CRU

October 7, 2021

CRU: U.S. Longs Market Tightness Again Puts Upward Pressure on Prices

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley and Analyst Dave Thewlis, from CRU’s Steel Long Products Monitor

Long product prices in the U.S. remained elevated and moved higher again m/m in some cases for October. Wire rod mills pushed through another round of price increases in mid-September and there was little to no resistance from buyers or end-users. In contrast, rebar was stable m/m, although this was due to greater availability for it compared to some other long products.

Much of these price increases were due to continually high construction activity. According to U.S. Census data, total seasonally adjusted construction spending rose by 9% y/y in August—the latest available data point. Although this is only a small increase from July’s spending, it was the highest level ever recorded since this metric began being tracked in January 1993. Likewise, rebar, structural, and merchant bar prices have now either met or surpassed their records set since CRU began tracking them in January 1994.

For wire rod, mills by and large are now booked out through the remainder of 2021 and into portions of 2022 Q1. Demand from end-users is strong, and market participants across the wire rod supply chain have had minimal issues with passing on higher prices even after mills announced another $1.50 /cwt price increase in mid-September. At the same time, import activity remains relatively subdued given tightness in the global wire rod market, although availability has become higher than what it had been the past few months.

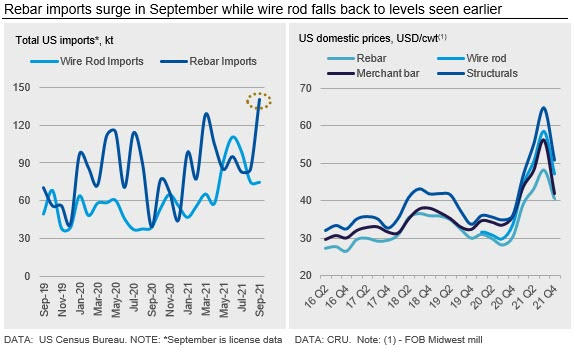

Indeed, after peaking at 110,600 t in July (n.b. the highest level in over two years), total wire rod imports have been on a consistent downward trend, falling to 74,600 t in September, according to U.S. Census Bureau preliminary data. Still, availability is growing, and buyers are weighing importing yet more material even if it is priced somewhat above the domestic market. Preventing a surge in imports are concerns over international delivery times, freight costs and worry that prices in three or four months may be below current levels.

Conversely, rebar import volumes in September spiked to their highest level in over two years (see chart). An atypically large amount of material arrived from Algeria, which surpassed Turkey as the largest rebar exporter to the USA. There was also a notably large amount of material arriving from the Dominican Republic. Offers have fallen m/m in October, according to market participants, and the buying frenzy that occurred domestically earlier this year appears to be over. As such, rebar prices were unchanged for a fourth month in a row.

Outlook: Market Tightness May Ease Somewhat

We expect some seasonal weakness in buying patterns as winter hampers construction activity in the coming months, although this is unlikely to be a factor in November pricing. With domestic mills booked out for the rest of the year for wire rod, we see little downside price pressure looming, although the completion of maintenance outages in December will allow for the market to slacken somewhat. For rebar, rising availability and seasonally slower demand present a higher risk to lower prices next month, but overall demand stability will likely mitigate or prevent actual price falls from occurring.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com