Market Data

November 2, 2020

SMU Energy Analysis for October

Written by Brett Linton

The October Energy Information Administration (EIA) Short Term Energy Outlook remains subject to heightened levels of uncertainty because mitigation and reopening efforts related to COVID-19 continue to evolve. Reduced economic activity from the pandemic has caused changes in 2020 energy demand and supply patterns and will continue to affect these patterns in the future. EIA expects high inventory levels and surplus crude oil production capacity to limit upward pressure on oil prices. U.S. crude oil production is expected to decline in the second quarter of 2021 due to new drilling activity not generating enough production to offset declines from existing wells. EIA expects natural gas spot prices to rise into 2021 due to rising demand and reduced production.

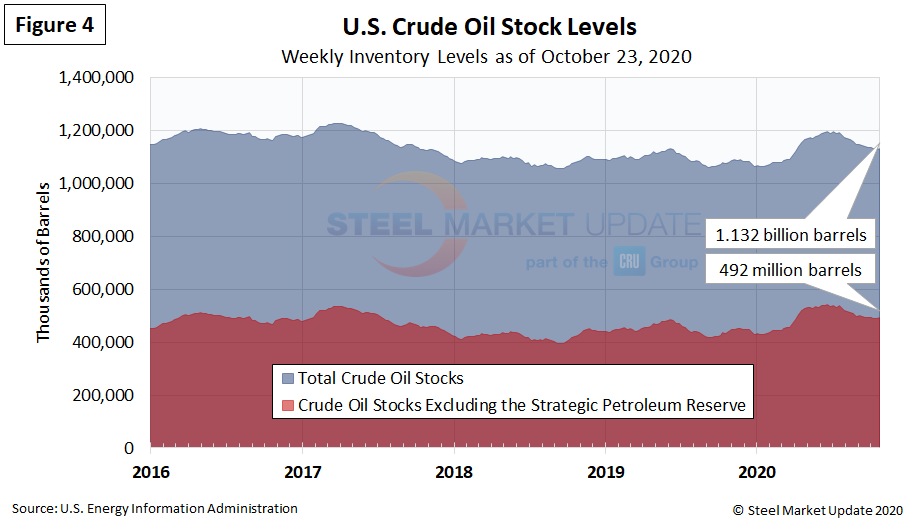

Spot Prices

The spot market price for West Texas Intermediate (WTI) has remained relatively table since the mid-August peak, now at $40.34 per barrel as of Oct. 23. Natural gas at the Henry Hub in Oklahoma was priced at $2.74 per MMBTU (million British Thermal Units) as of Oct. 23, the highest price of 2020 and in line with 2019 prices.

