CRU

March 16, 2021

CRU: Iron Ore Steady as Pollution Controls in China Ease

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

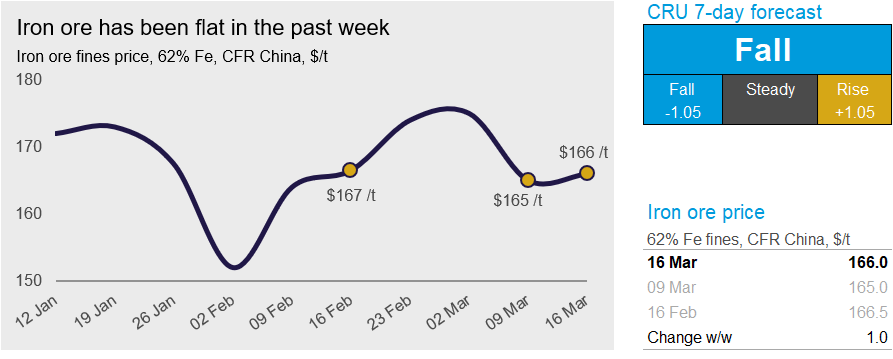

Iron ore prices have been steady in the past week as stricter pollution controls in China have been lifted and seaborne supply has been strong. On Tuesday, March 16, CRU has assessed the 62% Fe fines price at $166.0 /dmt, up $1.0 /dmt w/w.

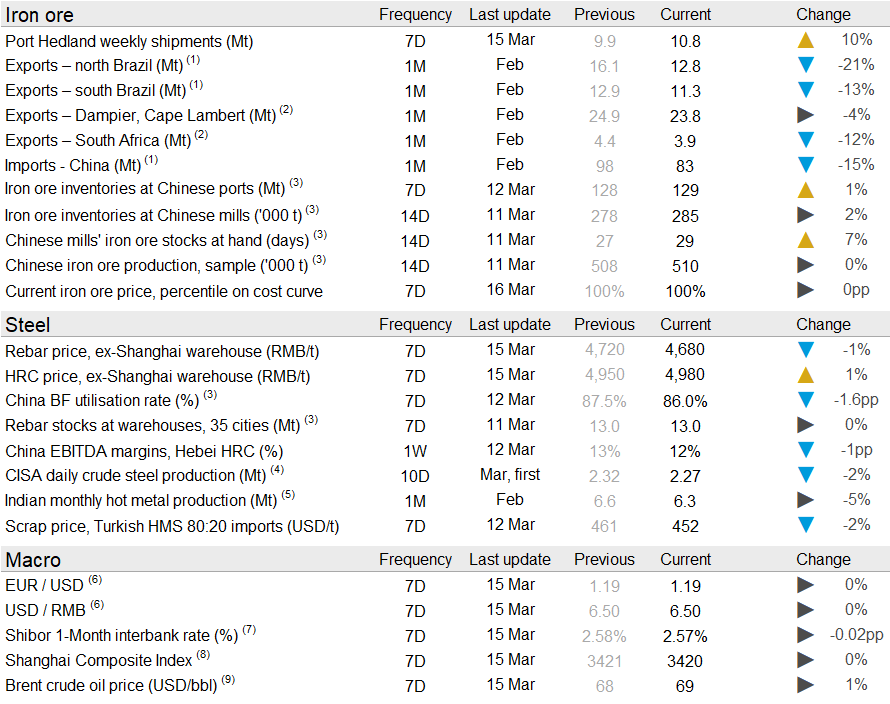

Chinese steel demand continued to improve last week and had almost gone back to normal levels from CNY, but domestic steel prices have changed modestly w/w with HRC price edging up by RMB30 /t with rebar prices dropping by RMB40 /t. In contrast, iron ore and coke markets were shocked by stricter operating restrictions in a few cities in Hebei and Shandong province including Tangshan, a major steelmaking hub.

On March 9, the Tangshan government alerted heavy pollutions over the coming days and, consequently, requested stricter operating restrictions on BFs, sintering and coke ovens. In combination with a bearish macro environment, the iron ore futures price dropped by ~10% on that day. The restrictions were further reinforced in Tangshan city after the Minister of the Ministry of Ecology and Environment (MEE) visited a few steel mills without notice. Some BFs that could not meet emission standards were put into hot-idling, and more sinter capacity was shut down. This has resulted in exceptionally strong demand for pellet and lump, while fines inventories have continued to rise in the past week. On March 15, as air quality improved, the Tangshan government revoked the reinforced version of restrictions. While news of operational recovery remains unavailable at the time of this writing, the iron ore futures price lifted sharply in response to the ease of restrictions.

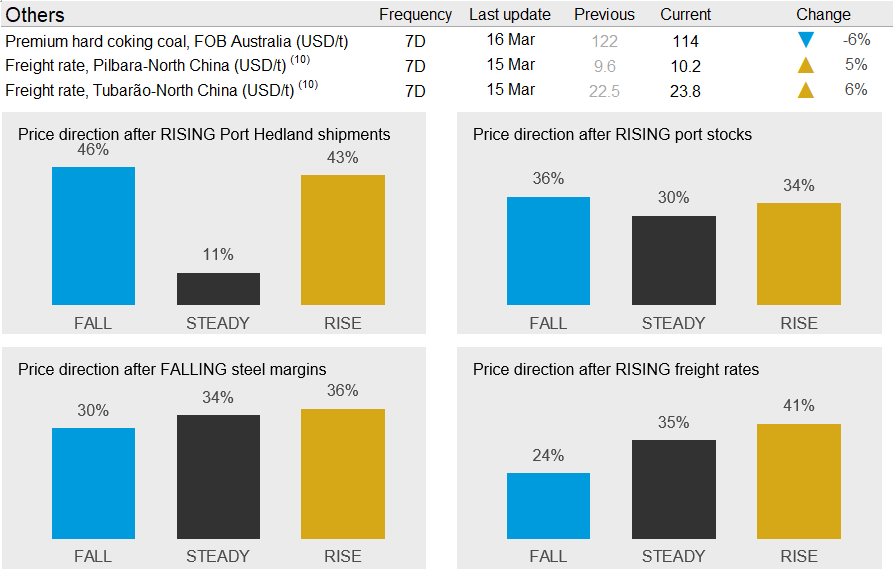

Seaborne supply has been robust in the past week. Australia continues to ship at a high rate with Port Hedland registering 10.8 Mt of exports and Rio Tinto maintaining its high level of exports. For the first 10 weeks of the year, the company has maintained an export level 6% above last year’s level. The weather conditions continue to look favorable in Australia with a low risk of cyclones developing towards the end of the cyclone season. In Brazil, iron ore exports have been slightly lower in March, but still above last year’s levels. The restart of wet processing at Timbopeba is good news for Vale’s ability to produce pellet feed and shows that the company’s resumption of production is going according to plan. There is, however, one risk emerging in Minas Gerais. Covid-19 cases have been on the rise again and a statewide lockdown has been announced. Although the mining industry is exempt from restrictions, employee absenteeism is a risk, particularly as the mines in the state are more labor-intensive than in Australia or in northern Brazil.

We are getting mixed signals from our indicators below. Although the production restrictions have been eased, iron ore is still trading ~$10 /dmt lower than a few weeks ago. Inventories in China continue to rise, particularly of fines products. As we expect strong shipments in the coming weeks and steelmakers are aware that production curbs could be implemented again, we maintain our bearish view and expect prices to fall in the coming week.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com