lifted to 85 percent while EAF capacity utilization has also gone up to 67 percent. The CISA members’ crude steel production in the first 10 days of May was reported to rise by 5.4 percent m/m and 0.3 percent y/y.

On the back of a tighter supply-demand balance, steel plate prices have risen to RMB3,700 /t, up by RMB100 /t m/m. According to the China Construction Machinery Association, domestic loader and excavator sales increased by 35.1 percent and 64.5 percent y/y, respectively, in April. This is in tandem with busier construction activities in the real estate and infrastructure sectors.

Outlook: Chinese Steel Prices to Rise Due to Expected Stimulus

Steel demand recovery has been visibly strong in China, but there are concerns about its sustainability. The massive increases of auto sales in April are a result of short-term subsidies and also associated with the fact that people feel safer in private cars than on public transportation. Meanwhile, hot weather and the rainy season will disrupt construction activities in southern China. These will limit further growth of underlying steel demand. CRU believes that steel destocking will continue, but at a slower pace than in April.

Having said that, we believe steel prices will stay on the uptrend due to bullish market sentiment, as more government stimulus is expected to be announced in the NPC and CPPCC starting on May 21.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com