Prices

December 17, 2020

CRU: U.S. Zinc Demand Holds Firm as Covid-19 Cases Soar

Written by Sam Grant

By CRU Analyst Sam Grant

It is now clear that Joe Biden will become the new president of the United States in January 2021, yet he will need control of the Senate to implement his economic policy agenda. As a result, the contest for two Senate seats in Georgia on Jan. 5 will be crucial. If Biden gains a majority in the Senate, then his Build Back Better infrastructure bill could be a positive for U.S. metals demand next year. Recent new peaks in Covid-19 cases emphasize that the U.S. recovery still needs support, and we expect a second federal stimulus package of ~$1.5 trillion to be signed early in 2021.

Despite new spikes in Covid-19 cases across the United States over the past month, with daily cases regularly exceeding 200,000, the industrial sector has continued to recover. The construction and automotive sectors are reportedly doing very well. As a result of a continuing preference for home ownership and favorable market conditions, residential construction is outperforming 2019 levels. We now expect housing starts to reach 1.34 million units in 2020, growing by 3.7% y/y. CRU’s economics team has also moderately upgraded its U.S. automotive production forecast this month, to -18.8% in 2020, equivalent to the loss of an estimated 78,000 tons of refined zinc demand.

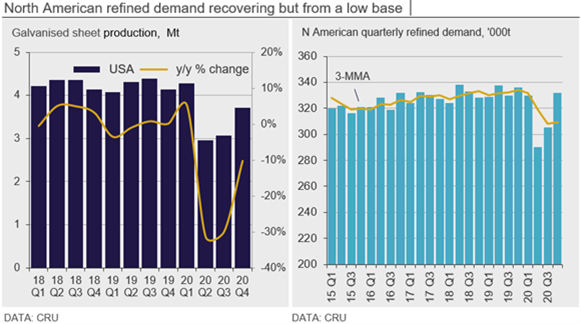

We continue to hear that U.S. consumers are maintaining good levels of demand, with all zinc-consuming sectors performing relatively well. Steel mills, which had been struggling earlier in the year due to their exposure to the automotive sector, are now hungry for refined metal. One market contact noted that their galvanizing customers’ order books are looking firm for the next 60-90 days, when usually 30 days would be typical. However, our steel sheet team currently estimates that U.S. galvanized sheet output will contract 10% y/y in 2020 Q4. We have also heard that the North American brass mill sector is doing well and estimate that combined U.S. output of Cu Alloy flat-rolled products and RBS (rods, bars and sections) will increase 4.6% y/y in Q4. This feedback certainly bodes well for U.S. refined demand in the short term, but the outlook beyond 2021 Q1 remains uncertain.

North America Refined Production Has Been Strong in 2020

North American smelter output has been strong this year, especially in Q3. We estimate that output increased 4.6% y/y in Q2 and 4.6% y/y in Q3, despite weaker Q2 output from Peñoles’ Torreon smelter in Mexico. In Q4, we expect North American refined output to increase 10.8% y/y, assuming Peñoles increases output in line with expanded capacity and that AZR continues to produce as expected. The latter was having some issues producing SHG earlier in the year, but is now producing normally.

We have heard from traders in the U.S. and in Europe that they have been selling good volumes of refined metal into Brazil at high numbers, despite an 8% import duty. Brazil’s galvanized sheet output has surged this year and could reach levels not seen since 2013. While Nexa has more than enough refined output to satisfy Brazilian end-user demand, it is possible that a combination of higher refined net exports from Brazil (up 10.2% in January-November, to 43,351 tons) and a rebound in domestic demand have given consumers the chance to shop around and give themselves some leverage in future purchase contract negotiations with Nexa.

Brazil’s refined exports increase by 4.2% y/y in January to November and although refined imports picked up in November, this was due mainly to a surge in imports from Peru which, along with higher year-to-date Spanish imports, helped offset a decrease in imports from Mexico. It is possible that December’s imports will be higher, although this is likely to be a temporary uptick given that Nexa’s output returned to normal in Q3 and remains stable.

With new capacity at Penoles and AZR ramping up next year, contract premia for 2021 in the U.S. have reportedly been settled at around half a cent below 2020 levels. We assessed 2020 SHG premia to be around 8.0 c/Ib., which implies 2021 premia will average close to 7.5 c/Ib.

U.S. refined imports weakened in September, falling 34.7% y/y, before strengthening again in October, increasing 16.6% y/y, bringing the year-to-date increase to 12.6% y/y. From January-October, imports from Canada, Mexico and Peru have contracted 5.6% y/y, 2.0% y/y and 26.0% y/y, respectively. However, these declines have been more than offset by higher imports from South Korea, Brazil and Europe. We have not heard of any tightness in the U.S. market over the past month, and we understand there is sufficient refined metal available. There have been a handful of spot deals reported to us over the past month with quotes in the range of 7.0-7.5 c/Ib. and we have kept our assessment of premia flat at 7.5 c/Ib. this month.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com