CRU

September 8, 2021

CRU: Semiconductors, Covid-19 Take a Toll on Global Sheet Market

Written by Josh Spoores

By CRU Principal Analyst Josh Spoores, from CRU’s Steel Sheet Products Monitor

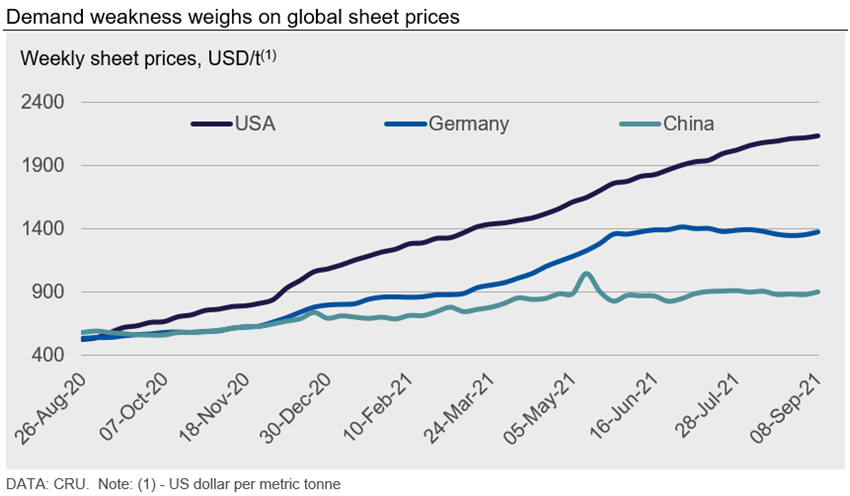

Regional sheet markets have continued to exhibit divergent trends for not only prices, but also production and demand. The lone continent where sheet prices have yet to fall from a peak is North America. All other markets now have prices below their recent peak.

The U.S. Midwest market continues to see prices rise, yet the momentum of this trend has clearly slowed. Further, due to the continued rise here and decline elsewhere, new import orders have surged as buyers take advantage of the record discount of sheet products produced in other countries.

Additionally, recent chatter within the local U.S. market has picked up various anecdotal points about some mills able to sell extra volume with shorter than reported lead times and at lower than market values. We expect that these types of sales are related to volume that would normally go to the automotive sector. This trend of increased supply due to weaker than expected demand from the automotive sector is a global trend. Alongside weak demand from automotive, demand in other markets continues to be stunted by the spread of Covid-19.

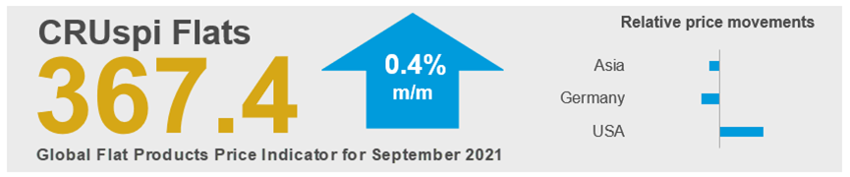

Overall, CRU’s Global Flat Products Steel Price Indicator (CRUspi flats), is incrementally higher in September as gains in the U.S. outpaced lower prices in Europe and Asia. Prices in these markets are down m/m, yet some stability has emerged over the past few weeks where sheet prices have transacted within a limited range. Reflecting this, the CRUspi flats gained 0.4% m/m, the lowest m/m increase since this global price indicator bottomed in July 2020.

Outlook: Chinese Policy Remains in Focus

Risk surrounding our near-term view is dominated by potential changes in China, yet further suppression of global steel production, exports, or demand is not a given. Our global contacts continue to keep a close watch on Chinese business policy, especially as it relates to Chinese steel production and exports.

We are expecting steel production in China to remain held back through the winter and as such, exports will also be limited. We continue to hear rumors of an export tax on some products from China and this is an upside global price risk, particularly if global demand growth remains at recent levels. The roots of this policy seem to have come from the Chinese Government’s efforts to limit the rampant escalation of commodity prices, notably iron ore. While iron ore prices have collapsed and recently were more than 40% below their prior peak, coal prices have since surged.

Global demand growth, though, continues to be limited by logistics, component shortages, and the continuing spread of Covid-19. In the near term, we expect that most global prices will be near their current levels, though markets such as the USA will likely start to fall back from current levels.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com