CRU

January 15, 2021

CRU: Sheet Order Volume Decreases Globally

Written by George Pearson

By CRU Prices Analyst George Pearson, from CRU’s Steel Sheet Products Monitor

Sheet order volume decreased in the last week across regions as several buyers have recently placed forward orders and are now covered for deliveries. Prices remain stable at a high level because mills are well-booked and lead times are long. China is slowing down ahead of its New Year holiday next week.

North America

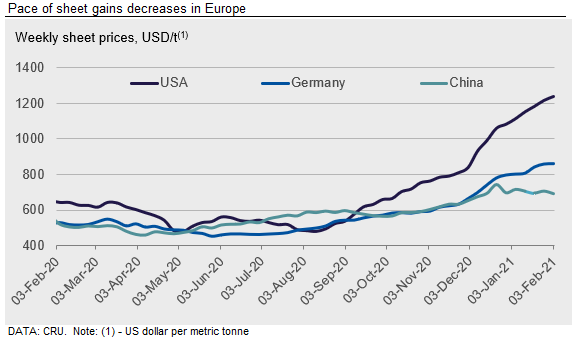

The uptrend in U.S. Midwest sheet prices has continued, though overall volumes booked at this level are somewhat low for this time of year. The lower spot volume we have recorded is also reflected in comments from buyers that they are reducing orders at these price levels. Domestic production at BFs and EAFs is rising, and in addition to this we are now seeing increased production from slab conversion. Furthermore, we expect import arrivals to increase following high order activity last week. While supply is rising, sheet demand appears to be stabilizing, if not falling back. Part of this may stem from supply issues limiting automotive production, but more so, inventory building as a source of demand appears to have fallen back somewhat. Further price gains from here are likely, yet we continue to expect that a peak is near as some global prices are weakening and global costs are also falling.

Steel supply on the U.S. West Coast remains tight with more companies unable to purchase enough material to cover their needs. Buyers report that demand is still strong, although reports of projects being delayed due to high pricing have increased over the past week. There are expectations for another increase in mill pricing, although the increase is expected to be smaller than other recent increases. As domestic prices have risen, import offers have become more attractive, even after adding freight and other associated charges.

Europe

European sheet prices continued to rise and across all sheet products prices have increased by €2-10 /t w/w. We believe that the slower pace of growth this week indicates that we are nearing a peak in prices. Supply continues to be particularly tight for CR and HDG coil. This week’s German CR coil price of €814 /t is €6 /t lower than the nominal peak of €820 /t recorded by CRU in July 2008. Import offers are increasing availability and still match mill lead times, but prices for imports are still the same or slightly below domestic prices. Ad-hoc enquiries to SSCs from end-users that normally purchase from mills are evidence of a continued lack of short-term spot availability. We expect this to ease in Q2 once all idled domestic assets have come back online and import arrivals have increased.

China

The Chinese domestic sheet market deteriorated this week. Prices fell across the board w/w and buying interest from end-users and traders became weaker due to the upcoming Chinese New Year holiday. While sheet profitability declined to 7% EBITDA, steel output also reduced. Despite the cut in production, stocks increased by 2% w/w at major steel mills and warehouses. We expect weaker demand and lower spot activity to weigh on prices for the rest of the month.

Asia

Trading activity increased in Asia last week, but all flat product prices were unchanged. HR coil SAE1006 deals were heard at $645-655 /t CFR Vietnam for March shipment. Most transactions were sales by traders for their position cargoes. Chinese mills were reluctant to lower prices because raw material cost remains high and there are reports that the Chinese government might change its export tax rebate scheme after the Chinese New Year holidays.

For HR coil/sheet SS400, offers were stable at $635-640 /t CFR Vietnam with limited buying interest. Formosa Ha Tinh announced a rollover of the previous month’s price for HR coil, i.e. $720-725/t CFR Vietnam for rerolling material for March shipment. HR coil offers from Hoa Phat were at $655-660 /t CFR Vietnam.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com