Prices

September 1, 2020

CRU: Iron Ore Rises as Offloading Issues Persist

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from CRU’s Raw Materials Monitor

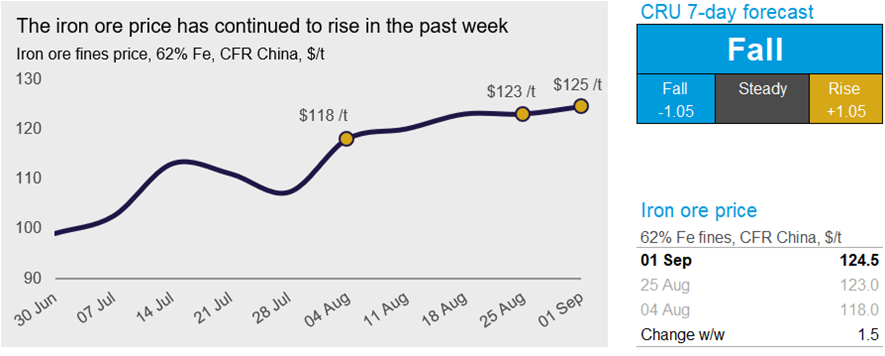

The iron ore price has risen again in the past week as offloading activities have continued while demand from China’s steel mills has been robust. On Tuesday, Sept. 1, CRU has assessed the 62% Fe fines price at $124.5 /dmt, up by $1.5 /dmt w/w.

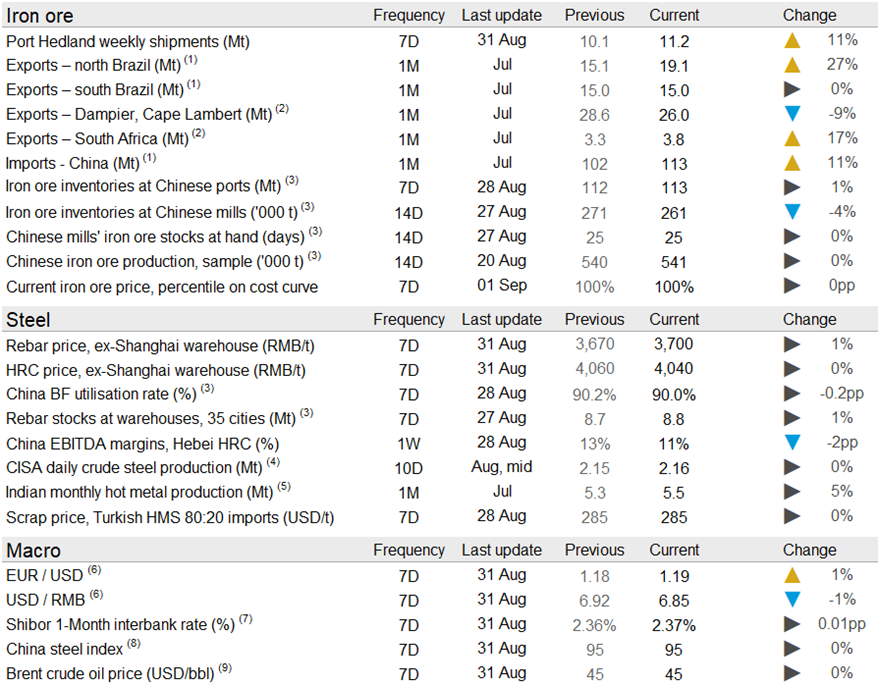

Last week, Chinese sheet products demand was stable, but the HRC price dropped after peaking at a two-year high of RMB4,090 /t in the previous week. Construction steel performed differently with underlying demand softened w/w while prices changed little. However, the prices of both products rose on Monday after a message came out over the weekend that the Tangshan government would tighten the enforcement of operating restrictions on BF, sinter capacity and independent rolling mills. At the time of this writing, we have yet seen any significant restrictions on BFs, but sinter capacity utilization was heard to have dropped since last week.

Because of lower sinter fines demand in Tangshan, iron ore port outflow slightly dropped last week, helping build up port inventories. As most of inventory increases were Brazilian products, its share has now risen to 26 percent from the recent low of 20 percent in May, while the Australian share has now declined to 51 percent from 58 percent. Our contacts told us that steel mills in Tangshan expected current operating restrictions to be short-term, so they did not plan to immediately shift to higher lump rates.

Seaborne supply was mixed in the past week, with Port Hedland and northern Brazil shipping at a high rate while southern Brazil and Rio Tinto saw lower shipments. Maintenance at Rio Tinto’s Dampier port resulted in shipments being affected between Aug. 28-30. South Africa, which accounts for ~4 percent of seaborne iron ore supply, has seen an increase in shipments at end-August as the country loosened its lockdown restrictions. Shipments in the past week were the highest since March and our sources mention an increase in rail capacity as the reason for the rise.

In the coming week, we maintain the view that iron ore prices should fall based on supply and demand fundamentals. Steel margins have taken a negative turn in the past week, while inventories of steel and iron ore have risen in the past week.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com