CRU

January 15, 2021

CRU: Global Metallics Markets Cool in February

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley, from CRU’s Steel Metallics Monitor

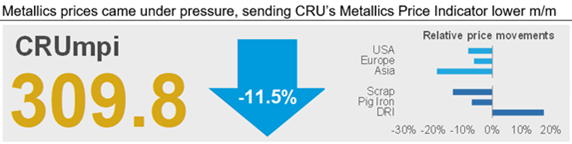

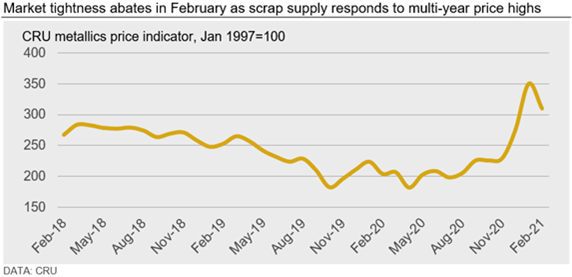

The CRU metallics price indicator (CRUmpi) fell by 11.5% m/m in February to 309.8. Scrap prices in western markets came under pressure as supply increased substantially, while those in eastern markets faced additional pressure from waning demand. Although supply, especially obsolete grade scrap, has risen, we expect that global metallics markets have reached a temporary floor.

Global scrap prices were brought lower m/m in February by a surge in supply that was spurred by rapidly rising prices over the last 60-day time period. This supply-side price pressure drove decreases in western markets like the U.S., EU and Turkey, while prices in eastern markets faced additional pressure from slowing demand ahead of holidays. Still, price inelastic scrap grades like #1 busheling and E8 resisted this downside pressure given persistently high demand and increasing supply scarcity. Pig iron prices were mixed following an absence of Chinese buying activity, with prices falling in the U.S., but maintaining relative stability in Italy.

Substantial scrap price hikes by mills in the U.S. market during December and January trade strongly incentivized scrap collection across the country, leading to plentiful obsolete grade availability and allowing mills to push prices lower m/m in February. However, with manufacturing activity relatively stable and demand still high, prime grade scrap prices were left unchanged despite being at historically elevated levels. A similar situation took place in Europe, although an increasing differential in some finished steel product pricing caused variations in what mills were willing to pay for scrap. Further east, Russian scrap prices also declined due to higher domestic supply, although this phenomenon was artificially driven by an increased scrap export tariff that became effective on Feb. 1.

Scrap was also more readily available to Turkish importers amid the influx in material in its traditional source markets (excluding Russia). While this partially allowed them to drop prices by about $70 /t m/m, they were also inclined to lower input costs given a decline in buying interest from steel buyers in Asia.

Indeed, stockists in Asia (ex-China) have been reluctant to make additional finished steel product purchases given elevated price levels and demand uncertainty as the Tet holiday approaches in Vietnam and China finishes its New Year celebrations. At the same time, supply from Japan was made more readily available as domestic steel producers there cut production because of a spike in electricity prices. Scrap collectors in the country struggled to sell high-priced inventories following this sudden demand fall and this, combined with the imposition of tighter COVID-19 containment measures, caused export offer prices to drop.

In China, scrap buying activity slowed and demand for steel dropped ahead of the New Year holiday beginning Feb. 11. As mill margins compressed, some decided to take maintenance outages or reduce production, resulting in weaker scrap demand overall. However, the market remained tight enough to prevent a substantial fall in pricing, so February’s correction was limited to just RMB60 /t m/m.

The decrease in Chinese demand for finished steel and scrap was also evident in the international pig iron market. Chinese buyers were largely absent during late January and early February following a spate of shipment redirections by them to the U.S. market, although this absence was partially offset by elevated bids from buyers in Italy.

Outlook: Prices Have Likely Reached a Temporary Bottom

While obsolete scrap supply has flooded into some markets due to elevated price levels, adverse weather conditions and price declines in February may hinder scrap collection. As a result, we expect little change in those prices in March, although mills in some regions may increase prices slightly to ensure material inflows remain intact.

Prime grades will also likely hold at current levels in March given supply scarcity even as demand remains high. A global shortage in semiconductors is likely to slow automotive production in the coming months as well, meaning that prime markets will only get tighter in the near term. This will likely lead to higher demand for ore-based metallics, though the startup of at least one pig iron producing facility in North America does present a small downside price risk.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com