Market Data

August 19, 2021

Steel Mill Lead Times: A Week Shorter

Written by Tim Triplett

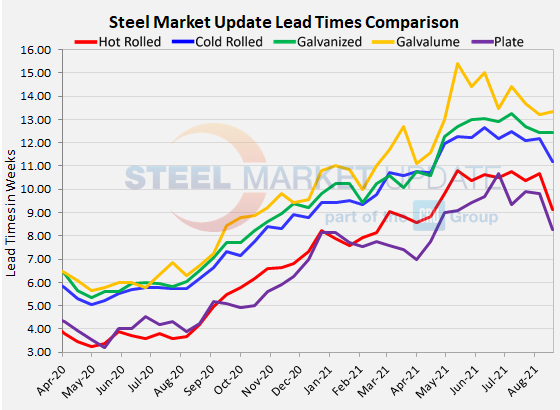

With the exception of coated products, lead times for delivery of flat rolled and plate steel have shortened by a week or more – the first significant decline this year and a possible sign that rising steel prices are losing momentum.

Lead times for spot orders of steel have extended continuously since the market bottomed last spring due to the pandemic-related shutdowns. The average lead time for hot rolled was a quick 3.25 weeks in late April 2020. By earlier this month it had stretched to nearly 11 weeks as demand continued to outpace supply. The longer the lead times, the busier the mills and the less likely they are to discount prices to win orders.

Steel Market Update’s check of the market this week shows the average lead time for spot orders of hot rolled at 9.15 weeks, down a week and a half from 10.67 weeks in the last survey and the shortest it has been since mid-April 2021.

Cold rolled lead times shortened by a full week from 12.17 in the first week of August to 11.17 this week.

At 12.43 weeks, lead times for galvanized products are basically unchanged. The same goes for Galvalume, with current lead times of 13.33 weeks.

Average plate lead times also came down by a week and a half, to 8.29 weeks.

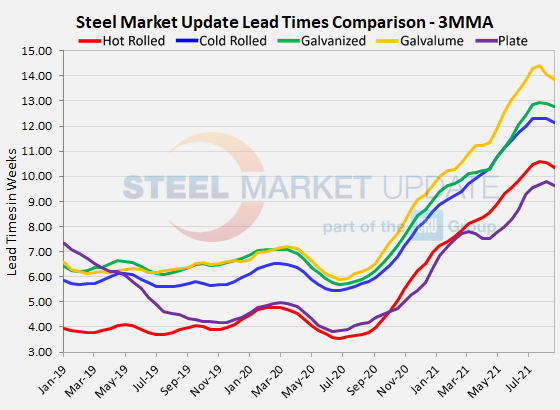

Three-month moving averages, which smooth out the weekly volatility of the lead times data, also backtracked for all products for the first time this year. The 3MMA for hot rolled lead times now averages 10.34 weeks, cold rolled 12.12 weeks, galvanized 12.79 weeks, and Galvalume 13.85 weeks. Plate’s 3MMA dropped to 9.62 weeks.

While it’s too early to declare that this is the beginning of a new downtrend for lead times – and by inference for steel prices – the decline of a full week for hot rolled, cold rolled and plate is noteworthy. Lead times for galvanized and Galvalume, unchanged at 12-13 weeks, suggest persistent tightness in those product categories.

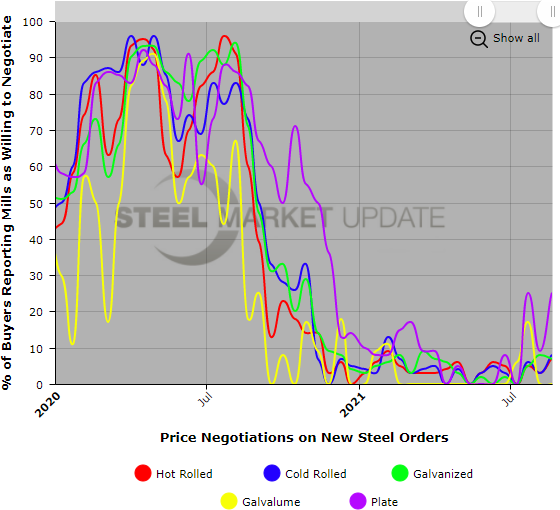

Negotiations

When lead times go down, negotiations tend to open up. In fact, this week’s poll results show a very small increase in the percentage of buyers who report mills willing to talk price to win orders. But nothing statistically significant at this point. The vast majority still report the mills in full control of price negotiations. One buyer said he has seen “insignificant goodwill gestures” from some suppliers, while another said, “it’s still about trying to find tons, not going back-and-forth on pricing.”

By Tim Triplett, Tim@SteelMarketUpdate.com