Prices

November 3, 2020

CRU: Steel Prices Continue Climb in the U.S., Leaving Scrap Behind

Written by Josh Spoores

By CRU Principal Analyst Josh Spoores and Senior Analyst Ryan McKinley, from CRU’s Steel Monitor

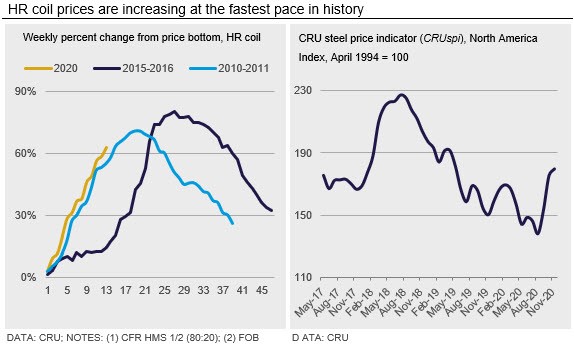

Strong underlying demand continues to provide substantial support to finished steel prices in the USA. Sheet prices have risen at their quickest pace since CRU started tracking them and, while there was little change m/m for long products, mills have recently announced additional price increases, which we expect to be quickly realized. Despite rapidly rising finished steel prices, many mills entered the November scrap market at unchanged prices m/m. This relative stability in scrap pricing helped drive the HR coil premium to #1 busheling to its highest level in two years.

North American sheet prices have continued to surge, rising by $281 /s.ton, or 64%, since August. This is the fastest percent gain over three months in CRU’s 41-year history of tracking these prices (see chart). These increases are the result of improved underlying demand. While the automotive market remains the primary post-lockdown driver of sheet consumption, other markets are also showing YTD increases. However, some market participants are now signaling that foreign steel is becoming more attractive in terms of both prices and lead times, especially for CR and coated sheet. Though global prices have started to increase at a faster rate, buyers may be more concerned about maintaining supply rather than having their supply dependent upon the latest mill production issue.

Long product prices were little changed m/m during November, but price increases were announced recently and will likely be fully realized. Wire rod import levels remain low even amid stable construction and rising automotive demand. However, much like for sheet products, domestic buyers are beginning to look abroad on fears of supply shortages. For rebar, import offers are competitive with domestic mills at $27.75-28.00 /cwt loaded truck Gulf coast, but buyers were still hesitant to secure too much supply ahead of the conclusion of the U.S. election.

In the plate market, prices have steadily increased over recent weeks with the latest price of $643 /s.ton, reflecting a $50 /s.ton increase since Oct. 21 and an increase of $113 /s.ton over the 2020 low of $530 /s.ton assessed on Aug. 26. As prices are gradually rising, mills continue to announce price increases with the latest one published over the past few days. Since mid-August, mills have now announced $230 /s.ton of price increases. The primary driver of these increases likely stems from the underperformance of plate versus HR coil. Historically since 2004, plate prices have averaged a $144 /s.ton premium over HR coil prices. Today, there is no premium. In fact, plate prices are at a record discount of $75 /s.ton versus HR coil. This negative spread stems from significantly tighter supply-demand fundamentals in the sheet market versus the plate market. For sheet at the end of 2020 Q3 versus a year prior, blast furnaces in operation were down 23%, reflecting an annualized decline of 9 Mt of capacity. For plate, only JSW’s plate rolling mill in Baytown has been idled due to the U.S. government making an ad hoc adjustment to the slab import quota for 2020 Q4.

Meanwhile, domestic U.S. scrap price movements varied by region and grade during November, with some prices unchanged m/m during early trade. Initial market expectations were that prices would rise across the board given solid domestic and international demand for scrap, but this did not materialize, resulting in a weaker market than expected by many market participants for a second month in a row. In general, price changes were smaller in areas like Detroit and the southeastern U.S., while prices in the south, Chicago, and Ohio Valley rose by more m/m.

Outlook: Further Price Gains to Come, Yet Watch Out for Seasonal and Pandemic-Related Risks

We expect that domestic prices will peak over the next several weeks, but not before moving higher. This expectation is based on seasonal demand weakness emerging in some markets while underlying demand gains slow. Additionally, we expect import arrivals to rise over the next few months. Furthermore, Covid-19 remains a downside risk, especially as the political environment is not addressing any new economic support or stimulus.

As winter weather continues to move into the northern regions of the USA, we expect scrap collection to slow. As things stand, price increases are likely to be around $20-30 /l.ton m/m, although there may be potential for more, especially considering the high spread between scrap prices and finished steel prices. Higher scrap prices will ultimately support prices of both longs and plate products, but for sheet prices, changes in scrap-based costs will remain irrelevant as prices will continue to reflect the balance of supply and demand.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com