Overseas

June 14, 2020

CRU: European Steel Prices are Yet to Hit the Bottom

Written by George Pearson

By CRU Prices Analyst George Pearson, from CRU’s Steel Monitor

In the U.S. Midwest market this week, sheet prices were somewhat mixed with HR coil near steady w/w while HDG coil fell by $19 /s.ton to $650 /s.ton and CR coil inched up by $4 /s.ton to $697 /s.ton. Our full HDG coil price, reflecting a G90 zinc coating on .060” substrate, fell further, losing $27 /s.ton. This decline comes as the coating weight extra has been lowered to $60 /s.ton from $68 /s.ton after some mills have announced lower zinc extras, which reflect activity in the physical zinc market. Lead times for these products remain short, especially when compared to other periods where prices were rising from a bottom.

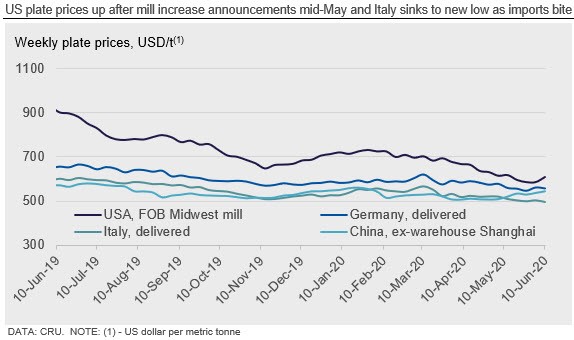

Scrap prices in June look to be mixed with prime scrap rising while obsolete grades fall. With the return of industrial activity, we expect scrap supply to increase, which will likely lead to lower scrap prices starting from July. As for plate, prices gained $21 /s.ton w/w, a delayed response to mill price increase announcements in mid-May. For both sheet and plate products, we continue to see scrap costs as a key determinant of how prices will develop from here, along with service center shipments and inventory data. We expect that finished steel inventory levels are high throughout the supply chain, though these levels will fall back as end demand starts to rise.

European sheet prices fell again. HR coil price declines in Italy and Germany were small for the third consecutive week, down €2 /t and €1 /t, respectively. German CR coil fell more, down €10 /t to €495 /t. Although demand is gradually improving from a low base, it has not been high enough to create any price tension, despite previous supply cuts. We still believe prices are near the bottom, despite the gradual erosion of HR coil prices in recent weeks. Mill margins are negative and are around the level that they previously rebounded from, while costs are increasing and imports are less competitive, with the exception of Indian offers. However, imports are still affecting Italian plate, which fell €13 /t to €439 /t w/w. Competitive import prices have put pressure on Italian rerollers, who have lowered their own offers to compete. Plate offers from Ukraine and South Korea last week were at €425 /t CFR southern European ports for delivery in July-August.

Chinese steel prices remained flat this week, with rebar at RMB3,650 /t and HR coil at RMB3,670 /t. A weaker demand outlook and higher steel output weighed on prices. Demand, especially for long products, remained robust as construction projects are working at pace ahead of the wet season. Total steel inventory decreased by 5 percent w/w, despite weekly output continuing to rise. Positive profit margins are supporting production gains, which now have capacity utilization rates reaching 87.4 percent—the highest level on record.

Looking ahead, demand is set to weaken as construction activity slows in southern China due to seasonally hot weather and heavy rainfall. Steel profit margins are expected to narrow due to higher iron ore prices, which have risen by around $20 /t since May 5. However, lower margins will discourage steel output, limiting price falls despite weaker demand. We expect prices will consolidate at current levels in the coming week as the market balances these supply and demand factors.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com