Market Data

December 2, 2020

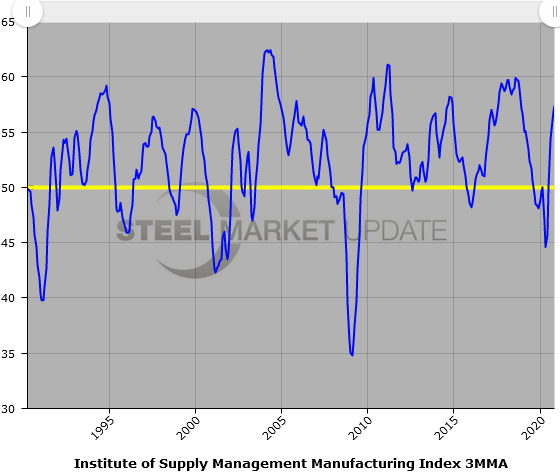

ISM Manufacturing Report Highlights Labor Constraints

Written by Sandy Williams

The ISM Manufacturing PMI dipped 1.8 points in November to register 57.5, remaining in positive territory but indicating concerns related to the latest surge of COVID-19.

“Manufacturing performed well for the sixth straight month, with demand, consumption and inputs registering growth, but at slower rates compared to October,” said Timothy Fiore, chairman of the Institute for Supply Management Manufacturing Business Survey Committee. “Labor market difficulties, both current and anticipated, at panelists’ companies and their suppliers will continue to dampen the manufacturing economy until the coronavirus (COVID-19) crisis ends.”

The new orders index fell 2.8 points from October to 65.1, but was supported by strong export demand (up 2.1 percentage points). The production index dropped 2.2 points to 60.8, remaining above 60 percent for the fifth consecutive month. Backlogs increased 1.2 points to 56.9.

Employment levels slid in November by 4.8 percentage points to 48.4, but comments from survey panelists indicate more firms are hiring than reducing labor forces.

“Survey committee members reported that their companies and suppliers continue to operate in reconfigured factories, but absenteeism, short-term shutdowns to sanitize facilities and difficulties in returning and hiring workers are causing strains that will likely limit future manufacturing growth potential,” said Fiore.

Inventories grew at a slower rate last month. The inventories index registered 0.7 points lower at 51.2. Transportation and labor challenges by suppliers slowed deliveries, further constraining production, said Fiore. Customer inventories were considered too low in November and the index, at 36.3, has been at its lowest levels in a more than a decade for the past four months. The import index fell 3 points to 55.1. Fiore noted that prices were expanding at higher rates making it a seller’s market.

Fiore said the November report on manufacturing was solid, but has gone from an input-restricted expansion to a labor-restricted expansion.

“There is nothing bad about this report,” said Fiore in an interview with Logistics Management. “The issue is that the longer there are constraints on labor, not only are you going to drag down the production output, you are going to drive up the backlog. It will hurt the [PMI] number, as labor continues to get more scarce, with inventory remaining around flat or maybe even dropping, because there are not inbound materials to replenish inventory.”

Sixteen of the 18 manufacturing industries reported growth in November including appliances, fabricated metal products, primary metals, machinery, and transportation equipment.

Comments from survey respondents include:

- “The resurgence in COVID-19 cases is adding strain on our Tier-1 and Tier-2 suppliers. Multiple suppliers mentioned that finding new people is an issue with the COVID-19 situation. And there is a learning curve for new [supplier] hires, impacting production efficiency at their place.” (Transportation Equipment)

- “We will finish out the fourth quarter very strong. Customers have increased demand and 2021 is expected to continue to grow.” (Fabricated Metal Products)

- “Business continues to be strong, with significant back-orders. Suppliers have struggled to hire people, as we have to support the increased business. We are seeing significant delays in getting parts and material from China through U.S. ports, especially [at the Port of] Long Beach. Material costs continue to hold steady. The national election and continued COVID-19 uncertainty are concerns.” (Machinery)

- “Our business is booming, as many customers need products ASAP. A great situation.” (Primary Metals)

- “Jet fuel being down in consumption really hurts the refining market.” (Petroleum & Coal Products)

- “Customer order volumes are very strong, but our suppliers are having issues meeting our orders due to people shortages.” (Plastics & Rubber Products)

Below is a graph showing the history of the ISM Manufacturing Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.