Plate

May 22, 2022

Plate Market Report: Chatter vs Charts

Written by Michael Cowden

What’s up with plate? I’ve been asked again and again how plate has managed to maintain such a high premium over sheet this year.

Here are a few arguments that have been made to me over the past week in support of high plate prices. And below that are a few charts I still find hard to square with those reasons.

First, in no particular order, are some of the cases advanced for the highest plate prices we’ve ever recorded:

• Plate, while it trends with sheet, does so on a significant lag

• Plate, because of duties rolled out in 2017 against product from 12 nations (combined with 232 tariffs), is more protected than sheet

• Plate mills are more consolidated than sheet mills

• An unplanned outage that was not broadly publicized might have limited supply

• Plate will benefit more from infrastructure spending, especially when it comes to offshore wind farms

• Increased demand from the military, notably for submarine upgrades

I can think of counterpoints to each: Consolidation didn’t help sheet when the market tanked in Q4’21/Q1’22. Infrastructure spending is more of a 2023-24 story, and plate lead times are barely into 2H’22. Military spending – in an era of composite drones – is not a big driver of steel demand.

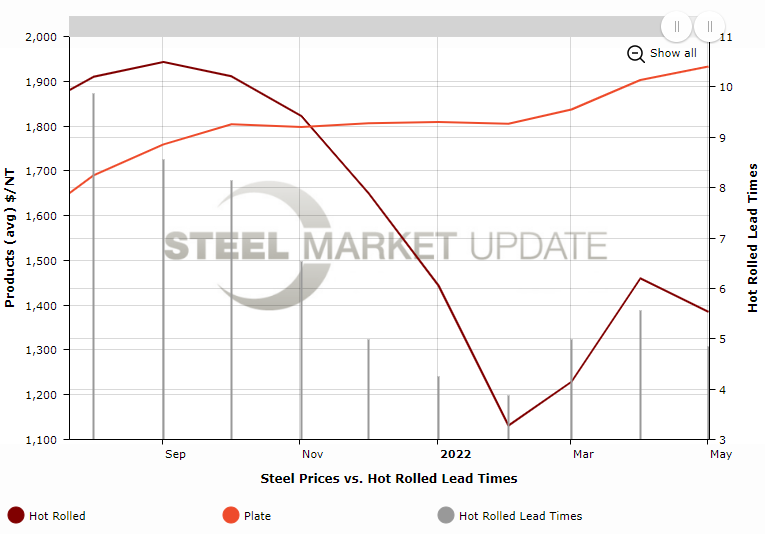

But let’s set aside the point-counterpoint stuff for now and just consider prices and lead times. In the chart below, plate prices are the orange line, HRC prices are the red line, and HRC lead times are the gray bars. (You can replicate the chart below using our interactive pricing tool.):

Plate prices were at around $1,800 per ton ($90 per cwt) at the beginning of the year. And they’ve been bouncing around $1,900 per ton since the outbreak of the war in Ukraine. That’s remarkably stable compared to the intense volatility seen in sheet prices over the same period.

But here is one thing both products have in common: Prices remain extraordinarily high. But lead times have contracted back to “normal” levels – or what would have been considered normal pre-pandemic.

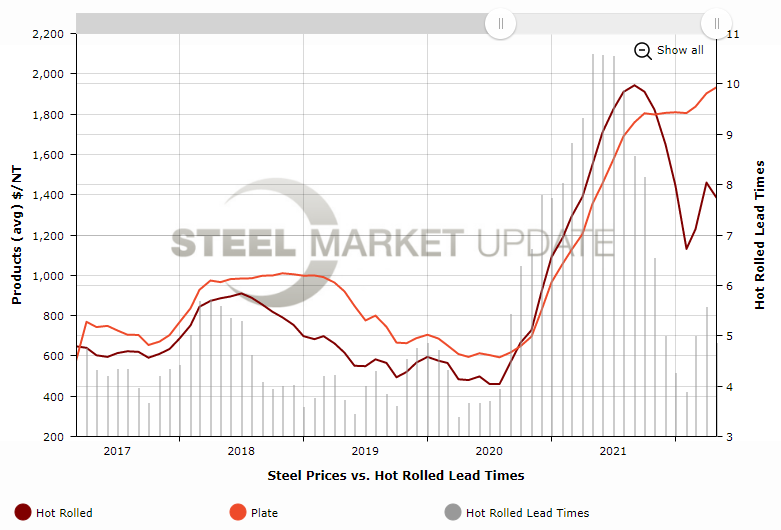

Plate lead times are five to six weeks, in line with historic norms. And yet plate prices are roughly twice their pre-pandemic high of around $1,000 per ton, which was set back in 2018 following the implementation of Section 232 tariffs and quotas.

You can see that prior highwater mark in the chart below, which takes a broader view of the relationship between plate prices, sheet prices, and lead times:

In other words, we’re back to where we were in January and February of this year, asking ourselves whether the plate price dam will break or whether this time is different – and, if it is, why? Do you have any theories? Let us know!

Side note: I know some of you get irritated when plate prices go up or down $10-20 per ton from one week to the next. My advice: Recall the context. Up or down $20 per ton matters when plate prices are around $700 per ton, a “normal” price in the past. When you’re talking about a $1,900 base, that’s just noise – a matter of pennies.

By Michael Cowden, Michael@SteelMarketUpdate.com