Market Data

September 30, 2020

SMU Energy Analysis for September

Written by Brett Linton

The September Energy Information Administration (EIA) Short Term Energy Outlook remains subject to heightened levels of uncertainty due to evolving COVID-19 mitigation and reopening efforts. In its outlook, EIA reports that reduced economic activity has caused changes in energy demand and supply patterns. Crude oil production has risen as operators have brought wells back online in response to rising prices. EIA expects that high inventory levels and surplus crude oil production capacity will limit upward pressure on oil prices. EIA forecasts that rising domestic demand, combined with reduced production, will cause natural gas spot prices to rise in 2021.

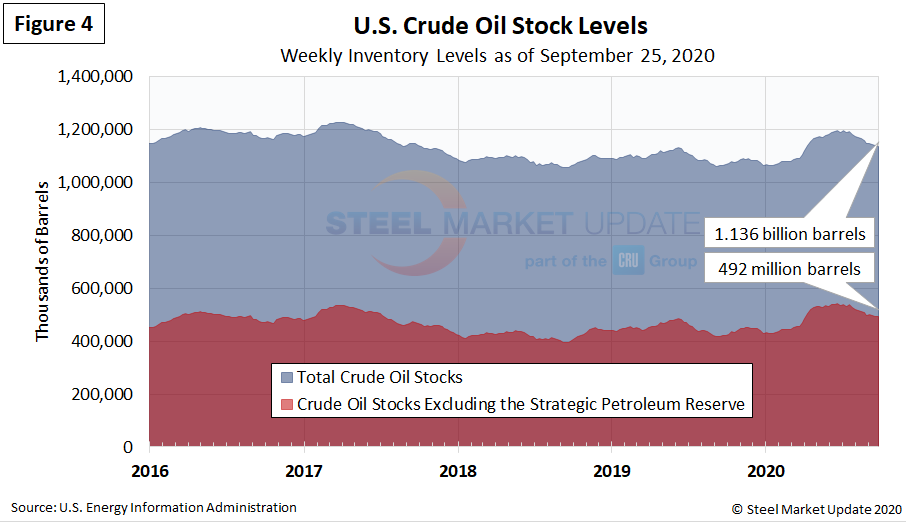

Spot Prices

The spot market price for West Texas Intermediate (WTI) had somewhat recovered from the April plunge after the cornonavirus shutdowns, but peaked in mid-August and is now down slightly to $39.78 per barrel as of Sept. 25. Natural gas at the Henry Hub in Oklahoma was priced at $1.68 per MMBTU (million British Thermal Units) as of Sept. 25, down from the seven-week bump seen in August and more in line with prices over the previous few months.

