Market Data

June 10, 2021

SMU Analysis: Energy Use Rising, Oil Prices at 32-Month High

Written by Brett Linton

Editor’s note: Steel Market Update is please to share this Premium content with Executive members. For information on how to upgrade to a Premium-level subscription, email Info@SteelMarketUpdate.com.

The Energy Information Administration’s June Short-Term Energy Outlook remains subject to heightened levels of uncertainty related to the ongoing economic recovery from the COVID-19 pandemic. That big caveat aside, the increase in economic activity and an easing of the pandemic have contributed to rising energy use. The EIA expects oil production to increase in the coming months in response to rising consumption, and it anticipates a mostly balanced global oil market for the remainder of 2021. Crude oil prices are forecast to remain steady through the remainder of the year, while natural gas prices are expected to slightly increase.

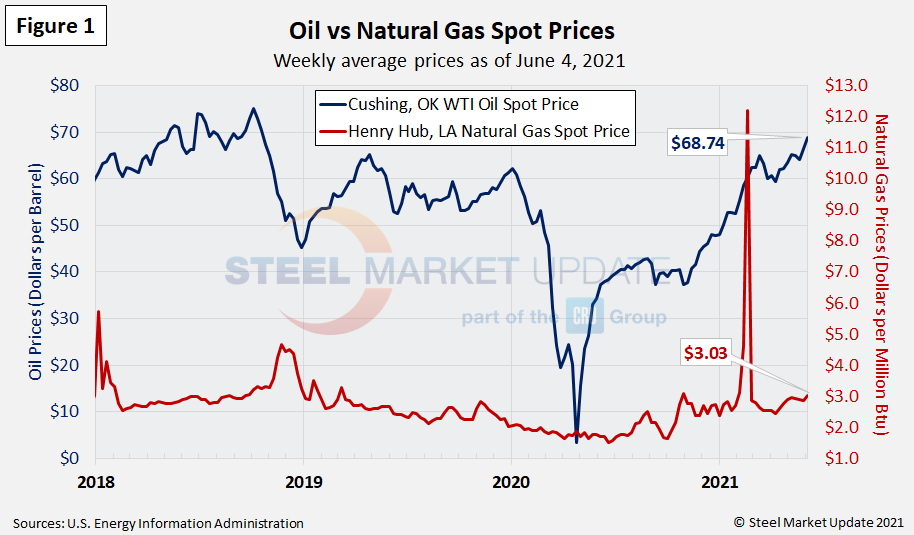

Spot Prices

The spot market price for West Texas Intermediate (WTI) has increased since our last energy update, at $68.74 per barrel as of June 4. This is the highest weekly oil spot price since October 2018, a 32-month high. Natural gas prices at the Henry Hub in Oklahoma are now up to $3.03 MMBTU (million British Thermal Units) as of June 4. Figure 1 shows the weekly average spot prices for each product.

