Prices

March 13, 2022

SMU Explains: What Russia Losing PNTR Could Mean for Steel

Written by Michael Cowden

The Biden administration rolled out a new round of trade actions aimed at punishing the Russian government for launching an invasion of Ukraine.

Some of those measures have the potential to reach deep into the steel supply chain – including with tariffs of 20% or more on many Russian steel products, according to trade experts and government documents.

![]()

The main news of the day on the trade front is that the U.S. – along with the European Union, Japan and other allies – is taking steps to revoke what is known as “most-favored nation” (MFN) status from Russia.

MFN is equivalent to “permanent normal trade relations,” or PNTR, in the U.S.

Removing PNTR from Russia Is a Big Deal

President Biden made the announcement about starting the process to remove PNTR from Russia on Friday, March 11.

Countries with PNTR are allowed to trade with the U.S. on preferential terms – meaning low tariffs and, in general, few barriers to trade.

For Russia to be stripped of PNTR, Congress must pass relevant legislation, and Biden must sign it into law – something the president seemed confident would happen, according to a transcript of his remarks.

The move is also supported by the American Iron and Steel Institute (AISI), one of the main lobbying groups for the domestic steel industry.

“Russia should not be able to benefit from normal trade relations with the United States as long as it is engaged in armed aggression against the people of Ukraine,” AISI President and CEO Kevin Dempsey said in a statement.

“We support today’s actions by the president and urge Congress to pass legislation to revoke permanent normal trade relations status for Russia as soon as possible,” he added.

As for the brass tacks of the legislative process, first the House must approve a bill removing PNTR from Russia. That’s because, under the Constitution, legislation relating to taxes must start in the House. And tariffs are a form of tax.

Some perspective on how serious losing PNTR status is: Until Friday, only North Korea did not have PNTR status for its imports.

What Would Russia Losing PNTR Mean for Steel?

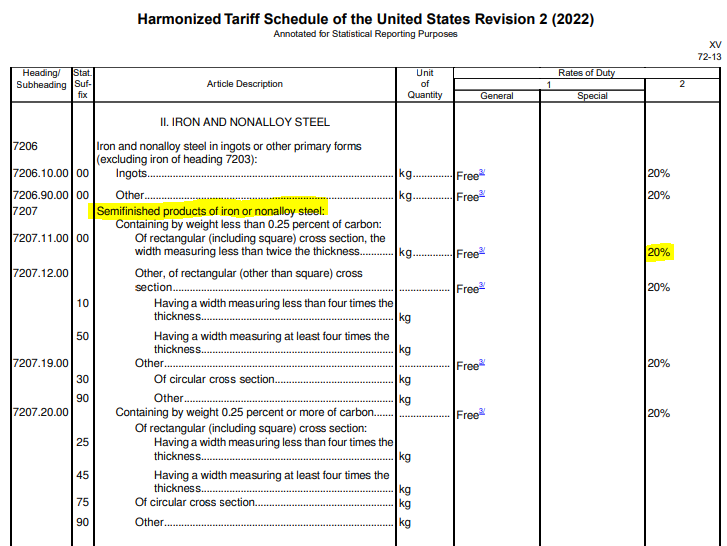

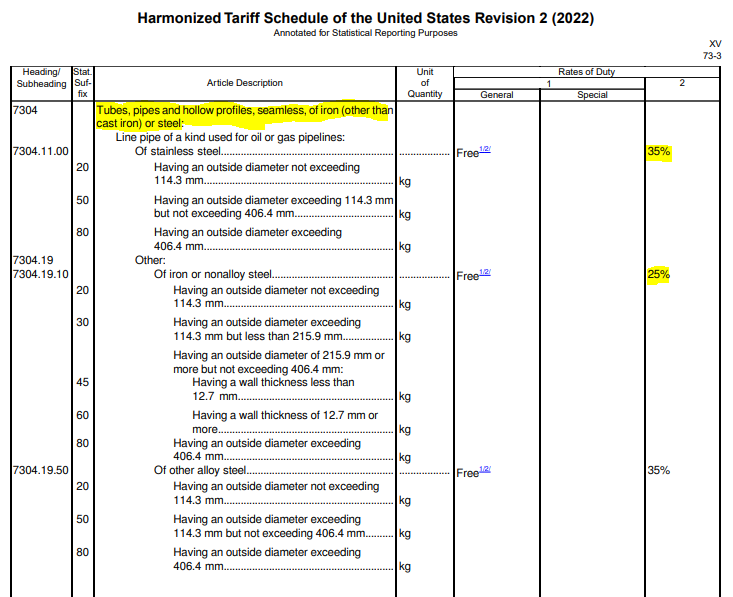

To get an idea, go the U.S. International Trade Commission web page on the Harmonized Tariff Schedule. You can find that here. And then open Chapter 72 and Chapter 73, which pertain to iron and steel products.

Category 1 is for PNTR countries. Category 2 is for nations without PNTR status. The latter are subject to higher tariffs as the snips from the tables below indicate.

Those higher tariff rates are the ones that existed before the General Agreement on Tariffs and Trade (GATT) went into effect in 1947.

Note that most steel products, including not only semifinished good such as slab but also finished products like coil, would be subject to a 20% tariff should PNTR with Russia be lifted. Line pipe, for example, would see tariffs of 25-35%.

The Import Ban: Probably Not a Big Deal, for Now

Also on Friday, President Biden issued an executive order banning certain imports from Russia. The ban centered on luxury goods. (The Commerce Department also imposed an export ban on U.S.-made luxury goods to Russia and Belarus, which has sided with Russa in the war.)

Among imports that are now prohibited from Russia are seafood (e.g., caviar), alcoholic beverages (e.g., vodka) and diamonds. That’s what has caught the attention of the mainstream media.

It’s not clear whether the import ban could have an impact on steel.

A Commerce spokesman reiterated to SMU on Friday that the ban related primarily to luxury goods. “I’m pretty sure it doesn’t touch steel writ large,” he said.

But some trade experts have said that one should not ignore the language stating that “any other products” originating from Russia could also be banned if Treasury Secretary Janet Yellen, Secretary of State Antony Blinken and Commerce Secretary Gina Raimondo decide that doing so is necessary.

They said that language leaves the door open to adding other goods – perhaps including steel – to the list of banned Russian imports at a future date.

The Tons

Big changes in U.S. trade policy toward Russia could have big implications for steel because Russia is one of the biggest foreign steel suppliers to the U.S. market.

The U.S. imported 1.47 million metric tonnes of steel from Russia in 2021, making it the fifth largest supplier of foreign steel to the domestic market, according to Commerce Department figures.

The bulk of that steel, 1.29 million tonnes, was semifinished products, a category that includes slabs.

By Michael Cowden, Michael@SteelMarketUpdate.com