Market Data

August 4, 2020

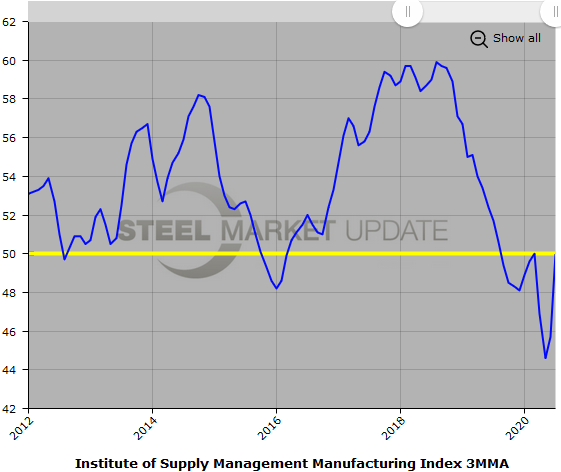

ISM: Manufacturing Expands in July

Written by Sandy Williams

The U.S. manufacturing sector expanded again in July indicating a third consecutive month of growth for the overall economy, said the Institute for Supply Management in the latest Manufacturing ISM Report on Business. The July PMI rose 1.6 points from June to register 54.2.

“The growth cycle continues for the second straight month after three prior months of COVID-19 disruptions. Demand and consumption continued to drive expansion growth, with inputs remaining at parity with supply and demand,” said Timothy Fiore, chairman of ISM’s Manufacturing Business Survey Committee. “Panel sentiment was generally optimistic (two positive comments for every one cautious comment), continuing a trend from June.”

The new orders index climbed 5.1 points to 61.5 percent and production increased 4.8 points to 62.1 percent. The backlog index registered 51.8 compared to 45.3 in June. Primary metals and fabricated metals were among those industries that saw backlogs expand.

The supplier deliveries Index fell 1.1 points to 55.8 (a reading above 50 percent indicates slower deliveries). “Suppliers continue to struggle to deliver, although at a slower rate compared to June. Plant interruptions, transportation challenges and continuing difficulties in supplier labor markets are still factors. The Supplier Delivery Index continues to reflect a healthier supply/demand balance compared to spring and early summer,” said Fiore.

Inventories declined in July and the prices index inched up 1.9 points to 53.2. The index for new export orders gained 2.8 points and the imports index gained 4.3 points.

Employment contracted at a slower rate in July, but Fiore noted that factories were able to achieve significant gains in production with a reduced labor pool.

Survey participants had the following comments:

- “Orders starting to pick up. [An] increase of about 35 percent to 40 percent.” (Chemical Products)

- “Overall business remains down almost 70 percent. We are hanging on to as many employees as possible, but we will have to lay off 30 percent or more for at least two to three months until September or October.” (Transportation Equipment)

- “While demand in the coming six months is stabilizing, it is at a significant reduction and clear that customers have little confidence in the forecasts. Export orders to Brazil, South Africa, [and the] Middle East are largely cancelled for the balance of 2020.” (Fabricated Metal Products)

- “Uncertainty regarding our industry and business has not improved. We are developing the 2021 budget around multiple scenarios.” (Petroleum & Coal Products)

- “General business climate continues to be subdued, driving highly conservative forecasting due to variability in the ongoing pandemic-driven conditions and economic response.” (Machinery)

- “We are still seeing our customers shut down or effected by COVID-19. We are hoping for a bounce back in September.” (Miscellaneous Manufacturing)

- “General business conditions are in a general slowing pattern. Many of the plants are on reduced hours and/or furloughs. About 20 percent to 25 percent of plants are scheduled to be consolidated in the next six months to improve margins and profitability.” (Nonmetallic Mineral Products)

- “Manufacturing outlook has improved greatly in June, as business has resumed at nearly 100 percent. We have implemented a number of safeguards that are costing extra money, but we are running.” (Computer & Electronic Products)

Below is a graph showing the history of the ISM Manufacturing Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.