CRU

August 26, 2021

CRU: Iron Ore Price Fall Resumes as Supply Increases

Written by Erik Hedborg

By CRU Principal Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

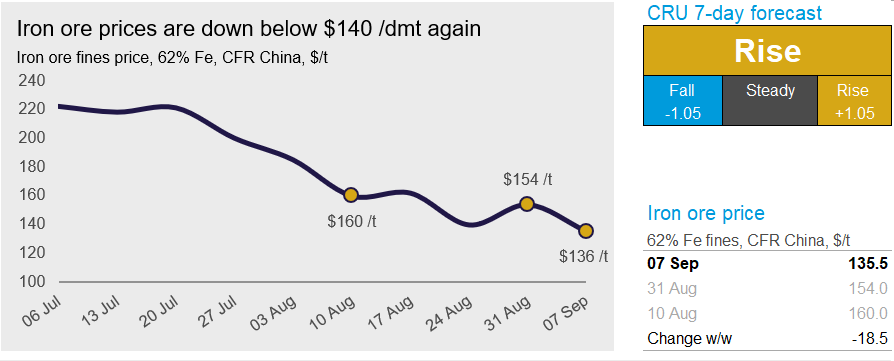

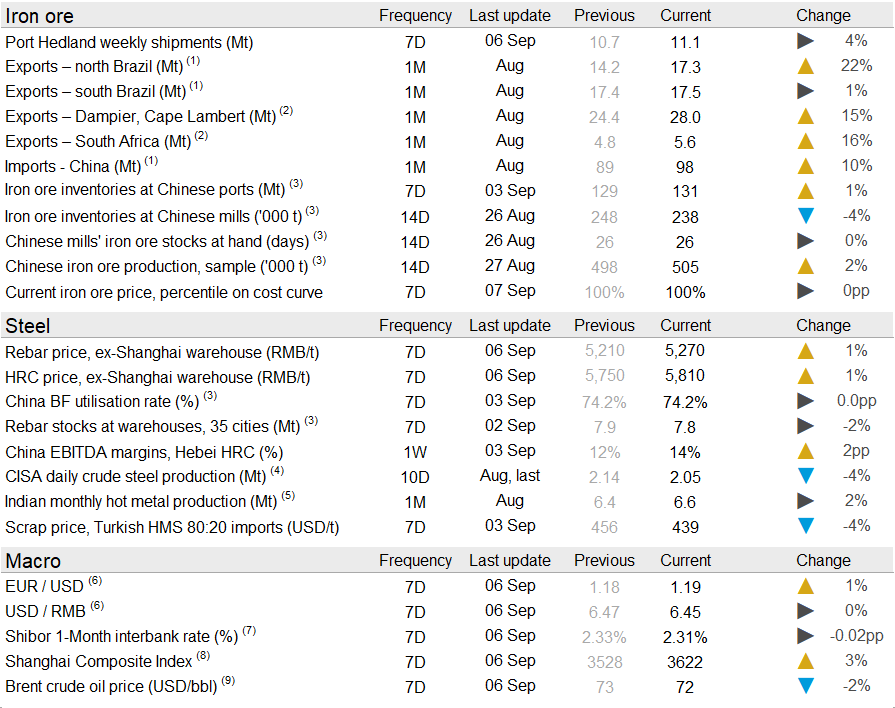

After rising at end-August, iron ore prices have started pointing downward again in the past week as Chinese demand remains tepid while seaborne supply has been at the strongest level since end-June. Iron ore is currently trading at $135.5 /dmt, down by $18.5 /dmt w/w.

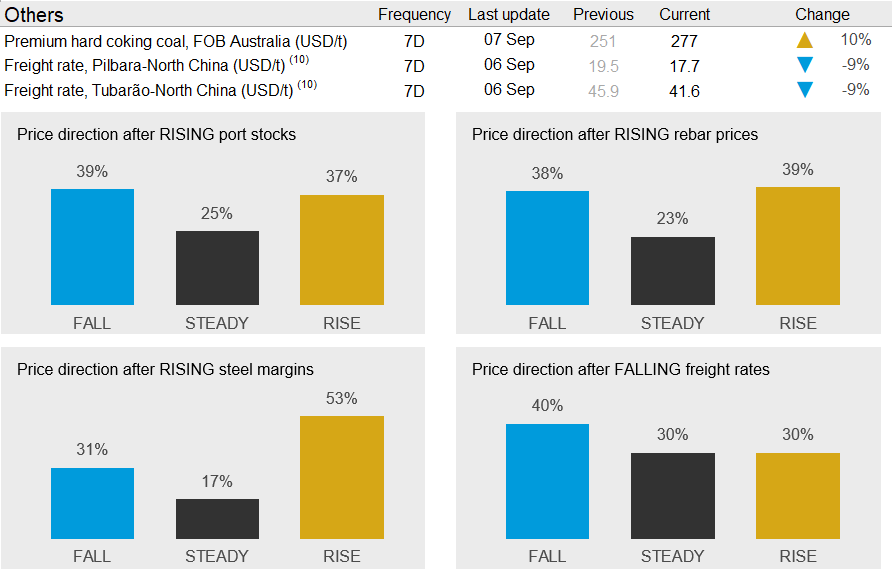

Last week, Chinese domestic steel demand remained weak, but steel prices rose on speculative trading after more production cuts were reported in Jiangsu and Hebei province. Our assessed HRC and rebar price both rose by RMB60 /t w/w, expanding the EBITDA margin to 14% and 5%, respectively. With the expectation of more constraints on BF operations for the rest of the year, steelmakers continued to destock and were cautious in iron ore procurement. Given this, iron ore port inventories rose again for the third consecutive week and are now above 130 Mt, with plenty of low-grade material in stock. Among different products, low-grade and lump materials exhibited sharper price falls due partly to incredibly high fuel prices as some Chinese coking coal products are now trading over $600 /t. Our sources in China have highlighted this as the main reason for the elevated low-grade discounts and the low lump premium.

Iron ore producers have had a very good week with a strong performance by all major producers in the market. FMG continues to ship at a high rate while BHP’s exports have risen after registering weak exports in both July and August. Brazilian trade data revealed 35 Mt of exports from the country in August compared with 31 Mt last year. This is mainly driven by large volumes of low-grade fines being exported while pellet and pellet feed exports remain low. In other news, the port congestion in China has eased with faster offloading at ports and numerous vessels leaving the Chinese coast in the past week. Freight rates have come down as a result, but remain at an overall high level.

For the coming week, we are hearing mixed signals from the market. While some of our contacts are expecting prices to fall back towards $100 /dmt in the coming month, others hold the view that iron ore is oversold and expect prices to climb higher in the coming weeks. Our view is that there is room for prices to bounce back in the short run, but we maintain our medium-term view that there is little upside to iron ore prices as Chinese demand is likely to remain soft while supply continues to improve.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com