CRU

March 16, 2021

CRU: Steel Price Movements Diverge in East and West

Written by George Pearson

By CRU Analyst George Pearson, from CRU’s Steel Monitor

Chinese prices continued to buck the global trend this week as further government meetings about preventing higher steel prices being passed on to consumers were taken seriously by the market and trading activity reduced. Prices in Europe and the U.S. are still rising, with U.S. plate producers raising prices again in the last week.

U.S. steel sheet prices continued to increase last week, with HR coil gaining $52 /s.ton w/w. Last week we recorded the largest amount of reported spot transactions since August 2020. Mills are ramping up, increasing availability. While mills have started to catch up on past due orders, most buyers report their inventories remain below normal levels and they are seeking more buying opportunities. Demand is strong, but there are indications that some steel consumers are purchasing material only for specific projects and are unwilling to accept any extra material due to the high cost. Some service centers report that they have been unable to pass on the full replacement cost to end-users. Further price gains are expected in the near term but not at the same pace as recent months.

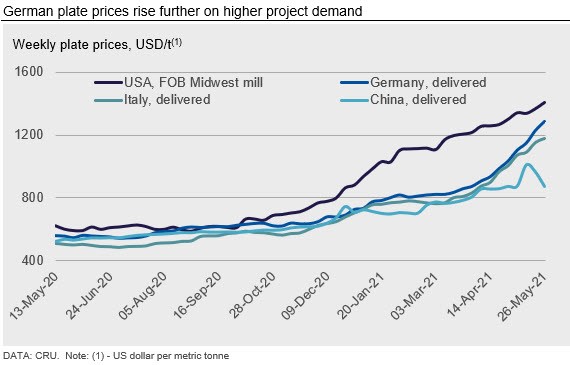

U.S. plate producers announced a $100 /s.ton price increase on as-rolled plate last week. Plate prices rose by $36 /s.ton w/w, though the spread between HR coil and plate widened to $314 /s.ton. We expect further gains as new higher-priced transactions are reported. Plate prices have been supported by higher pig iron prices and an expected increase in June scrap costs, but the recent weakness in iron ore costs may undermine this. Companies report that bidding activity for 2022 projects has intensified, but with mill pricing validity limited to sometimes a day or less, quoting projects is very difficult.

European sheet prices have sharply increased by €31–57 /t w/w across all products. Our latest price assessment for HR coil is €1,111 /t for Germany and €1,092 /t for Italy. Supply tightness in the European domestic market continues with increasing difficulty to secure material. Various steel service centers have started to negotiate shorter payment terms with customers. Some have reportedly reduced their payment terms from 90 to 60 days as a means of rebalancing their finances. Lead times for HR coil are now in November for some mills. Market sentiment is bullish with tight supply expected to go on for some time. That said, we previously heard of a European mill offering spot HR coil tonnes that became available at short notice for June-July shipment to the UK and have heard this week that the same mill has sold material to the U.S. for July shipment. This continues to suggest that gaps in orderbooks have appeared, despite official lead times remaining in Q4.

Plate prices in Europe rose by €42 /t to €1,053 /t in Germany and by €16 /t to €966 /t in Italy w/w. The price gap between plate and HR coil is narrowing, particularly in Germany. There has been no change in lead times, with German mills offering for September and Italian plate mills are quoting July delivery and some tonnage available for June.

Chinese steel prices continued to fall this week following the government’s continuous efforts to stabilize commodity prices. Rebar fell by RMB 570 /t w/w and HR coil fell by RMB 490 /t w/w. Trading was limited as downstream buyers and traders were hesitant to buy in a falling market. Inventory fell by 3% w/w, slower than the previous week’s 4-7%. However, weekly output remained flat w/w. Looking ahead, we expect weekly output to fall this week as a result of falling prices. Steel margins have fallen by more than 10 percentage points w/w, according to the CRU cost model. Meanwhile, downstream reluctance to buy and panic selling of previous speculative stock will continue to weigh on market sentiment. These factors, along with further expected falls in iron ore are likely to continue to weigh on prices in the short-term.

Plate prices fell by a significant RMB 610 this week following the government’s continuous efforts to stabilize commodity prices. Rebar fell by RMB 570 /t w/w and HR coil fell by RMB 490 /t w/w. Trading was limited as downstream buyers and traders were hesitant to buy in a falling market. Plate inventory increased marginally w/w, while production remain high. Looking ahead, we expect weekly output to fall this week as a result of falling prices. Steel margins have fallen by more than 10 percentage points w/w, according to the CRU cost model. Meanwhile, downstream reluctance to buy and panic selling of previous speculative stock will continue to weigh on market sentiment. These factors, along with further expected falls in iron ore, are likely to continue to weigh on prices in the short-term.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com