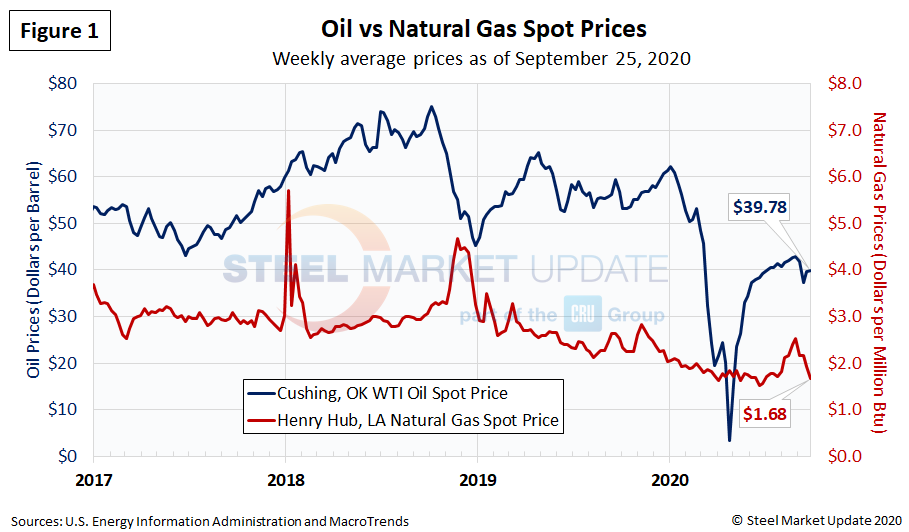

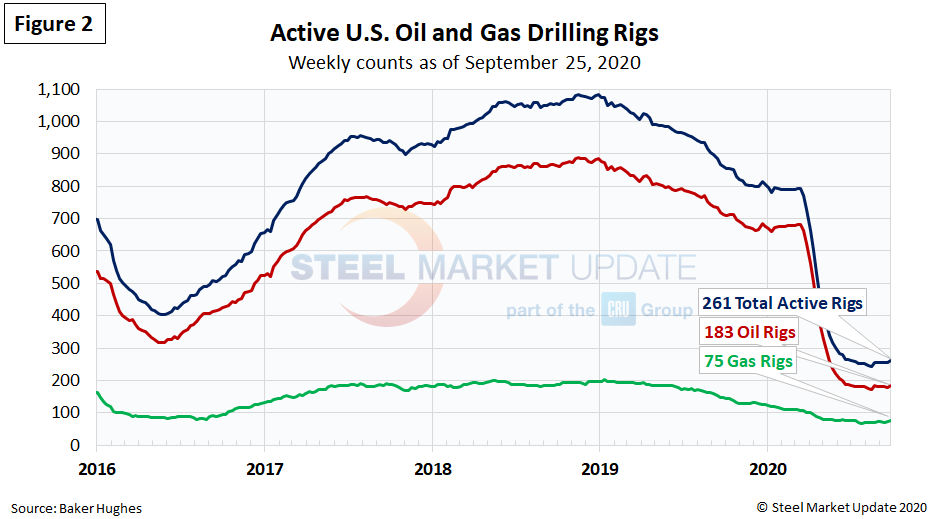

Rig Counts

The decline in active U.S. rigs drilling for oil and gas flattened in August, which is an improvement. Last week there were 261 active drill rigs, including 183 oil rigs, 75 gas rigs and 3 miscellaneous rigs, according to the latest data from Baker Hughes (Figure 2). That’s still a decline of 67 percent from the 793 rigs in production in March prior to the coronavirus shutdowns. The table below compares the current U.S., Canada and International rig counts to historical levels.

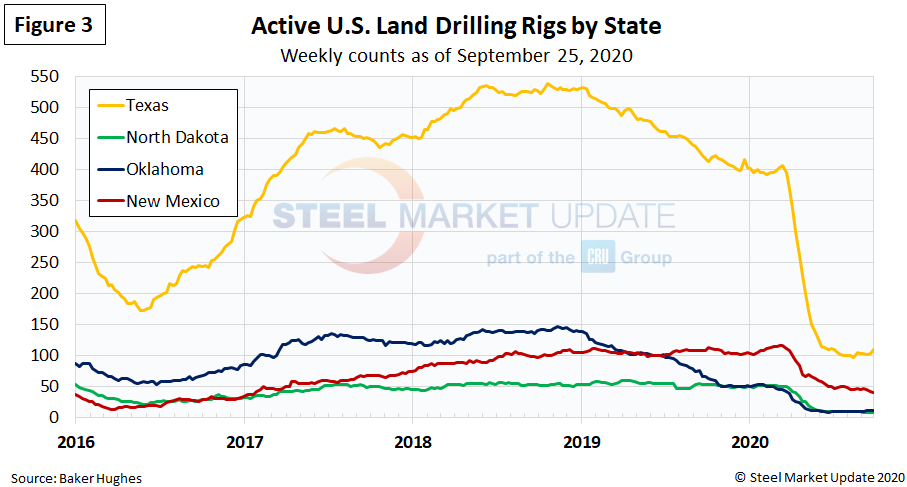

U.S. oil and gas production are heavily concentrated in Texas, Oklahoma, North Dakota and New Mexico, which have all seen declines of 65 to 82 percent since mid-March. The rig count in Texas plummeted from 407 in mid-March to 111 as of last week, hitting a low of 97 rigs in mid-August (Figure 3).

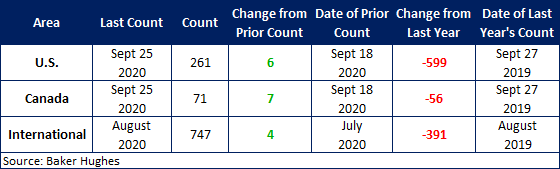

Stock Levels

Total crude oil stocks in the U.S. had been on the rise since mid-March, but started to decline in July, falling to 1.136 billion barrels as of Sept. 25, up from just over 1 billion barrels at the beginning of the year (Figure 4).