Prices

December 8, 2020

CRU: Iron Ore Exceeding $150 Per Ton

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg from CRU’s Steelmaking Raw Materials Monitor

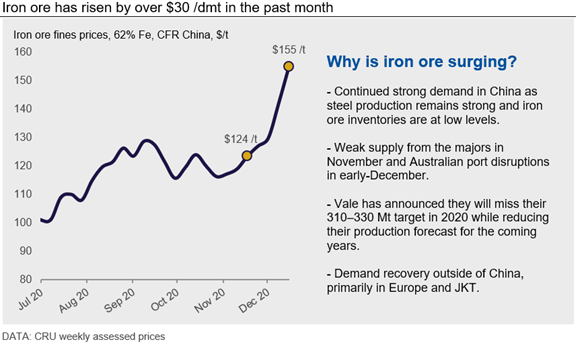

The iron ore price rally has continued in the past week as the market tightness worsened, with continued strong demand while seaborne supply has taken a major hit following the halting of operations at Australia’s two largest iron ore ports due to bad weather. On Dec. 15, CRU assessed the 62% Fe fines price at $155 /dmt, up by over $30 /dmt m/m.

Australian Port Closures Adding to Market Turmoil

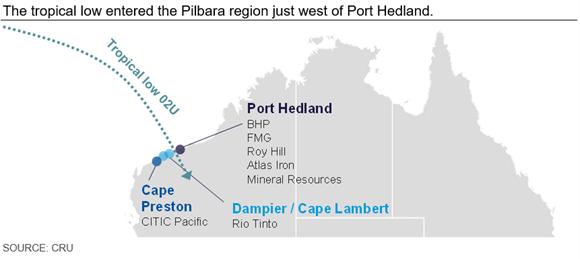

Between Dec. 10-12, a tropical low swept in across the Pilbara region and forced the closure of both Port Hedland and Rio Tinto’s largest port, Cape Lambert. Together they account for nearly 50% of seaborne iron ore supply, and the closures came at a critical time as producers in Australia were recovering exports following a weak performance in November. However, iron ore production at mines continued and it is CRU’s understanding that port inventories were built up during the closures.

With many vessels waiting outside the ports and with high inventory levels, we expect a strong performance from all major producers in the coming weeks. Considering the 10-14 day lead time to get the ore to China, we can expect arrivals to the Chinese market to increase during the last week of December. This is also the last few weeks of Rio Tinto’s financial year, meaning it is a priority for them to maximize shipments and reduce inventory levels as much as possible before Dec. 31.

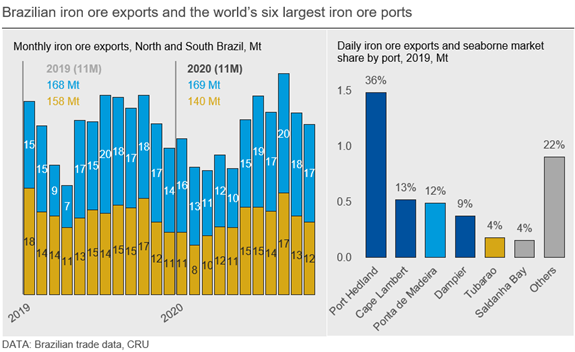

Brazilian Struggles to Continue into 2021

In Brazil, exports have been low in the past month as heavy rain in the north and accidents at ports and mines have slowed down production levels. For the full year, Brazilian iron ore exports are expected to be 15–20 Mt lower y/y, despite most producers in the country registering flat production levels. The reason is that, in 2019, Vale exported high levels of iron ore stocks after the accident and, in 2020, the company needed to rebuild its inventory for blending and operational purposes. However, Vale has not been able to fully rebuild inventory. This means, even though Brazilian production is expected to rise next year, we will see some of that production kept in the country.

Inventories in China are Falling

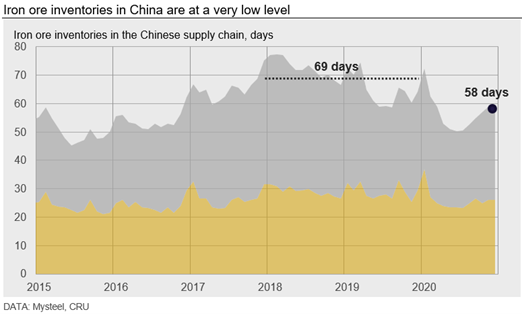

December is usually a month of rising inventory levels in China. Australian and Brazilian supply is typically strong and steel mills reduce output due to lower steel demand during the winter season. In addition, winter heating season (WHS) restrictions in recent years have reduced output levels in some regions from November to March. There is also a shift of inventory levels from ports to mills as steelmakers rebuild their stocks ahead of the Chinese New Year. In 2020, however, supply has disappointed the market and inventory levels at both ports and mills have failed to lift.

As a result, there are increasing concerns in China about iron ore availability, especially considering the very high production levels that would normally require higher levels of iron ore stocks in the system. Our data below illustrates how low inventories of imported iron ore are now. In recent years, there has been ~70 days of inventory in the system (at ports and mills) during December. However, this time, when the steel industry is experiencing similar profit levels as during the period 2017-2019, there is less than 60 days of inventory. This translates into an inventory deficit of 40-45 Mt. Besides this, we are hearing that a higher than normal proportion on inventory at port is “non-traditional” material that is poorer quality and in low demand relative to fines from Australia and Brazil. This suggests that the inventory situation for mainstream material is even worse than this data suggests.

Outlook: Prices to Remain High, But Not at Current Levels

The low inventory situation, strong Chinese demand and disappointing seaborne supply will continue to plague the market going into Q1, especially as China’s mill restocking intensifies. We are also approaching a seasonally weak supply period and there are fears in the market about a cyclone season in Australia that could be stronger than in previous years, while La Niña is already causing heavy rainfall in northern Brazil. With plenty of supply risks in the coming quarter, prices will remain high, but we believe it unlikely that they will persist at current levels of over $150 /dmt as steel production in China is expected to decline while seaborne supply is expected to be stronger in the last weeks of December. As such, a slight price decline is expected in the coming month.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com