CRU

August 10, 2021

CRU: Iron Ore Price Falls Again to $160/dmt

Written by Erik Hedborg

By CRU Principal Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

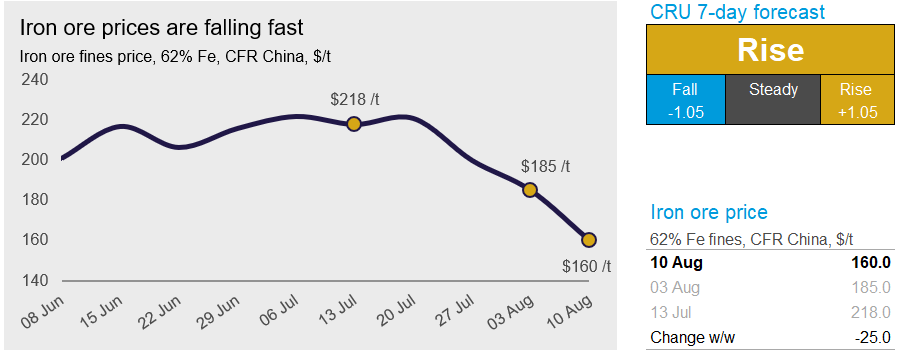

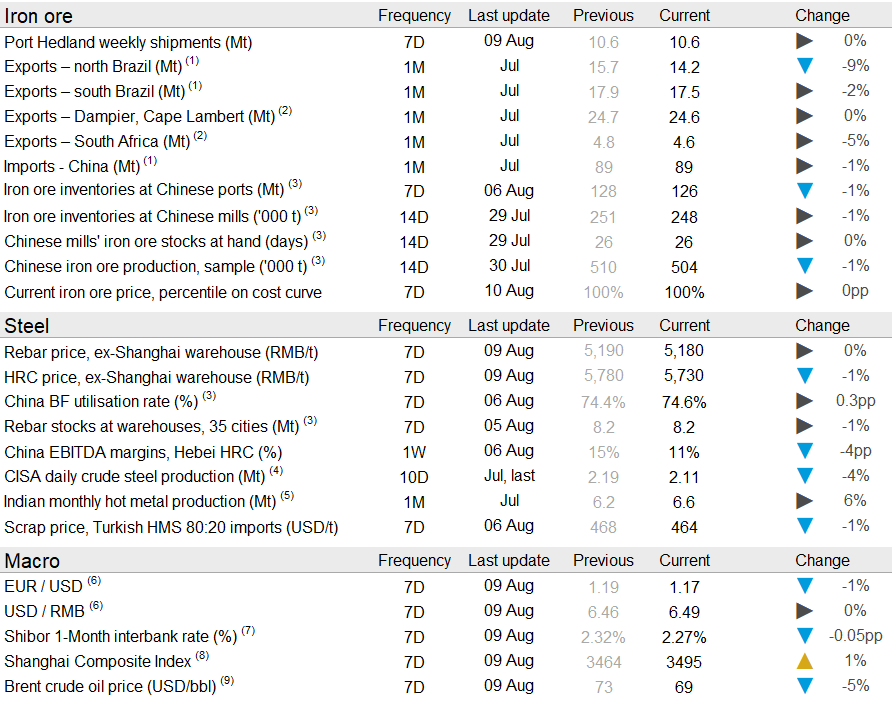

The iron ore price decline continues as demand for spot cargoes in China is exceptionally weak, while we have started seeing signs of improving supply from Australia. On Tuesday, Aug. 10, CRU assessed the 62% Fe fines price at $160.0 /dmt, a $25.0 /dmt decline in the past week.

Last week, the Chinese domestic HRC price fell by RMB50 /t w/w, despite underlying demand improving slightly. In contrast, demand for construction steel such as rebar and wire rod fell again, resulting in higher inventories at steel mills, even after the reported weekly output declined further. Our latest assessment shows that the rebar price fell by RMB10 /t w/w. Some BF-BOF producers that supply long products to the market have now experienced negative margins for over two months and some of these producers are now taking action to reduce steel output. Surveyed BF capacity utilization fell last week and is now at the lowest level since May 2020, except for the time around China’s 100th year anniversary of the CCP. As a result, iron ore consumption continued to fall, but onshore inventories at mills and ports fell slightly w/w due to ship crews testing positive for COVID-19 at some ports. Given this, iron ore ship-offloading slowed and the vessel queue is now as long as 192, the highest level since February 2021.

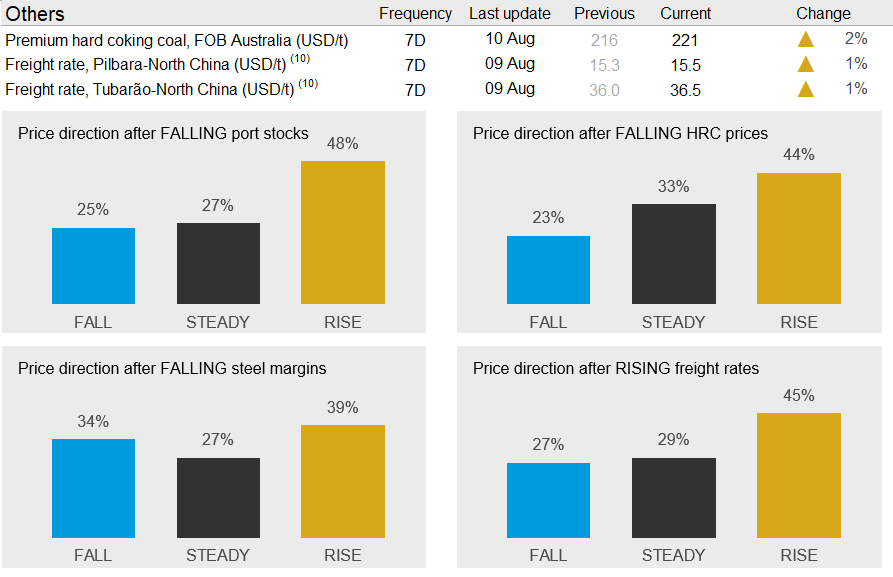

On the supply side, Australian exports have improved in the past week as Rio Tinto has reported one of the strongest weeks in months and Port Hedland continues to ship at high rates as BHP has also been increasing exports in the past week. Australian exports are now at the highest level since June and much higher than at this time last year. Exports in August typically increase as most miners carry out maintenance in July.

In Brazil, trade data revealed low exports from Vale’s Northern System (NS) with only 14 Mt of exports, compared with 19 Mt in July last year. S11D continues to struggle and the mine has for the first seven months of the year exported 4 Mt less than last year. The mine produced 83 Mt in 2020 and has a nameplate capacity of 90 Mt/y. Exports from Minas Gerais remained strong, but a high proportion of the exports were low-grade fines as beneficiation remains an issue in Brazil.

In the next week, we expect prices to rebound slightly. Steelmakers’ inventories have been in decline and there will come a point when demand for spot cargoes improves. Steel prices have been rising slightly in the past few days and if this trend continues, there is a chance we could see steelmakers starting to build inventories again.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com