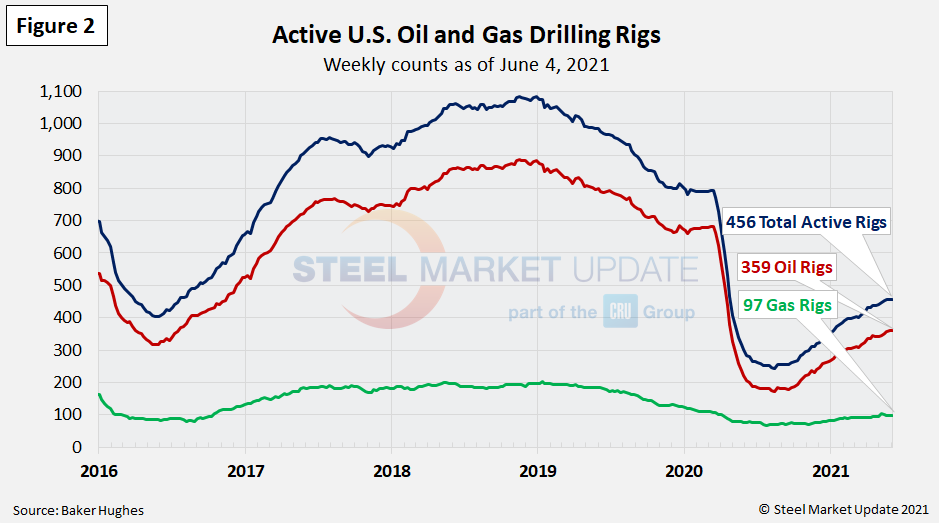

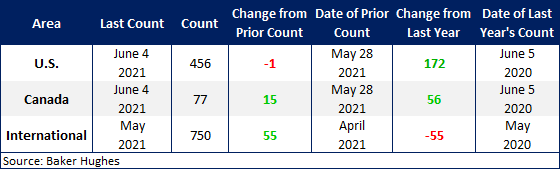

Rig Counts

The number of active U.S. oil and gas drill rigs has continued to recover since mid-2020. The count was 456 active drill rigs as of the end of last week. That total is comprised of 359 oil rigs and 97 gas rigs, according to the latest data from Baker Hughes (Figure 2). While up over recent months, active drill rigs are still down 42 percent from 793 rigs in March 2020, just prior to the coronavirus shutdowns. The table below compares the current U.S., Canadian and international rig counts to historical levels.

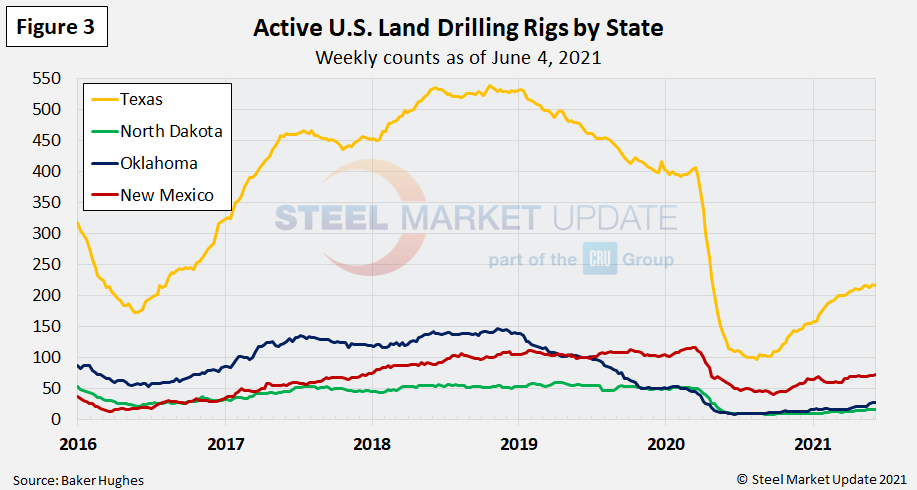

U.S. oil and gas production are heavily concentrated in Texas, Oklahoma, North Dakota and New Mexico, which have seen declines of 28-67 percent since March of last year. The most active state, Texas, now has 216 active rigs in operation. Texas rigs had plummeted from 407 in March 2020 to 97 rigs in August 2020 (Figure 3).

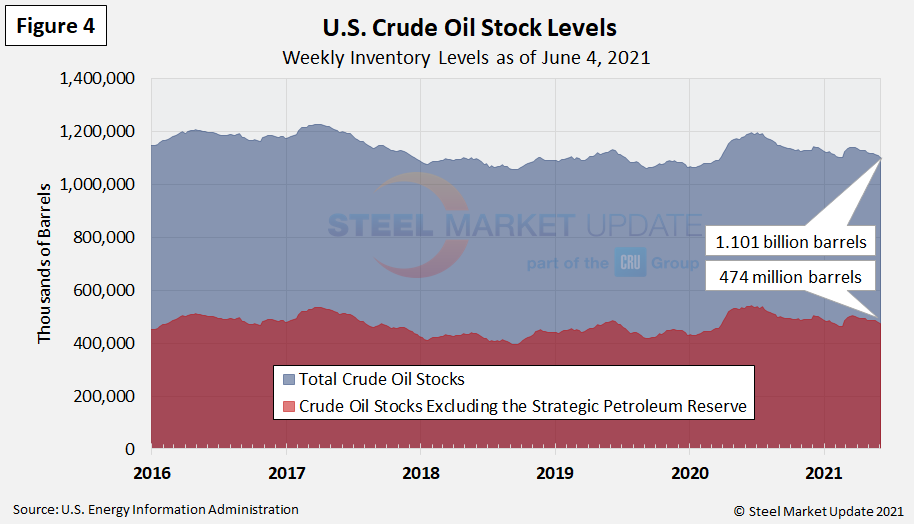

Stock Levels

U.S. total crude oil stocks in 2020 surged from mid-March through July, but they have steadily declined since then. The latest level is down yet again compared to the previous Energy Update: 1.101 billion barrels as of June 4, down from 1.188 billion barrels at the same time last year (Figure 4).

Trends in energy prices and rig counts are a predictor of demand for oil country tubular products (OCTG), line pipe and other steel products.

By Brett Linton, Brett@SteelMarketUpdate.com