CRU

January 15, 2021

CRU: Chinese Policies Boost Global Sheet Prices

Written by Josh Spoores

By Josh Spoores, from CRU’s Steel Sheet Products Monitor

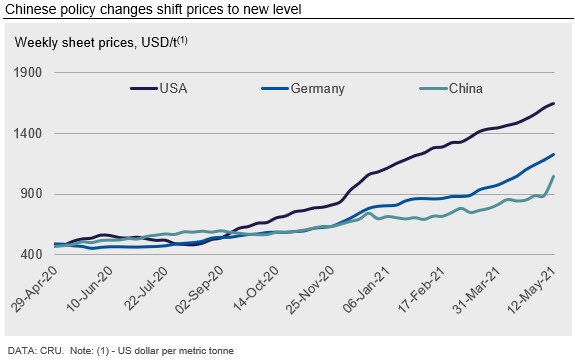

One year ago, the title of our May Steel Sheet Products Monitor was “Global sheet markets move past bottom of demand cycle.” Today, global sheet consumption continues to rise, reaching levels where current global production cannot keep pace. In addition to the continued demand rebound from lows seen just over a year ago, most end-use sectors require higher inventory levels to accommodate this demand environment. While some portion of demand gains reflect inventory building, it is not yet clear how much, if any, inventory has been built through the global supply chain.

Sheet demand has been led higher by automotive production, though more recently in most regions production levels have been tempered by a true shortage of electronic components, namely microchips. While this shortage continues to hamper the production of vehicles, we are only now starting to see evidence of mills shipping less sheet products to automakers. As this trend continues, we expect shipments or mill production time to shift to other end-use segments. We currently expect that the automotive supply chain is building inventory in anticipation of stronger automotive production rates later this year, relative to 2021 Q2 levels, which has helped to limit overall sheet supply to other end markets.

China Cuts Production, Eliminates Tax Rebates

Perhaps the most notable change to global sheet markets in recent weeks has come from two significant changes in China: elimination of the export tax rebate and capacity cuts. While we were closely following these potential changes, both policies ended up with more aggressive changes than our base case expected.

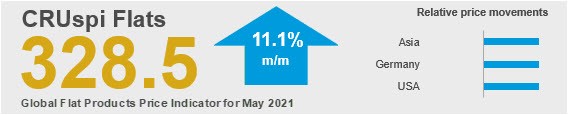

These changes in China have recently helped to drive local and global sheet prices higher, with some significant gains in China and Southeast Asian markets since the end of the Labor Day holiday in China. Reflecting the continued, yet substantial m/m price rises, CRU’s Global Flat Products Steel Price Indicator (CRUspi flats) has again reached a new record high. Our current reading of 328.5 is up 11% m/m, up 146% y/y and, perhaps most notably, up 19.7% from the 2008 high.

Indian Mills Fight COVID-19 Locally While Continuing to Redirect Production to Exports

In India, a very serious upsurge in COVID-19 cases has led to localized lockdowns and a disruption to demand for sheet products. Due to this, mills have been able to increase export allocations, while moderating steel output to keep inventories somewhat balanced. Though even with these options, production cuts have taken place. These cuts, though, are not in response to a potential weakness in demand but are attributed to steelmakers diverting liquid oxygen supplies for medical needs. In fact, leading Indian steelmakers are currently supplying well over 3,500 tonnes/day of liquid oxygen for medical needs, up from about 1,500 tonnes/day in the third week of April. This increased oxygen diversion has led to steelmakers reducing their safety stock of oxygen from 3-4 days to less than a day, thus creating a potential risk to steel production.

Outlook: Further Sheet Price Gains Likely, Yet Iron Ore May Be a Leading Indicator for Any Trend Change in Sheet

Our near-term view continues to expect higher sheet prices over the coming weeks. While prices in most, if not all, markets are expected to rise, we may be nearing a point where regional fundamentals have more influence on local prices than any singular global factor.

Demand has been rising for the past year and while we expect further demand gains, upward momentum of demand will inevitably slow. This slower demand momentum comes from an easing of inventory building. In prior market cycles, this shift of inventory-related demand often coincides with price momentum stalling. From here, regional demand may more closely reflect seasonal factors as well as coming changes to trade, restarted production and the start-up of new mills. However, due to current profitability levels for producers, maintenance outages have been pushed out to the autumn. This shift may lead to unseasonably stronger production output over the summer for some regions.

We continue to focus on the capacity cuts in China, and our upside price forecast risk is that production cuts there will lead to changes in global trade, which will keep supply tighter for longer. Alongside this, we are looking at iron ore prices as a potential leading indicator. Any sustained cuts in Chinese steel production should lead to lower iron ore prices. We are also curious to see if domestic demand for sheet products in China is also affected by the government’s actions.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com