Market Data

January 20, 2022

Steel Mill Negotiations: Turnabout in the Power Position

Written by Tim Triplett

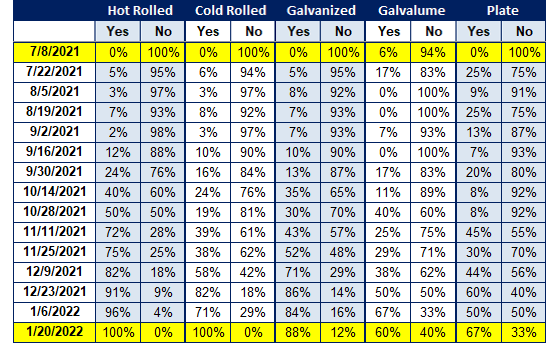

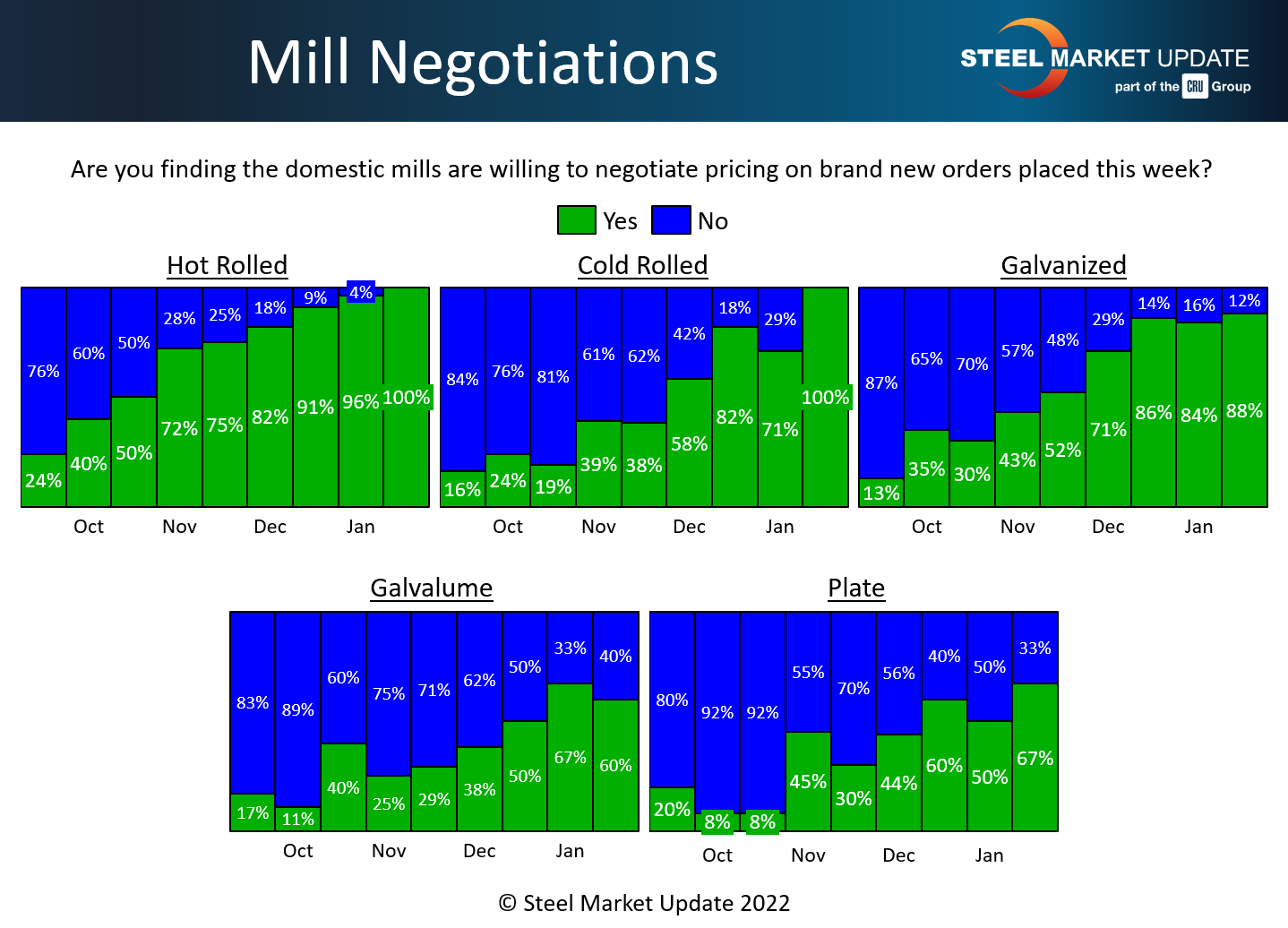

The power position in price negotiations between steel mills and steel purchasers has seen a complete turnabout in the past seven months, transitioning from a nearly 100% seller’s market in July 2021 to a 100% buyer’s market today (see chart below).

Every two weeks, Steel Market Update asks readers: Are you finding the domestic mills willing to negotiate spot pricing on new orders placed this week? Last summer, the mills were in the driver’s seat and nearly all buyers said, no, the mills were not willing to talk price. This week nearly all the buyers of hot rolled, cold rolled and galvanized steel said, yes (green bars below), the mills are now open to price negotiations to secure orders.

What’s the difference? Steel supply and demand, of course. Last year steel was in tight supply and the mills could basically name their price. Buyers were desperate to secure material at almost any price to keep production lines running. The imbalance of supply and demand had driven benchmark hot rolled prices to $1,800 per ton as of last July on their way to a peak near $2,000 in early September.

Since then, supplies have caught up to and even surpassed demand as excess ordering and import arrivals have inflated inventories, while end-users have postponed purchases to see how low prices will go. Steel prices have plunged more than 25% so far and continue to erode. SMU pegs the current hot rolled steel price at $1,425 per ton. Mills are willing and anxious to make deals at today’s price, knowing tomorrow’s will likely be lower.

As one respondent commented: “The mills are definitely trying to hold the line, but they’re sure calling us more than they were.”

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.

By Tim Triplett, Tim@SteelMarketUpdate.com