CRU

March 16, 2021

CRU: Iron Ore Falls by Over $20/dmt in the Past Week

Written by Erik Hedborg

By CRU Principal Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

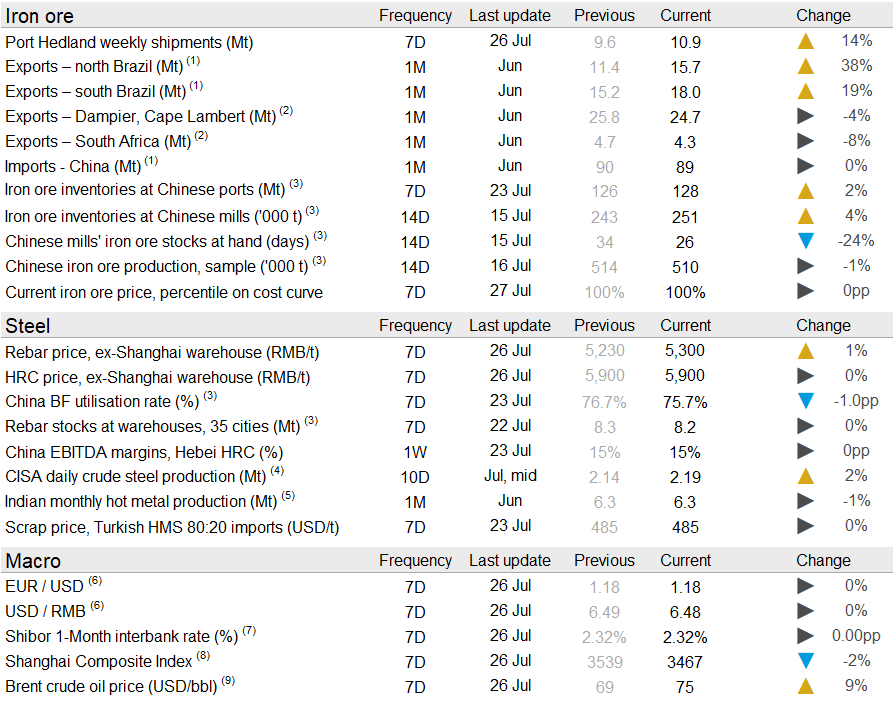

Iron ore prices have fallen back to $200 /dmt as Chinese demand continues to weaken and the country’s ports have registered the highest level of iron ore inflow since Q1. On Tuesday, July 27, CRU assessed the 62% Fe fines price at $200.0 /dmt, a $21.0 /dmt fall in the past week.

In China, the improving steel demand took a pause last week, partly due to heavy rainfall and resulting flooding in Henan province in Central China. As steel production has started falling at many steel mills as requested by Local Government, Chinese domestic steel prices kept elevated. In particular, our assessed rebar price lifted by RMB70 /t w/w, after surveyed weekly rebar production fell to the lowest level since end-February.

In line with our expectation, Chinese steelmakers cut production of steel long products prior to flat products with the latter having higher margins for the time being. In combination with the ongoing power shortage, EAF production fell faster than BOF production last week. This helped integrated steelmakers maintain their hot metal production, which only fell slightly last week. Having said that, the bearish sentiment on iron ore demand continued, evidenced by large steelmakers continuing to sell contract volume in the spot market while many traders started to offer large discounts. As a result, we continue to see the premium for higher-quality iron ore decline and our sources in the market have mentioned that it is mainly that type of ore that is being re-sold by steelmakers.

Seaborne supply has lifted slightly in the past week. Port Hedland registered 10.9 Mt of exports after a strong performance by FMG. Rio Tinto’s export numbers are still on the lower side, which has contributed to Australian exports in July remaining slightly below last year’s level. Brazilian exports have been steady with exports from Minas Gerais remaining at high levels, including strong exports of lower-grade ore. South African exports in July have been disappointing with rail issues continuing along with further disruptions at the port. Lump supply from South Africa and Australia has been weak this month, but demand in China is falling even faster, which has brought the lump premium down from 70 c/dmtu to current levels of 50 c/dmtu.

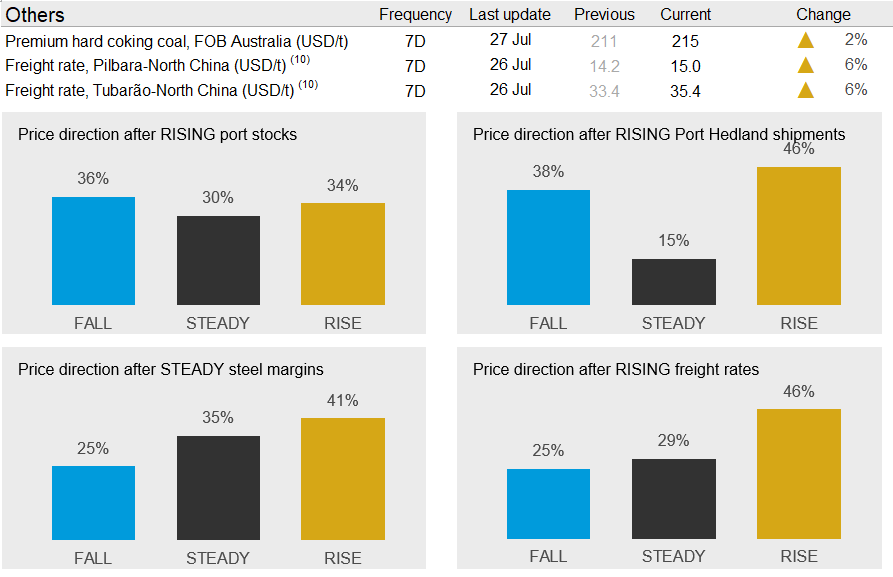

In the coming week, we see further pressure on iron ore prices. Port stocks have risen due to high port inflow. And the vessel queue has grown, while we see continued strong arrivals in the coming weeks. That means iron ore availability is expected to improve in the coming weeks and iron ore prices are likely to continue to decline as steel mills are continuing to reduce output levels.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com