Market Data

June 2, 2020

ISM: May PMI Shows Slight Improvement

Written by Sandy Williams

The Institute for Supply Management’s May Report on Business showed improvement, with the manufacturing PMI rising to 43.1 percent from a reading of 41.6 percent the previous month. The PMI score was at a contraction level not seen since April 2009, but the slight uptick was a promising sign. Manufacturers, however, continue to be guarded regarding the near-term outlook with two cautious comments for every optimistic comment, said Timothy Fiore, chairman of ISM’s Manufacturing Business Survey Committee.

“The coronavirus pandemic impacted all manufacturing sectors for the third straight month,” said Fiore. “May appears to be a transition month, as many panelists and their suppliers returned to work late in the month. However, demand remains uncertain, likely impacting inventories, customer inventories, employment, imports and backlog of orders.”

Demand contracted again in May but at a slower rate than April. New orders and production posted index scores of 31.8 and 33.2, but gained 4.7 and 5.7 points, respectively, last month.

The backlog index at 37.8 was the lowest reading since March 2009. “Despite weak production output, backlogs heavily contracted for the third straight month because of weak levels of new orders and new export orders. There are also indications that order books are being trimmed to coincide with forecasted weaker demand, resulting in cancellations of outstanding orders. None of the six big industry sectors’ backlogs expanded during the period,” said Fiore.

Supplier deliveries slowed further, dropping 8.0 points to 68.0 due to plant shutdowns, transportation challenges and difficulty importing parts and components.

The inventory index, at 50.4 percent, expanded for the first time since May 2019. Growth was attributed to having enough inventory to respond to shorter lead time demand by customers. Customer inventories were at 46.2 percent in May, down 2.6 points from April and were considered “too low.”

Prices for raw materials decreased for a fourth straight month, but at a slower rate.

Import and export orders remained in contraction at 42.7 percent and 39.5 percent, respectively. Low demand in the U.S. economy and difficulty refilling inventory pipelines were cited as reasons for the import contraction.

Survey respondents had the following comments:

- “We have been fortunate that most of our customer base is considered to be a part of the critical workforce, so we have been running at around 80 percent of our normal production volume.” (Primary Metals)

- “We see an issue with suppliers that are affecting production. At the same time, social distancing measures in [the] manufacturing plant and customer demand are impacting the rate of production.” (Transportation Equipment)

- “Getting out from under several suppliers being closed worldwide. Also, looking at what really needs to be in China.” (Machinery)

- “Returning to full production for automotive; ramp-up will still depend on speed of automotive start-ups. We have built up inventory to stock. Ready to ship.” (Fabricated Metal Products)

- “Fuel sales demand is beginning to rebound in May as stay-at-home orders are lifted across the country.” (Petroleum & Coal Products)

- “Current conditions in the automotive, construction, oil and gas, agricultural equipment, and tube/pipe markets are all adversely impacting our business results.” (Chemical Products)

- “Despite the COVID-19 issues, we are seeing an increase of quoting activity. This has not turned into orders yet, but it is a positive sign.” (Computer & Electronic Products)

- “Business activity remains strong for consumable applications and very weak in durable segments.” (Plastics & Rubber Products)

- “We see a lot of positive signs, despite what’s going on. People seem to continue to be building and looking to projects for fall of 2020 and beyond. There is good optimism out there.” (Nonmetallic Mineral Products)

- “Increased COVID-19 sales in the food business have really stressed our production capabilities.” (Food, Beverage & Tobacco Products)

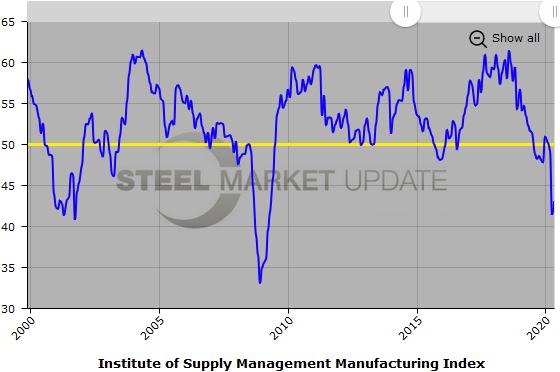

Below is a graph showing the history of the ISM Manufacturing Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.