Prices

November 3, 2020

CRU: Iron Ore Exceeds $130 /dmt on Continued Strong Chinese Demand

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

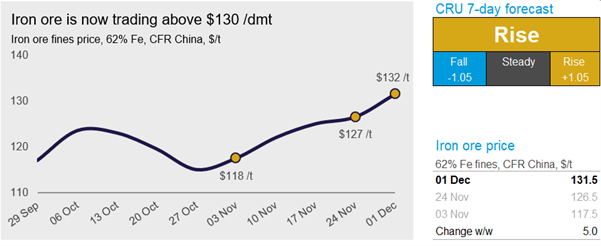

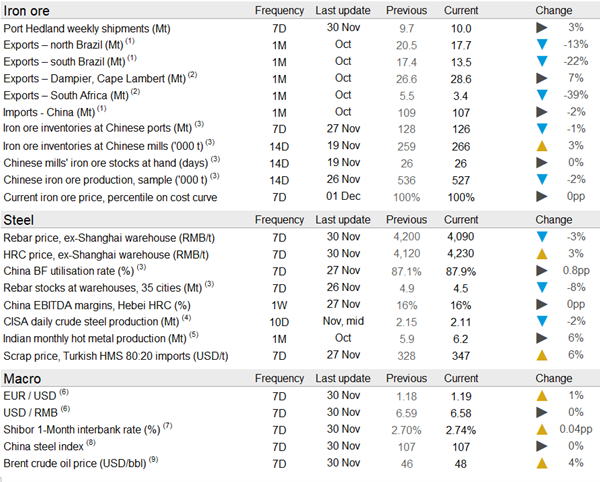

Iron ore prices have continued to surge in the past week as robust Chinese demand has coincided with lower Australian exports. As a result, prices have climbed above $130 /dmt and on Tuesday, Dec. 1, CRU assessed the 62% Fe fines price at $131.5 /dmt, up $5.0 /dmt w/w.

Chinese domestic steel prices have diverged between long and flat products over the past week. While the rebar price declined by RMB110 /t w/w, the HRC price lifted by the same amount. Such price movements reflected the supply-demand fundamental changes, and the market volatility was intensified by speculative trading in the futures market. Last week, surveyed BF and EAF capacity utilization lifted marginally, but steel output was stable for both long and flat products. However, the inventory drawdown for steel longs significantly slowed, only half of the amount we saw in the previous six weeks. This implied a slowdown of underlying demand that might be associated with slower construction activity as weather got colder in the northern part of China.

Iron ore, coke and coking coal demand remained strong, well supporting their prices. We spoke with a few contacts including physical and futures traders and all of them were bullish and expected steelmaking raw materials prices to hike further. This reflected positive market sentiment, but also implied risks are building up.

Seaborne supply was weak in the month of November with exports falling below last year’s level. Port Hedland registered 10.0 Mt of exports in the past week, taking its November total to just below 41 Mt, compared with over 43 Mt last year. In Brazil, the early rainfall has continued in the northern parts of the country, although the levels are much lower than during the peak period stretching from February through April. In addition, there has been an accident at Ponta de Madeira, the only iron ore port in northern Brazil. A Valemax vessel (400,000 dwt) collided with two other vessels while docking and our sources have mentioned that there has been a slight disruption to shipments following the damage to the ships. No person was injured and the impact on shipments going forward is expected to be minor.

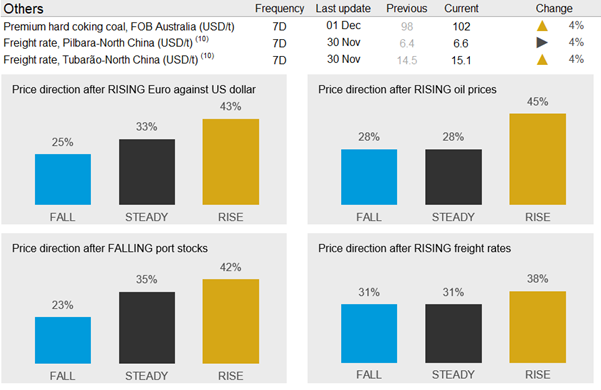

In the coming week, we see room for further price increases. Arrivals of iron ore in China will continue to be weak due to the low exports from Australia while China’s domestic iron ore production has started declining due to the colder weather in the north. Steel mills will keep restocking iron ore, which typically happens at this time of the year.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com