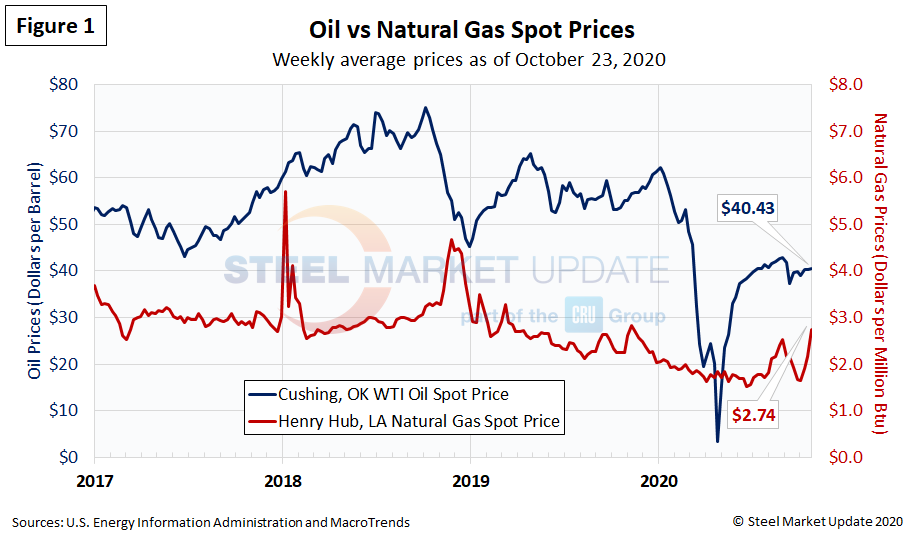

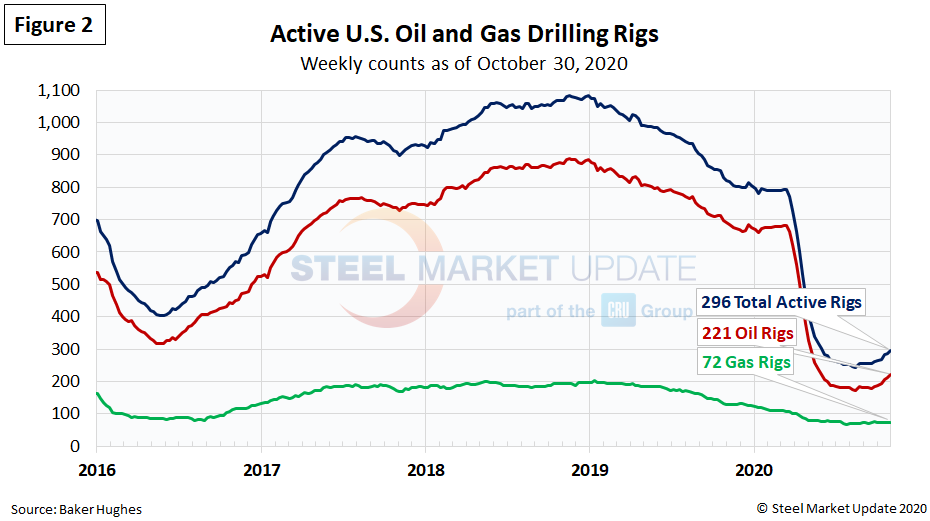

Rig Counts

The decline in active U.S. rigs drilling for oil and gas flattened in late-August and has improved each week since. Last week there were 296 active drill rigs, including 221 oil rigs, 72 gas rigs and 3 miscellaneous rigs. according to the latest data from Baker Hughes (Figure 2). While up over recent weeks, active drill rigs are down 63 percent from the 793 rigs in production in March prior to the coronavirus shutdowns. The table below compares the current U.S., Canada and International rig counts to historical levels.

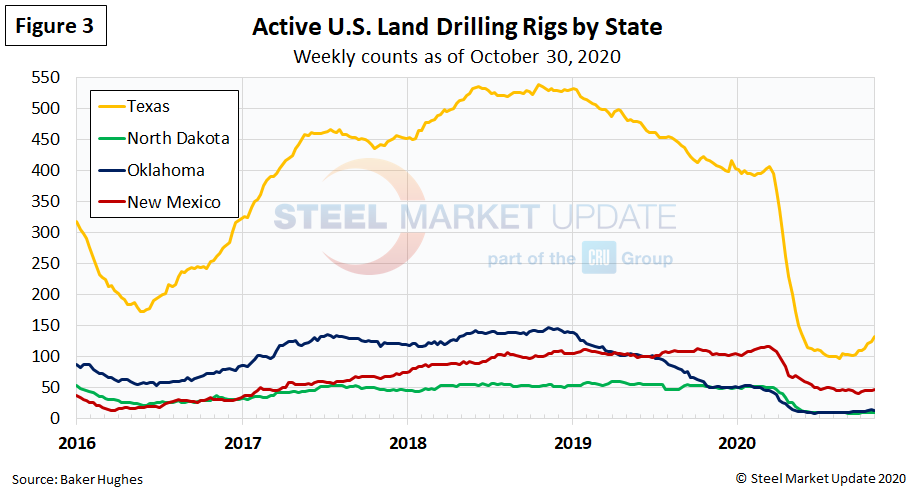

U.S. oil and gas production are heavily concentrated in Texas, Oklahoma, North Dakota and New Mexico, which have all seen declines of 60 to 78 percent since mid-March. The rig count in Texas plummeted from 407 in mid-March to 132 as of last week, hitting a low of 97 rigs in mid-August (Figure 3).

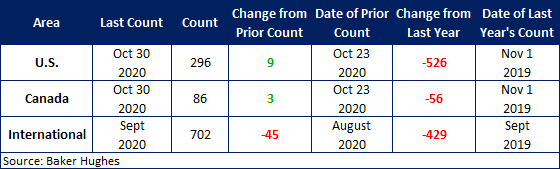

Stock Levels

Total crude oil stocks in the U.S. had been on the rise since mid-March, but started to decline in July. The latest price has declined to 1.132 billion barrels as of Oct. 23, up from 1.066 billion barrels at the beginning of the year (Figure 4).