Prices

October 15, 2020

CRU: Iron Ore Price Pulls Back on Rising Supply and Port Stocks

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

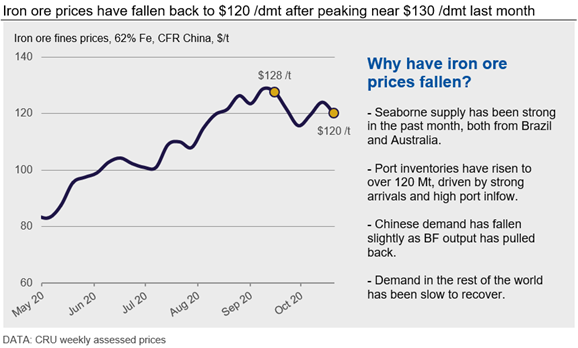

Iron ore prices have fallen by $8 /dmt in the past month as seaborne supply has been robust, even during the start of the new quarter, which is typically a weak supply period. As a result, arrivals to China have remained strong and port inflow (i.e. offloading material from vessels) is at close to full capacity. Port inventories have risen steadily in the past month, with Brazilian ore and non-traditional material being the largest contributor to the rising inventory levels.

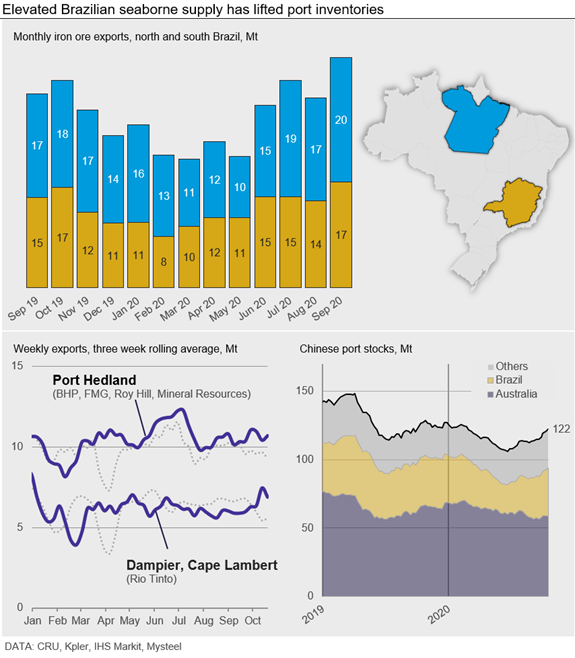

Brazil and Australia Both Deliver in September and October

In Brazil, Vale’s NS had its best months on record with over 20 Mt of material shipped in September. A high proportion of this was exported to the Chinese market and the strong arrivals of Brazilian ore have continued in the past month, with rising inventory levels of Brazilian ore at Chinese ports. This has kept the premium for 65% Fe material steady at ~10%, a level lower than the historical average. Vale is on track to produce ~200 Mt from NS in 2020, a slight increase y/y, but the struggles with mine restarts and poor weather in Minas Gerais earlier in the year means we will only see a marginal increase in Vale’s production in 2020. We expect the company to fall short of its 310 Mt target in 2020. In 2019, Vale produced 302 Mt as the company lost its position as the largest iron ore producer in the world to Rio Tinto.

In Australia, exports from both Port Hedland and Rio Tinto’s two ports came in at a high level at end-September, which is normal for the end of a quarter. What is more surprising is that shipments continued at a high level into October – last year, Australian exports fell drastically in early-October. In fact, if current shipping rates continue, we can expect the country’s iron ore exports in October to be up to 10 Mt higher than in October 2019. This means a high level of arrivals to China is expected at end-October, which should raise the inventory levels of Australian fines from its current low levels.

Freight Rates Declining in Volatile Market

The freight market has been in a volatile state in 2020 H2 with rising Brazilian demand for Capesize vessels and a high proportion of the fleet stuck at ports in China. Despite this, freight rates have yet to reach the same levels as last year. Our analysis shows that a large number of new vessels have come to the market in 2020 H2, which will keep vessel supply elevated and restrict the upside to freight rates from here, even though Brazilian iron ore exports are expected to remain high for the rest of 2020. The cost of shipping iron ore from Tubarão to Qingdao has, in the past few weeks, fallen from over $20 /wmt to $16 /wmt.

Outlook: Price Pressure to Remain

More iron ore is on its way to China as the demand recovery in the rest of the world is weak. Port stocks have already started rising and will continue to do so in the coming month. With a slightly more bearish market in China and increased availability of iron ore, we expect the price decline to continue in the coming month.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com