Analysis

September 7, 2021

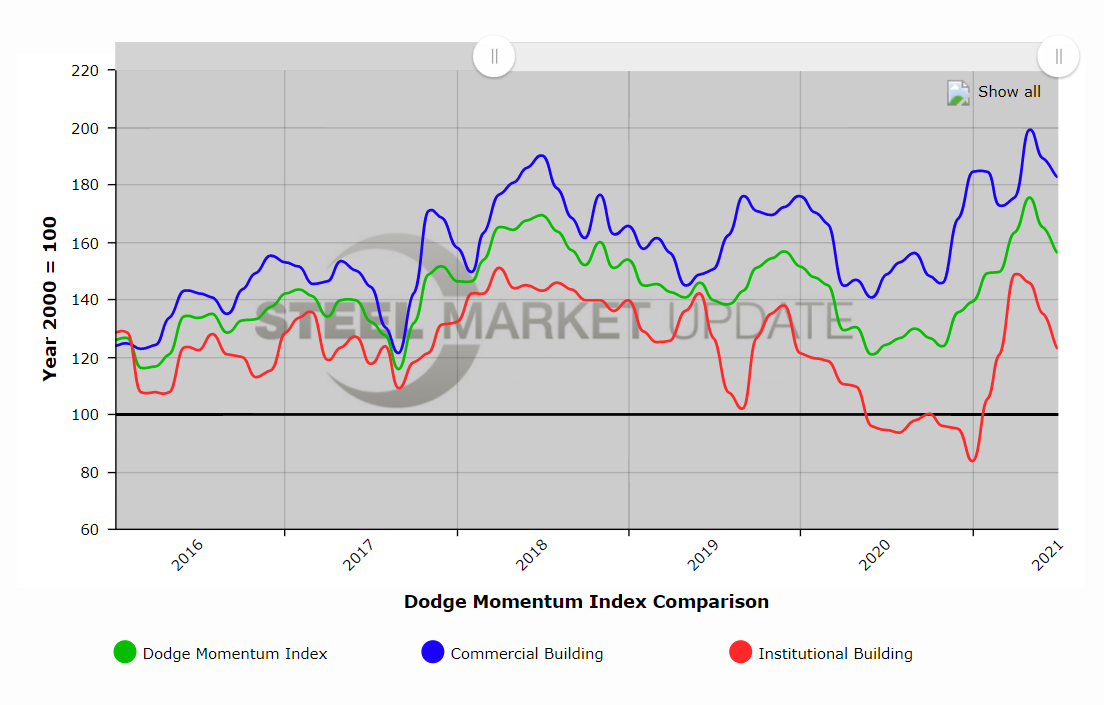

Dodge Momentum Index Slips Again in August as Construction Spending Slows

Written by David Schollaert

The Dodge Momentum Index declined for a third straight month in August, a stark contrast from the six consecutive months of gains seen since the close of 2020. The downturn suggests strong headwinds from supply-chain limitations, rising raw material prices, and labor shortages that are plaguing the nonresidential construction sector, especially new projects.

![]() The index now stands at 148.7, down 3% from the revised July reading of 154.0, according to the latest Dodge Data & Analytics release. Both components of the index declined again in August, with commercial planning down 3% to 178.5 and institutional planning down 6% to 111.9. August’s measure is now off 14% from the most recent high in May, while the commercial component is down 10% and the institutional component is 22% lower over the same period.

The index now stands at 148.7, down 3% from the revised July reading of 154.0, according to the latest Dodge Data & Analytics release. Both components of the index declined again in August, with commercial planning down 3% to 178.5 and institutional planning down 6% to 111.9. August’s measure is now off 14% from the most recent high in May, while the commercial component is down 10% and the institutional component is 22% lower over the same period.

Although the overall level of the Momentum Index is 19% higher than one year ago, and institutional planning and commercial planning are up 17% and 20% respectively over last year, Dodge Data & Analytics said the current trend reversal is due to a confluence of impediments. Prices for materials used in nonresidential buildings are rising at the same time that labor is short and the Delta variant is spreading, all working in concert to undermine confidence in the fledgling construction recovery.

“Despite the recent declines in the Momentum Index, it is still too early to call this a retrenchment or a new cyclical downturn,” he report said. “Demand for nonresidential buildings remains weak, but the recent rising number of new COVID cases should not cause the same amount of disruption as previous waves did. As the economy continues to trudge forward, momentum will return to the construction sector and moderate growth in projects entering planning will return.”

The Dodge Momentum Index is a key advance indicator of nonresidential construction demand, leading construction spending by as much as a year. The report noted a total of 21 projects with a value of $100 million or more entered planning during August. The leading commercial projects were a pair of $165 million Google Data Centers in Ohio. The leading institutional projects were a $158 million Sentara Albemarle Medical Center in North Carolina and a $140 million Apex Outpatient Center Ohio.

An interactive history of the Dodge Momentum Index is available here on our website, an example is shown below. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.